- China

- /

- Electronic Equipment and Components

- /

- SHSE:600353

Uncovering Three Global Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with U.S. small-cap stocks leading the charge as the Russell 2000 Index gained 3.19%, buoyed by a cooling yet stable labor market and optimism surrounding AI-related sectors. Amid this backdrop of cautious optimism and fluctuating economic indicators, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to navigate these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tohoku Steel | NA | 5.34% | -2.26% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Chengdu Xuguang Electronics (SHSE:600353)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chengdu Xuguang Electronics Co., Ltd. is engaged in the manufacturing and sale of metal-ceramic triodes, tetrodes, and transmitting tubes both within China and internationally, with a market cap of CN¥8.99 billion.

Operations: Chengdu Xuguang generates revenue primarily from the sale of metal-ceramic triodes, tetrodes, and transmitting tubes. The company's financial performance is influenced by its cost structure and efficiency in production. It holds a market capitalization of CN¥8.99 billion.

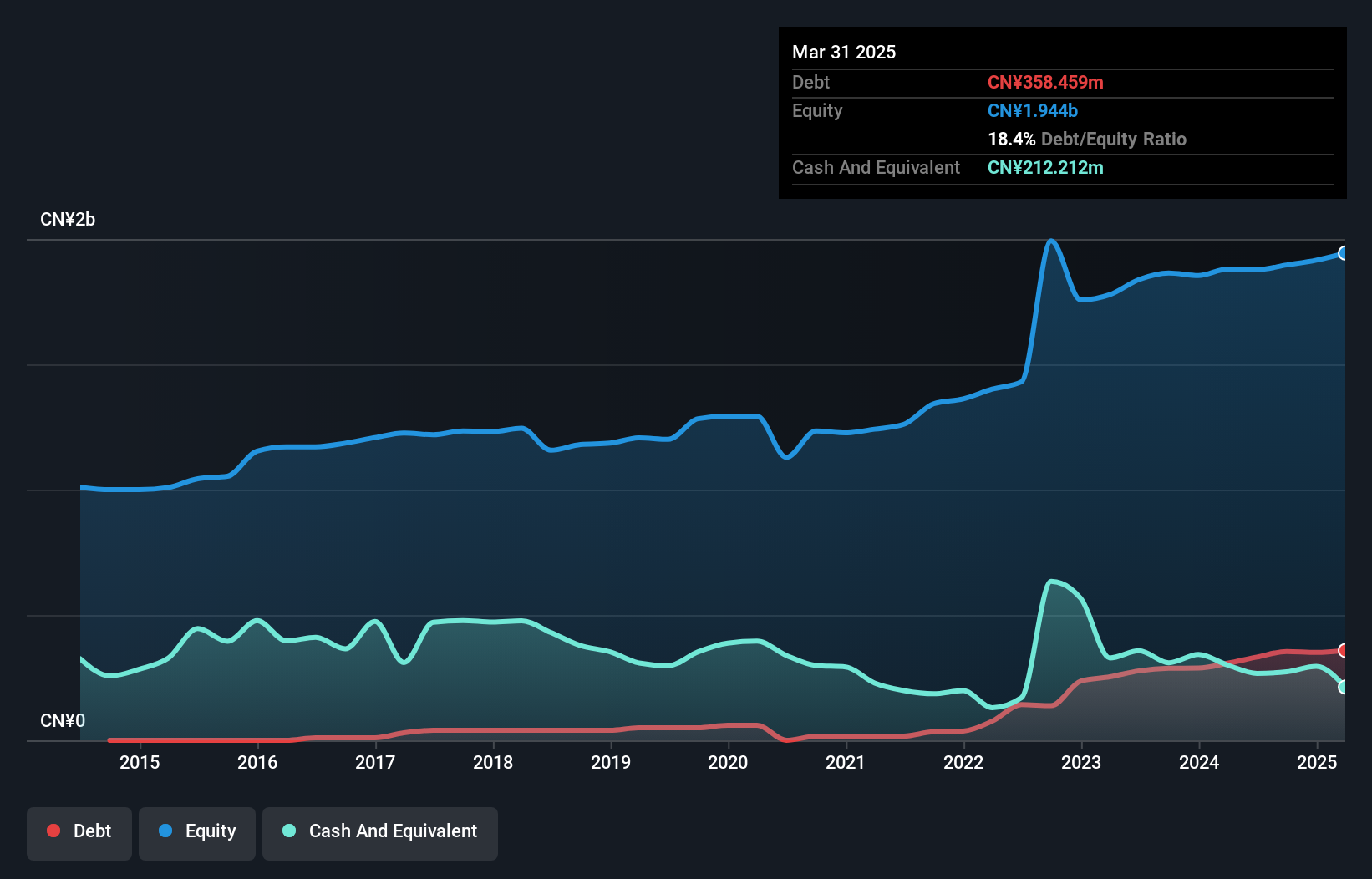

Chengdu Xuguang Electronics is showing promising signs despite its small size. Over the past year, earnings grew by 7.6%, outpacing the electronic industry's 2.7% growth rate, and indicating robust performance. The company's net debt to equity ratio stands at a satisfactory 7.5%, reflecting sound financial health, while interest payments are well covered with an EBIT coverage of 9.9 times. However, revenue for Q1 2025 decreased to ¥342 million from ¥387 million last year, though net income rose to ¥30 million from ¥25 million, suggesting improved profitability amidst sales challenges.

- Click to explore a detailed breakdown of our findings in Chengdu Xuguang Electronics' health report.

Dongguan Dingtong Precision Metal (SHSE:688668)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongguan Dingtong Precision Metal Co., Ltd. operates in the precision metal industry and has a market cap of CN¥7.87 billion.

Operations: The company generates revenue primarily from its precision metal products. It has a market cap of CN¥7.87 billion, indicating its significant presence in the industry.

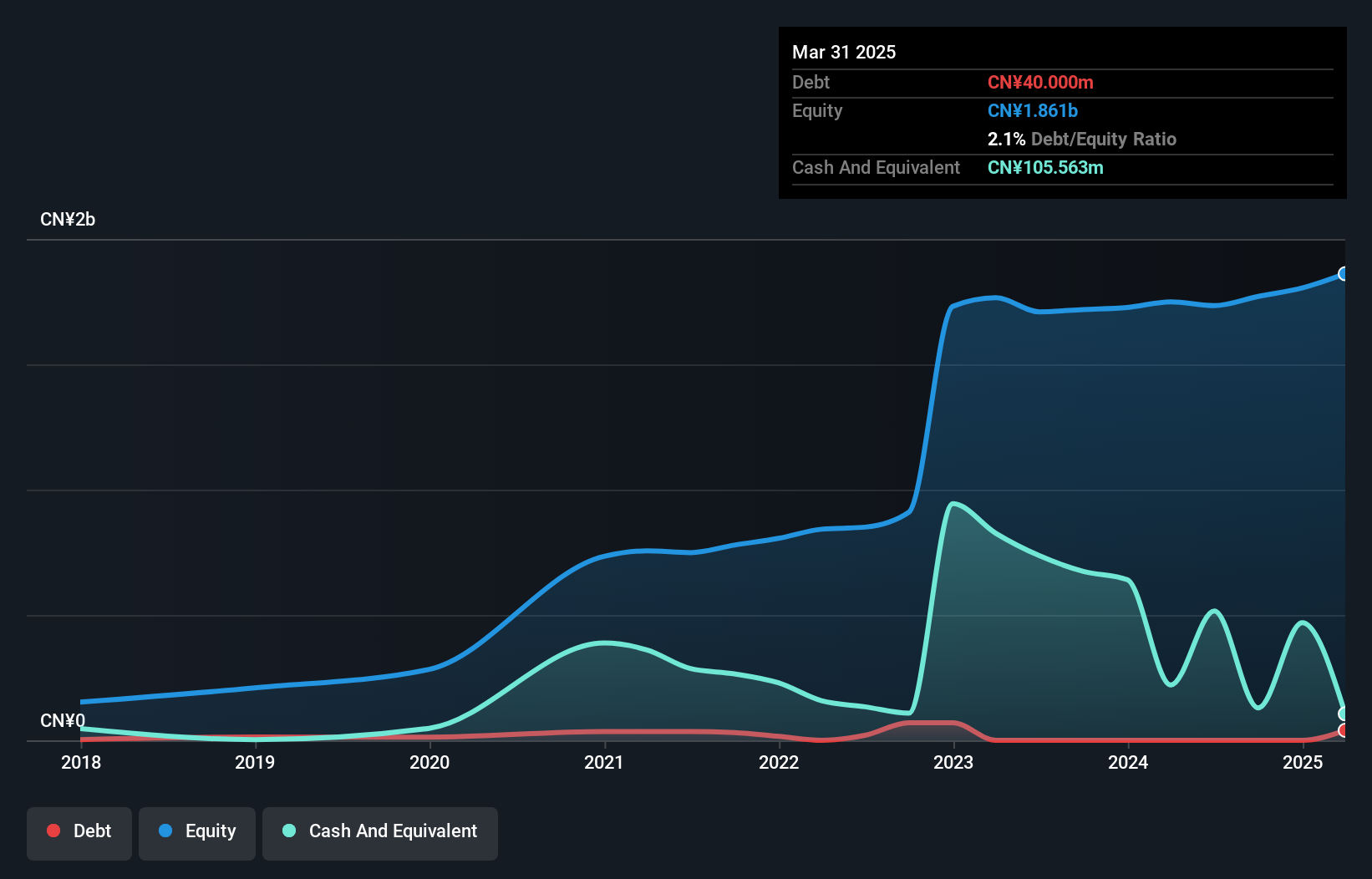

Dongguan Dingtong Precision Metal, a smaller player in the precision metal industry, has shown remarkable growth. Over the past year, earnings surged by 181%, outpacing its industry's -1.4% performance. This growth is supported by a reduced debt-to-equity ratio from 4.6 to 2.1 over five years and more cash than total debt, highlighting financial prudence. Despite negative free cash flow of CNY -162 million recently, their robust net income of CNY 52.9 million for Q1 2025 suggests resilience and potential for future expansion with earnings forecasted to grow at nearly 30% annually in coming years.

Tibet AIM Pharm (SZSE:002826)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tibet AIM Pharm. Inc. focuses on the research, development, manufacturing, and sale of medical products in China with a market capitalization of CN¥3.27 billion.

Operations: Tibet AIM Pharm. generates revenue primarily through the sale of medical products in China. The company reported a gross profit margin of 57.32%, indicating efficiency in managing production costs relative to its sales revenue.

Tibet AIM Pharm has been making waves with a recent M&A transaction, where Beijing Fuhao Enterprise Management acquired a 23.34% stake for CNY 660 million. Despite earnings declining by an average of 1.2% annually over five years, the company posted a notable net income jump to CNY 45.93 million in 2024 from CNY 15.39 million the previous year, thanks in part to a significant one-off gain of CN¥38.7M. Its debt-to-equity ratio rose to 4.6% over five years, yet it holds more cash than total debt and maintains positive free cash flow, highlighting its financial resilience amidst industry challenges.

- Dive into the specifics of Tibet AIM Pharm here with our thorough health report.

Examine Tibet AIM Pharm's past performance report to understand how it has performed in the past.

Next Steps

- Delve into our full catalog of 3168 Global Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600353

Chengdu Xuguang Electronics

Manufactures and sells metal-ceramic triodes and tetrodes and transmitting tubes in China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives