As global markets navigate the challenges posed by rising U.S. Treasury yields and a cautious Federal Reserve rate-cutting outlook, small-cap stocks have faced particular pressure, underperforming their large-cap counterparts. In this environment of tepid economic growth and fluctuating indices, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and potential resilience amid broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anhui Tongfeng Electronics (SHSE:600237)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Tongfeng Electronics Company Limited focuses on the research, development, production, and sales of thin films, film capacitors, and related electronic components in China, with a market capitalization of approximately CN¥4.84 billion.

Operations: Anhui Tongfeng Electronics generates revenue primarily from the sale of thin films, film capacitors, and related electronic components. The company experiences fluctuations in its net profit margin, reflecting varying levels of profitability over time.

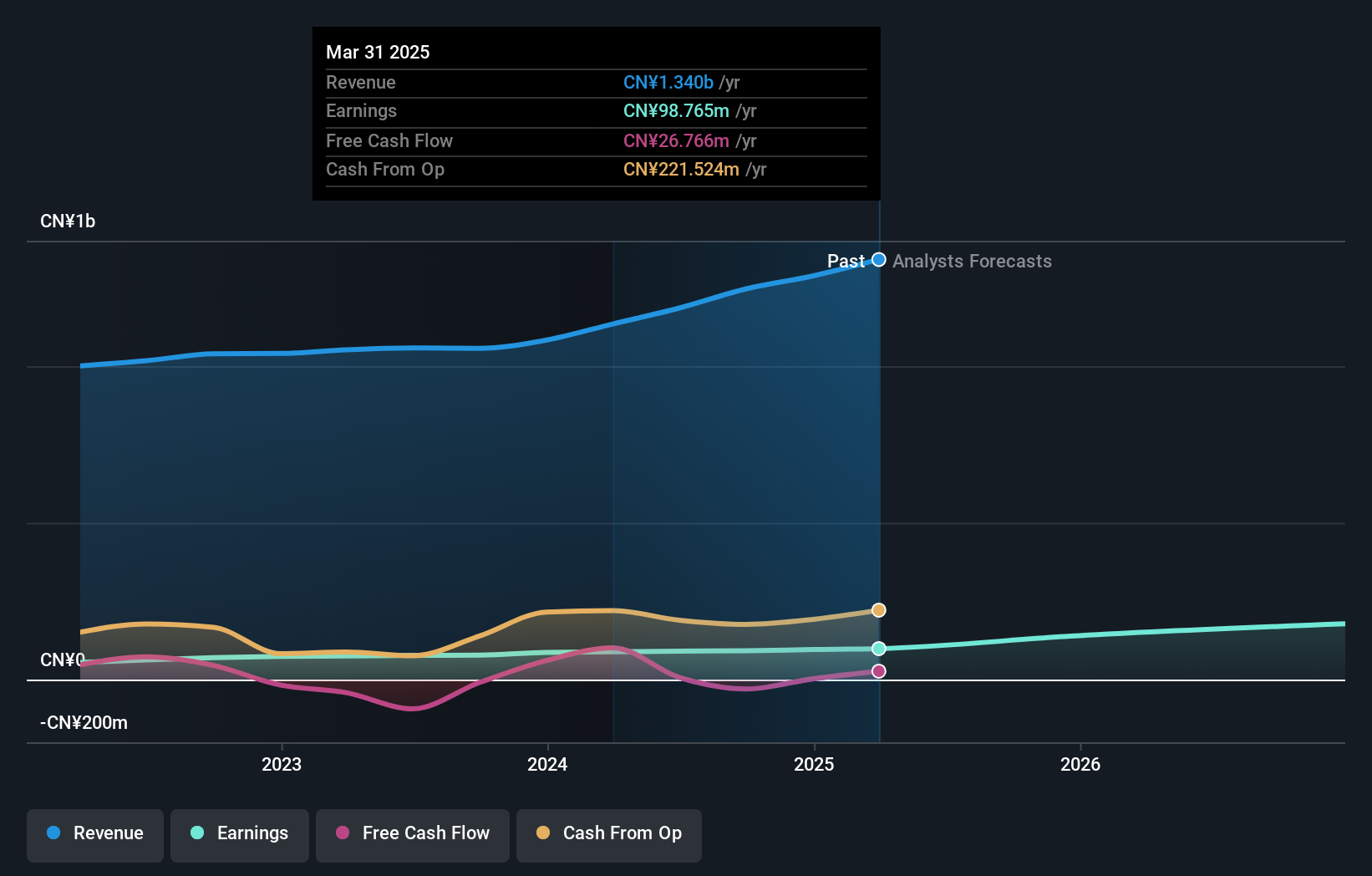

Anhui Tongfeng Electronics, a smaller player in the electronics industry, has shown robust growth with earnings up 18.1% over the past year, outpacing the industry's 0.3%. The company reported sales of CNY 962.49 million for nine months ending September 2024, a notable rise from CNY 799.05 million last year. Net income also increased to CNY 62 million from CNY 56.63 million previously. With high-quality earnings and reduced debt-to-equity ratio from 16.9% to just 3.1% over five years, Anhui Tongfeng is positioned well despite not being free cash flow positive currently.

Hsino Tower Group (SHSE:601096)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hsino Tower Group Co., Ltd. is involved in construction engineering design activities and has a market capitalization of approximately CN¥13 billion.

Operations: The company generates revenue primarily from construction engineering design services. It reported a gross profit margin of 28% in the most recent period.

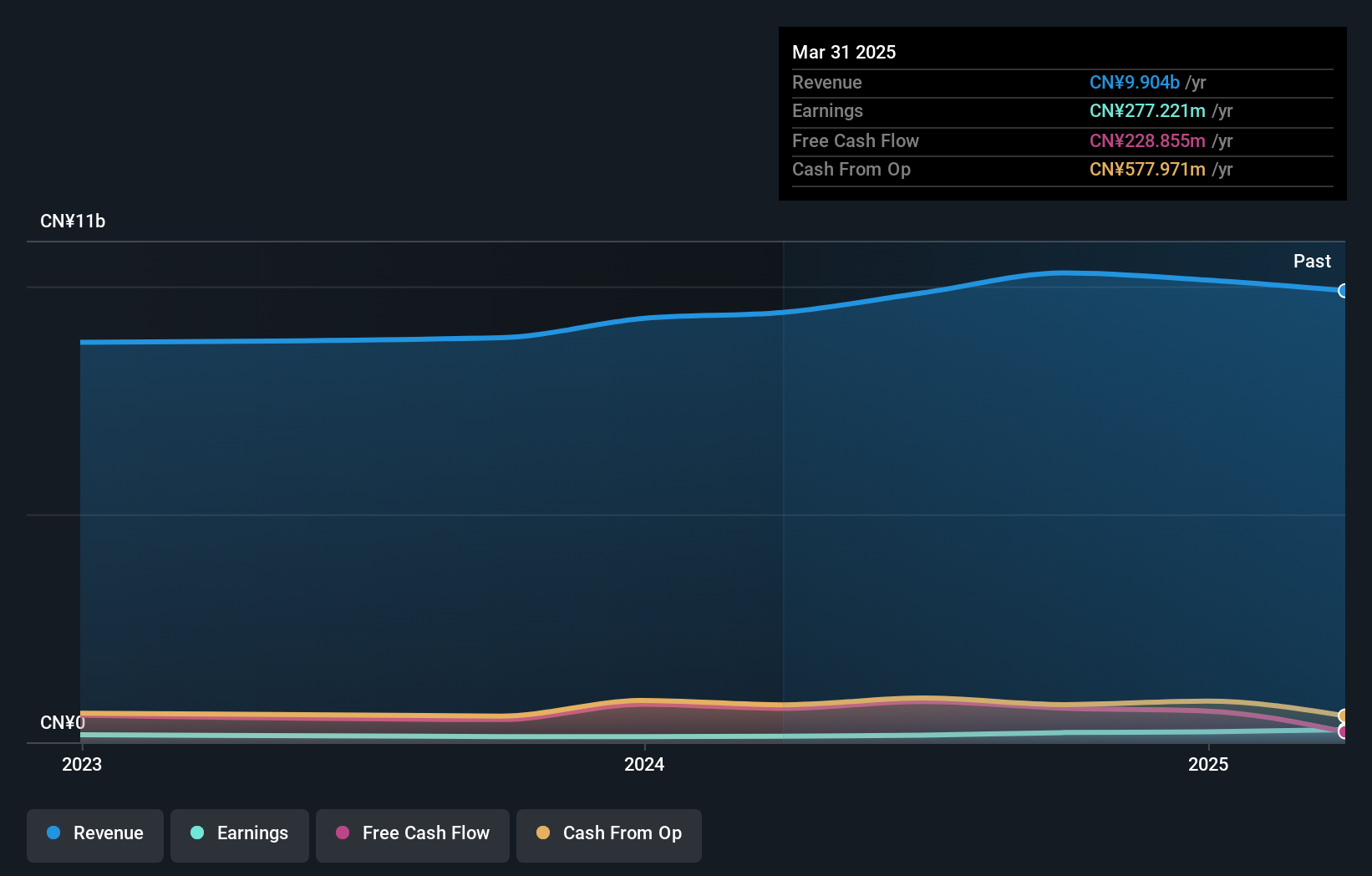

Hsino Tower Group, a smaller player in the industry, has shown impressive earnings growth of 70.2% over the past year, outpacing the electrical sector's average of 2.1%. With sales reaching CNY 7.58 billion for the nine months ending September 2024, up from CNY 6.58 billion last year, it reflects robust performance. The company trades at a significant discount of about 35% below its estimated fair value and boasts high-quality earnings with strong interest coverage by EBIT at 45 times its debt payments. Despite historical declines in earnings over five years by an annual rate of around 23%, recent results indicate potential for recovery and value appreciation.

