- China

- /

- Electronic Equipment and Components

- /

- SHSE:600183

High Growth Tech Stocks In Asia To Watch August 2025

Reviewed by Simply Wall St

As global markets experience a boost from favorable trade deals, with key indices like the S&P 500 and Nasdaq Composite reaching record highs, Asian tech stocks are drawing increased attention amid hopes for extended tariff truces and economic stabilization. In this dynamic environment, identifying high-growth tech stocks in Asia requires careful consideration of factors such as innovation potential and resilience to geopolitical shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shengyi TechnologyLtd (SHSE:600183)

Simply Wall St Growth Rating: ★★★★★☆

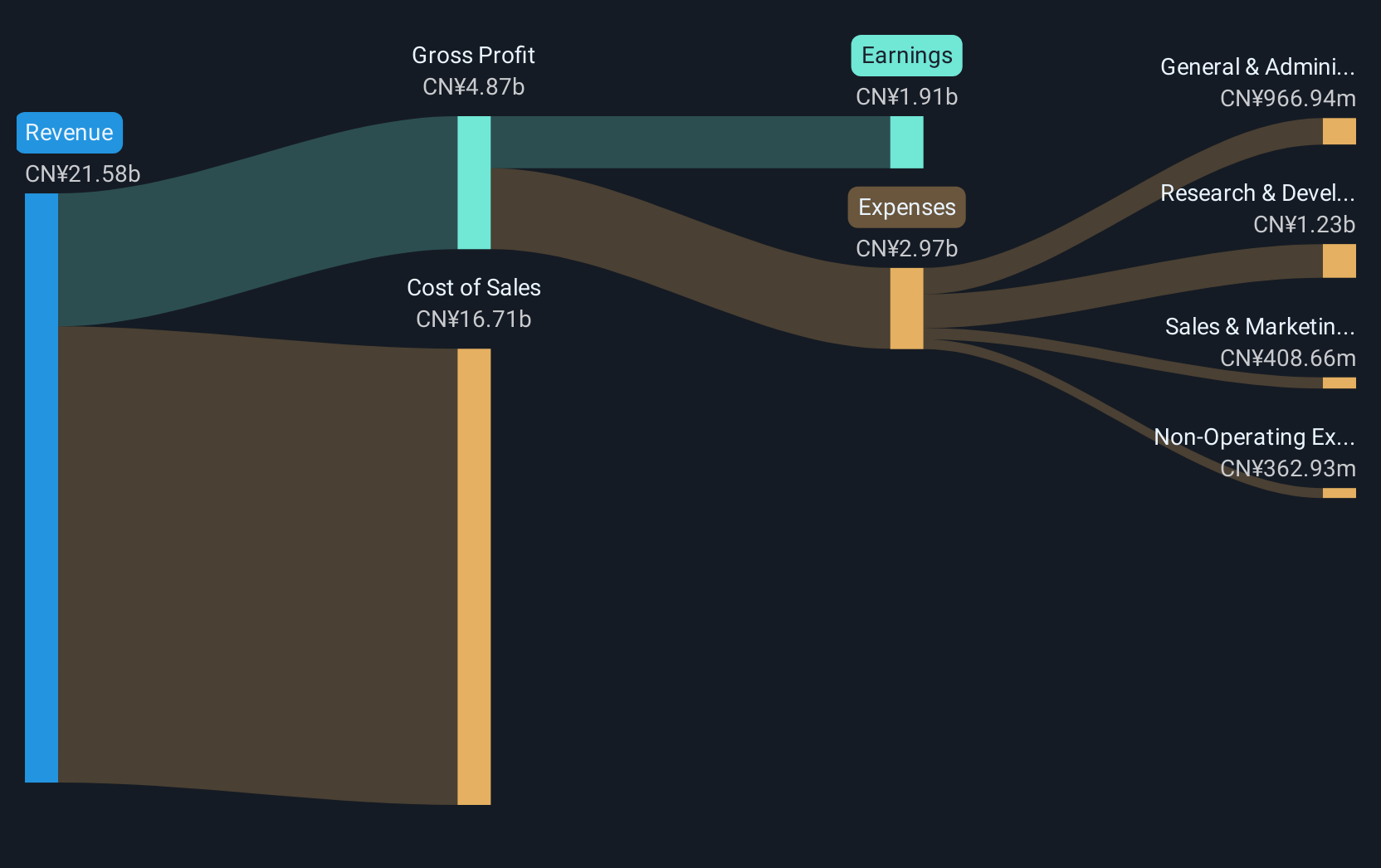

Overview: Shengyi Technology Co., Ltd. is engaged in the development, manufacturing, and sale of laminates in China with a market capitalization of CN¥104.26 billion.

Operations: Shengyi Technology Co., Ltd. focuses on producing and distributing laminates within the Chinese market.

Shengyi Technology Co., Ltd, recently added to the SSE 180 Index, demonstrates robust growth metrics that underscore its upward trajectory in the tech sector. With a notable annual earnings increase of 46%, outpacing the electronic industry's average of 2.8%, and revenue projected to rise at 15.7% per year—faster than the broader Chinese market's 12.5%—the company is positioned well against its peers. Its commitment to innovation is evident from an R&D focus that aligns with forecasted high returns on equity of 20.8% in three years, signaling potential for sustained competitive advantage and shareholder value creation in a dynamic industry landscape.

- Click to explore a detailed breakdown of our findings in Shengyi TechnologyLtd's health report.

Evaluate Shengyi TechnologyLtd's historical performance by accessing our past performance report.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

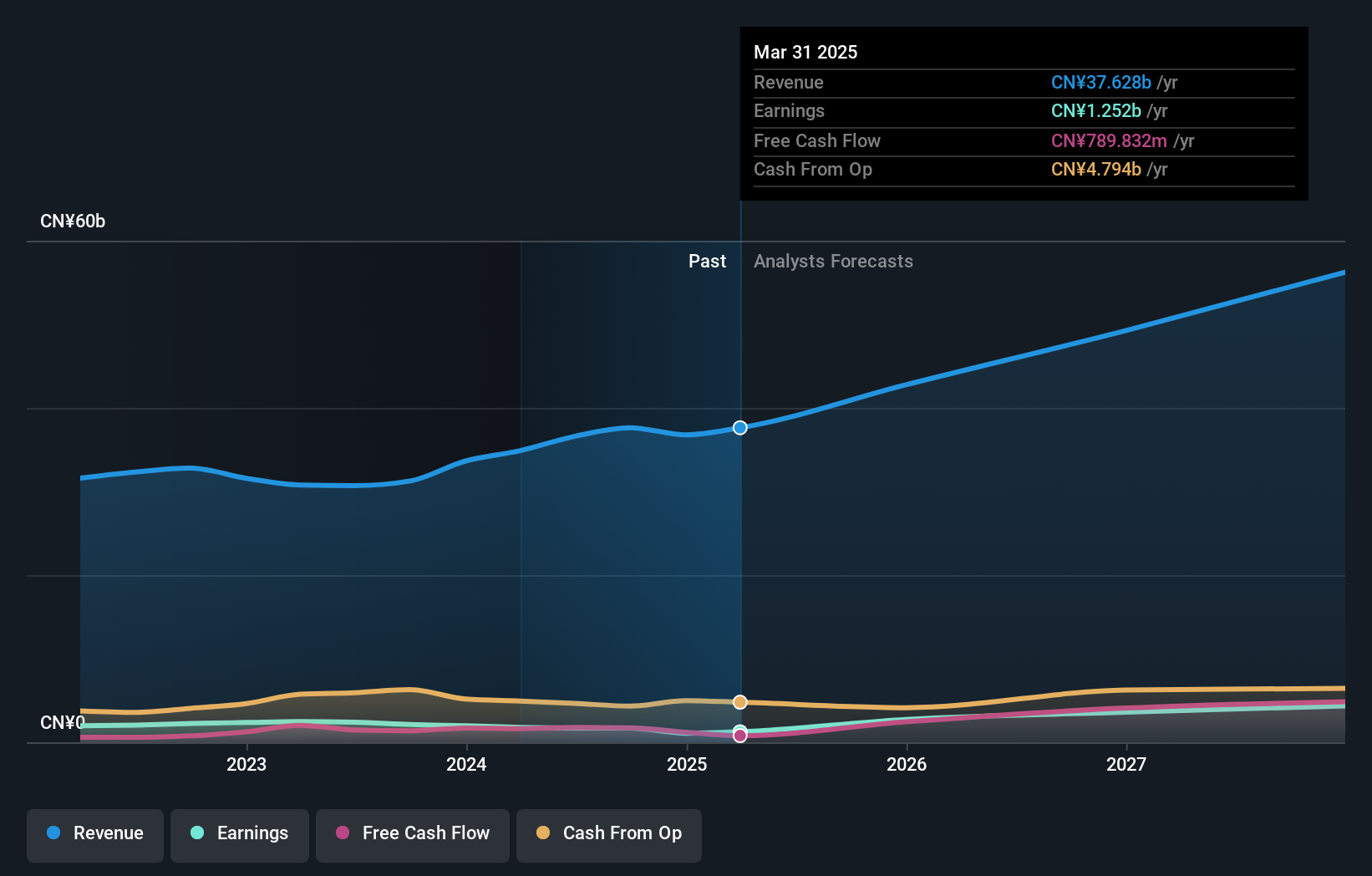

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. is a company engaged in the production of precision components and electronic products, with a market cap of CN¥106.61 billion.

Operations: Dongshan Precision focuses on producing precision components and electronic products. The company operates with a market cap of CN¥106.61 billion, indicating its significant presence in the industry.

Suzhou Dongshan Precision Manufacturing, amidst a challenging environment with a recent 29.7% dip in earnings, still shows promise with its strategic moves and robust revenue forecasts. The company's commitment to growth is evident from its aggressive share buybacks, repurchasing 0.25% of its shares for CNY 100.08 million, signaling confidence in its future prospects. Despite a dividend cut this year, the firm's projected annual revenue growth at 14.7% outpaces the broader Chinese market's expectation of 12.5%, coupled with an anticipated earnings surge of 37.5% per annum over the next three years—highlighting potential resilience and adaptability in the high-growth tech landscape of Asia.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

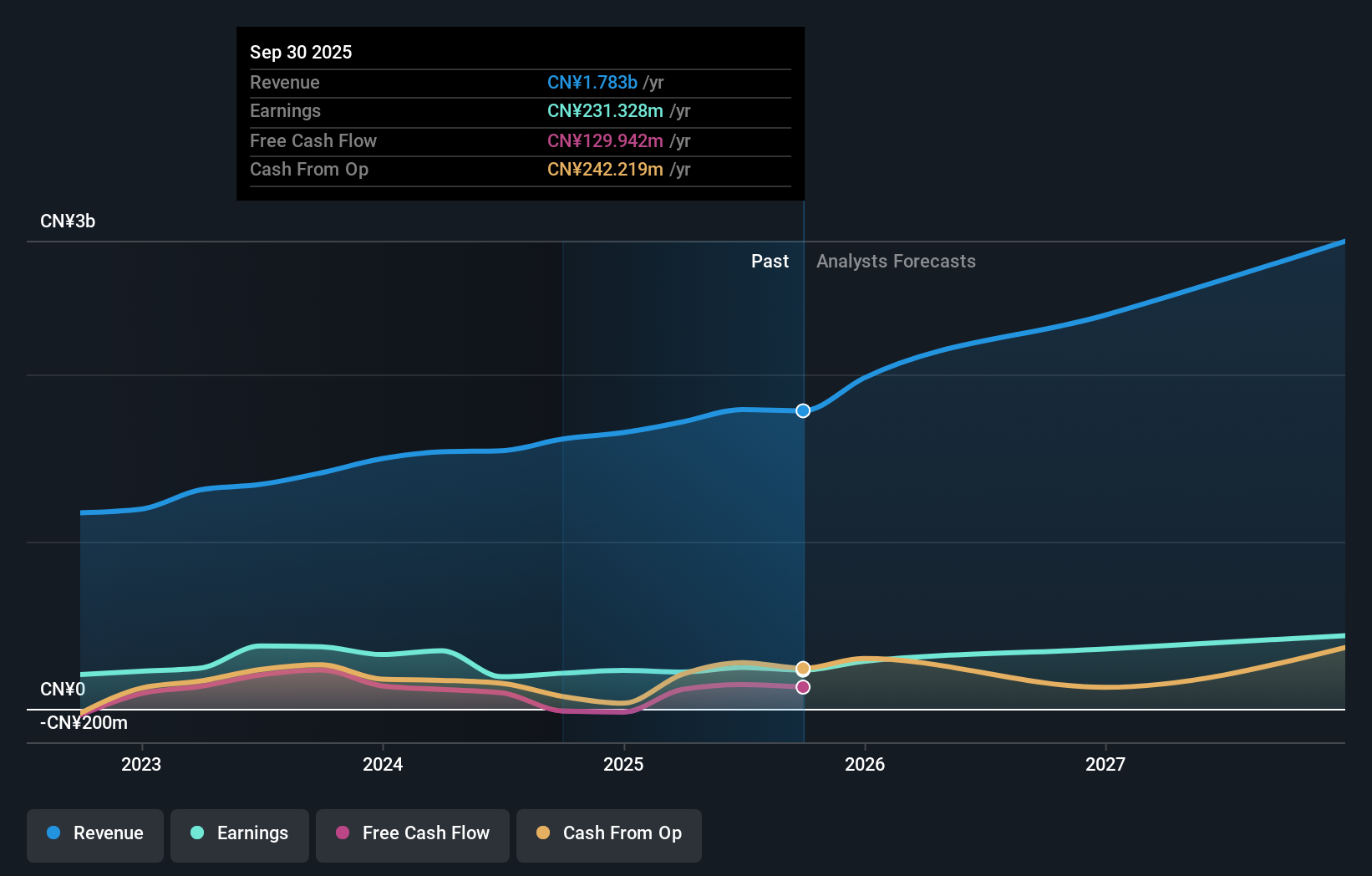

Overview: Richinfo Technology Co., Ltd. focuses on developing and selling software products in China, with a market capitalization of CN¥12.78 billion.

Operations: Richinfo Technology Co., Ltd. specializes in creating and marketing software products across China. The company generates revenue primarily through its software sales, with a notable focus on innovation and technology development within the sector.

Richinfo Technology, amidst a backdrop of board reshuffles and strategic amendments in governance, shows a robust trajectory with an 18.5% annual revenue growth outpacing the Chinese market forecast of 12.5%. Despite a recent dip in earnings by 36.8%, the company's forward-looking measures, including substantial dividend payouts totaling CNY 1.25 per share and anticipated earnings growth at an impressive rate of 24.5% annually, underscore its resilience and potential within Asia's competitive tech landscape. This outlook is further bolstered by its commitment to innovation as evidenced by significant R&D investments aimed at sustaining long-term growth in evolving technological domains.

Make It Happen

- Click through to start exploring the rest of the 164 Asian High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600183

Shengyi TechnologyLtd

Engages in the design, production, and sales of copper clad laminates, adhesive sheets, and printed circuit boards in China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion