- Singapore

- /

- Real Estate

- /

- SGX:5DM

Recent 13% pullback isn't enough to hurt long-term Ying Li International Real Estate (SGX:5DM) shareholders, they're still up 100% over 1 year

It might be of some concern to shareholders to see the Ying Li International Real Estate Limited (SGX:5DM) share price down 24% in the last month. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 100%.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Ying Li International Real Estate

Given that Ying Li International Real Estate didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Ying Li International Real Estate saw its revenue grow by 20%. We respect that sort of growth, no doubt. Buyers pushed the share price 100% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

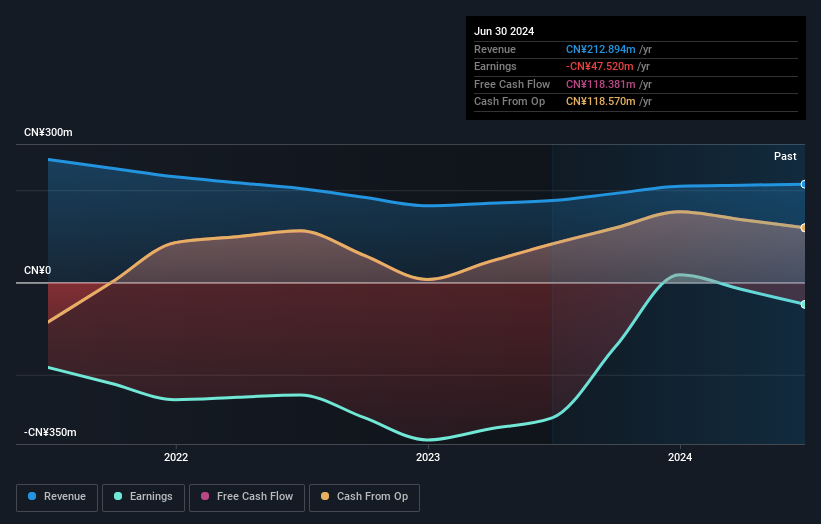

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Ying Li International Real Estate's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Ying Li International Real Estate has rewarded shareholders with a total shareholder return of 100% in the last twelve months. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Ying Li International Real Estate better, we need to consider many other factors. For instance, we've identified 2 warning signs for Ying Li International Real Estate (1 shouldn't be ignored) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5DM

Ying Li International Real Estate

An investment holding company, operates as a property developer in Singapore, Hong Kong, and the People’s Republic of China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives