- China

- /

- Electronic Equipment and Components

- /

- SHSE:600237

Should You Be Adding Anhui Tongfeng Electronics (SHSE:600237) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Anhui Tongfeng Electronics (SHSE:600237). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Anhui Tongfeng Electronics with the means to add long-term value to shareholders.

See our latest analysis for Anhui Tongfeng Electronics

How Fast Is Anhui Tongfeng Electronics Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Anhui Tongfeng Electronics has managed to grow EPS by 33% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

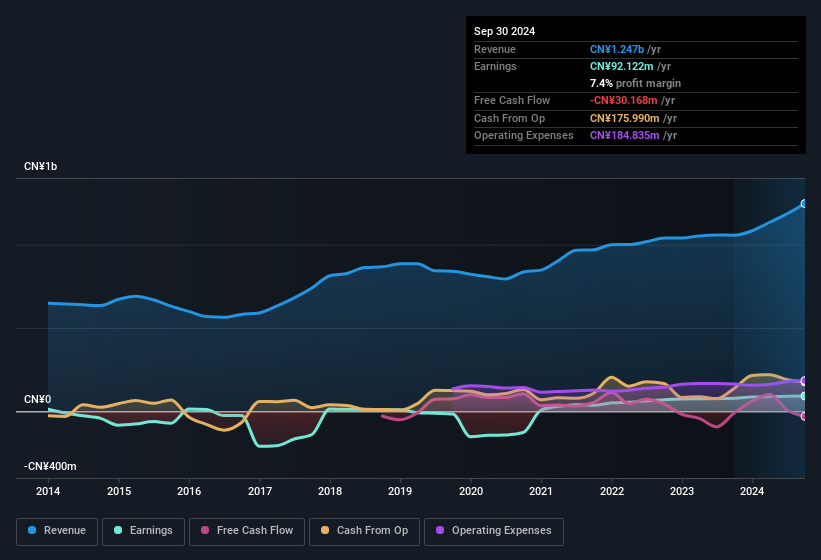

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Anhui Tongfeng Electronics' revenue from operations did not account for all of their revenue last year, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Anhui Tongfeng Electronics remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 18% to CN¥1.2b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Anhui Tongfeng Electronics Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Anhui Tongfeng Electronics, with market caps between CN¥2.8b and CN¥11b, is around CN¥991k.

The Anhui Tongfeng Electronics CEO received CN¥768k in compensation for the year ending December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Anhui Tongfeng Electronics Worth Keeping An Eye On?

For growth investors, Anhui Tongfeng Electronics' raw rate of earnings growth is a beacon in the night. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Of course, profit growth is one thing but it's even better if Anhui Tongfeng Electronics is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Anhui Tongfeng Electronics certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600237

Anhui Tongfeng Electronics

Engages in the research and development, production, and sales of thin films, film capacitors and related electronic components in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026