Youngy Health (SZSE:300247)

Simply Wall St Value Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is involved in the manufacture, export, and sale of sauna products in China with a market capitalization of CN¥3.38 billion.

Operations: The company generates revenue primarily from the manufacture, export, and sale of sauna products in China. It has a market capitalization of CN¥3.38 billion.

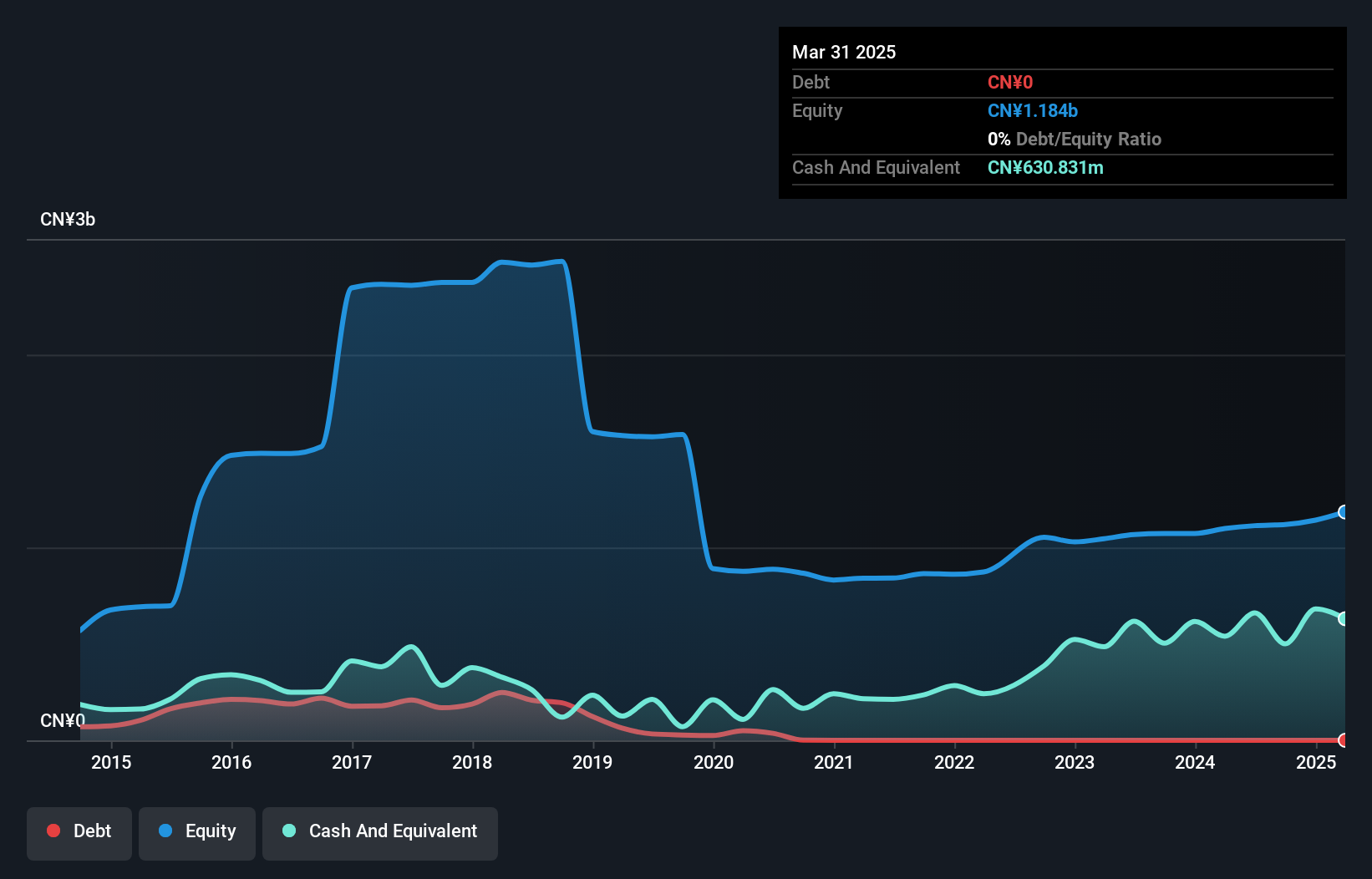

Youngy Health has demonstrated impressive growth, with earnings surging by 169.9% over the past year, significantly outpacing the Leisure industry's -1.4%. The company is debt-free now, a notable improvement from five years ago when its debt to equity ratio stood at 1.7%. Despite experiencing volatility in its share price recently, Youngy Health remains free cash flow positive and reported a net income of CNY 36.44 million for the nine months ending September 2024. Revenue for this period increased to CNY 475.8 million from CNY 374.17 million last year, reflecting solid operational performance amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Youngy Health.

Understand Youngy Health's track record by examining our Past report.

Where To Now?

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4739 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300247

Youngy Health

Engages in the manufacture, export, and sale of sauna products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives