- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NXSN

High Growth Tech Stocks with Promising Global Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed movements, with large-cap tech stocks driving gains in the Nasdaq Composite while smaller-cap indexes like the S&P MidCap 400 and Russell 2000 faced declines. Amid this backdrop of selective growth and economic adjustments such as the Fed's rate cut and a temporary U.S.-China trade truce, investors are increasingly focusing on high-growth tech stocks with strong global potential to navigate these dynamic conditions. In today's market environment, a promising tech stock often demonstrates robust innovation capabilities and adaptability to leverage trends like artificial intelligence spending that continue to shape industry landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 32.80% | 35.57% | ★★★★★★ |

| Zhongji Innolight | 27.12% | 28.49% | ★★★★★★ |

| Pharma Mar | 26.56% | 58.15% | ★★★★★★ |

| Fositek | 36.85% | 47.79% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Caihong Display DevicesLtd (SHSE:600707)

Simply Wall St Growth Rating: ★★★★★☆

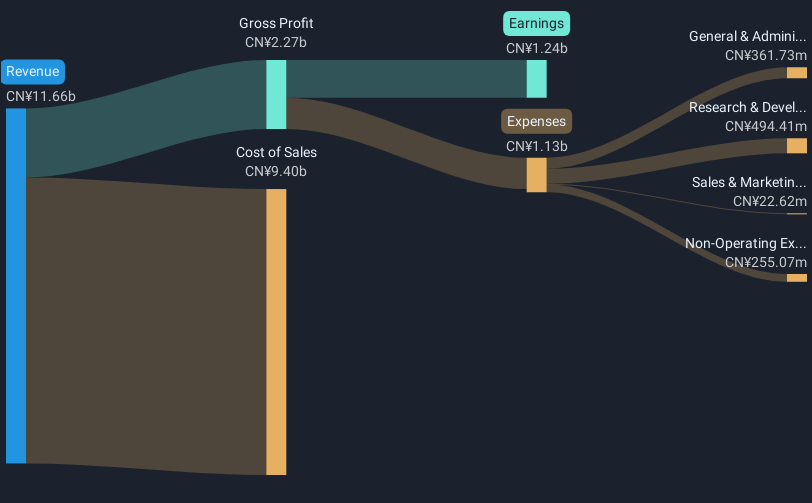

Overview: Caihong Display Devices Co., Ltd. focuses on the research, development, production, and sale of substrate glass and display panels in China, with a market cap of approximately CN¥21.03 billion.

Operations: Caihong Display Devices Co., Ltd. specializes in the development and manufacturing of substrate glass and display panels within China. The company generates revenue primarily through the sale of these products, leveraging its expertise in research and production to cater to various market demands.

Caihong Display Devices Ltd., despite a challenging year with earnings dropping by 75.4%, is poised for a robust recovery with an anticipated earnings growth of 78.2% annually, outpacing the Chinese market's average of 26.4%. This forecast aligns with their revenue growth rate of 22.2% per year, significantly above the market trend of 13.6%. However, recent financials show a dip in net income from CN¥1.23 billion to CN¥379.34 million over nine months, reflecting temporary setbacks but underscoring potential for rebound amidst high R&D investments aimed at innovation in display technology.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NextVision Stabilized Systems, Ltd. specializes in the development, manufacturing, and marketing of stabilized day and night cameras for ground and aerial vehicles, with a market cap of ₪13.74 billion.

Operations: NextVision Stabilized Systems generates revenue primarily from its electronic security devices segment, totaling $132.90 million.

NextVision Stabilized Systems, recently added to the FTSE All-World Index, demonstrates robust growth with a forecasted annual revenue increase of 23.2% and earnings growth of 19.5%, both surpassing their respective market averages. The company's commitment to innovation is evident from its R&D spending, which has significantly contributed to a 66.9% surge in earnings over the past year. Recent strategic moves include securing $5.1 million in new orders for their advanced camera systems, set for delivery by early 2026, underscoring their expanding market presence and operational agility in the tech sector.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Ltd (TSE:4071) is a company that specializes in providing marketing solutions, with a market capitalization of ¥96.58 billion.

Operations: The company generates revenue primarily from HR Solutions, contributing ¥12.66 billion, and Marketing Solutions, adding ¥3.87 billion.

Plus Alpha ConsultingLtd., amidst a dynamic tech landscape, is steering towards robust growth with its revenue and earnings outpacing the Japanese market averages, growing at 12.6% and 15.4% annually respectively. This performance is bolstered by strategic alliances like the one with RAKUS Co., enhancing sales opportunities across cloud services, reflecting a proactive approach in expanding its market reach. The firm's commitment to innovation is mirrored in its R&D endeavors, crucial for sustaining long-term growth in the competitive tech sector. Recent corporate maneuvers include a significant private placement of treasury shares, generating JPY 3 billion, earmarked to fuel further expansions and technological advancements.

- Delve into the full analysis health report here for a deeper understanding of Plus Alpha ConsultingLtd.

Understand Plus Alpha ConsultingLtd's track record by examining our Past report.

Summing It All Up

- Explore the 235 names from our Global High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextVision Stabilized Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NXSN

NextVision Stabilized Systems

Develops, manufactures, and markets a stabilized day and night photography solution for ground and aerial vehicles in Israel and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion