- Singapore

- /

- Commercial Services

- /

- SGX:WJP

November 2024's Top Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have shown resilience with U.S. indexes nearing record highs and smaller-cap indexes outperforming, despite geopolitical tensions and policy uncertainties. Penny stocks, though often seen as a relic of past market eras, continue to offer intriguing opportunities for investors willing to explore smaller or newer companies with potential for growth. These stocks can present affordable entry points while offering the possibility of significant returns when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$147.7M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.21 | £832.65M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$67.99M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.36 | £173.2M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.21 | £418.71M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.245 | £106.25M | ★★★★★★ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Hong Kong Technology Venture (SEHK:1137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hong Kong Technology Venture Company Limited, along with its subsidiaries, operates in the ecommerce and technology sectors in Hong Kong and has a market capitalization of approximately HK$1.11 billion.

Operations: The company's revenue is primarily derived from its Hong Kong ecommerce operations, generating HK$3.85 billion, and its new ventures and technology business, contributing HK$160.58 million.

Market Cap: HK$1.11B

Hong Kong Technology Venture Company Limited is navigating the penny stock landscape with a market capitalization of HK$1.11 billion and significant revenue from its ecommerce operations. Despite being unprofitable, it has reduced losses at 38.7% annually over five years and maintains a positive cash flow, ensuring over three years of cash runway without debt concerns. The management team averages 4.8 years in tenure, while the board averages 12.5 years, indicating seasoned leadership. Recent operating results show an increase in average daily GMV by 4.5%, reflecting potential growth momentum despite current profitability challenges.

- Jump into the full analysis health report here for a deeper understanding of Hong Kong Technology Venture.

- Evaluate Hong Kong Technology Venture's historical performance by accessing our past performance report.

VICOM (SGX:WJP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VICOM Ltd is an investment holding company that provides motor vehicle inspection and non-vehicle testing, inspection, and consultancy services in Singapore and internationally, with a market cap of SGD471.58 million.

Operations: The company generates revenue of SGD112.33 million from its vehicle inspection and non-vehicle testing services.

Market Cap: SGD471.58M

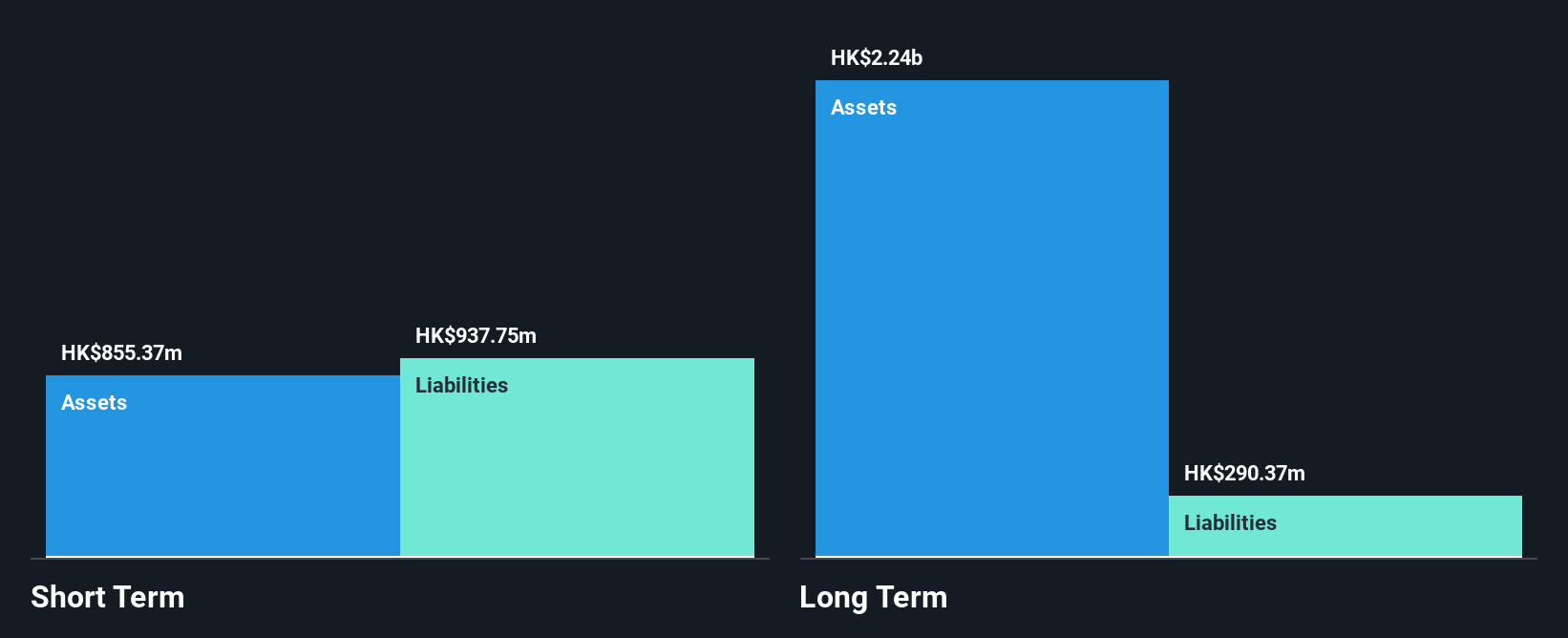

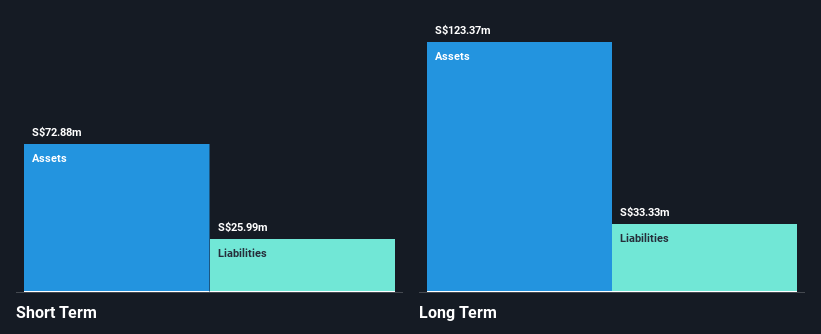

VICOM Ltd, with a market cap of SGD471.58 million and revenue of SGD112.33 million, stands out in the penny stock arena due to its stable financial footing and debt-free status. The company boasts high-quality past earnings and a strong return on equity at 20.5%. Its short-term assets comfortably cover both short- and long-term liabilities, highlighting financial prudence despite a dividend not fully covered by free cash flow. Recent board changes include the appointment of Professor Karina Yew-Hoong Gin as an Independent Non-Executive Director, potentially strengthening governance amidst stable weekly volatility in its stock performance.

- Take a closer look at VICOM's potential here in our financial health report.

- Assess VICOM's previous results with our detailed historical performance reports.

Founder Technology GroupLtd (SHSE:600601)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Founder Technology Group Co., Ltd. offers hardware and software solutions in China, with a market capitalization of CN¥15.60 billion.

Operations: Founder Technology Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥15.6B

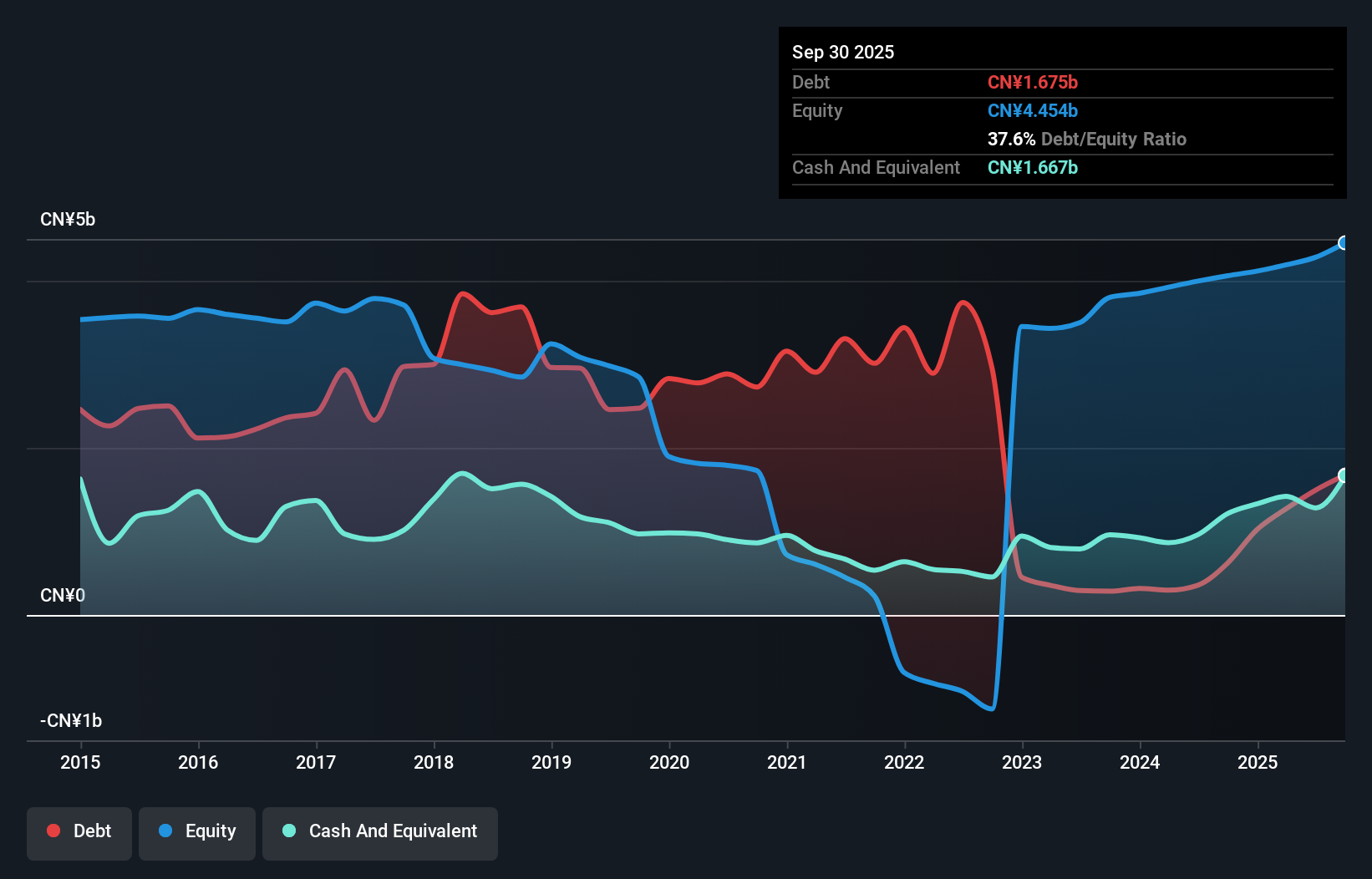

Founder Technology Group Co., Ltd. demonstrates solid financial health with a market cap of CN¥15.60 billion and recent earnings growth of 69.6%, surpassing the tech industry average. The company's net profit margins have improved to 6.8% from last year's 3.5%, supported by high-quality non-cash earnings and well-covered debt through operating cash flow at 76.7%. Its short-term assets of CN¥2.7 billion exceed both short- and long-term liabilities, indicating robust liquidity management, although return on equity remains low at 5.6%. Recent inclusion in the S&P Global BMI Index reflects growing recognition in the market landscape.

- Unlock comprehensive insights into our analysis of Founder Technology GroupLtd stock in this financial health report.

- Learn about Founder Technology GroupLtd's historical performance here.

Key Takeaways

- Reveal the 5,781 hidden gems among our Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:WJP

VICOM

An investment holding company, engages in the provision of motor vehicle inspection, as well as non-vehicle testing, inspection, and consultancy services in Singapore and internationally.

Flawless balance sheet with proven track record.