- China

- /

- Electronic Equipment and Components

- /

- SHSE:600745

Wingtech Technology Co.,Ltd's (SHSE:600745) Shares Bounce 25% But Its Business Still Trails The Industry

Wingtech Technology Co.,Ltd (SHSE:600745) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

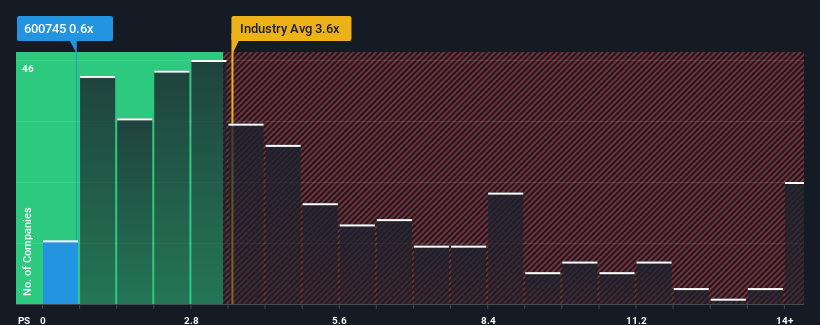

In spite of the firm bounce in price, Wingtech TechnologyLtd's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 3.6x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wingtech TechnologyLtd

How Wingtech TechnologyLtd Has Been Performing

Recent revenue growth for Wingtech TechnologyLtd has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Wingtech TechnologyLtd will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wingtech TechnologyLtd.Do Revenue Forecasts Match The Low P/S Ratio?

Wingtech TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The solid recent performance means it was also able to grow revenue by 25% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 10% per annum over the next three years. With the industry predicted to deliver 18% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Wingtech TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Even after such a strong price move, Wingtech TechnologyLtd's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Wingtech TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 3 warning signs for Wingtech TechnologyLtd that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wingtech TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600745

Wingtech TechnologyLtd

Engages in the research and development, designs, and manufacturing of various intelligent terminal products.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives