Amidst a backdrop of mixed global economic indicators, Asian markets have shown resilience, with China's stock indices recording gains and Japan's markets experiencing modest increases despite political uncertainties. In this environment, identifying high growth tech stocks in Asia requires careful consideration of factors such as innovation potential and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 27.20% | 30.47% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the global research, development, manufacture, and commercialization of antibody drugs with a market capitalization of HK$128.71 billion.

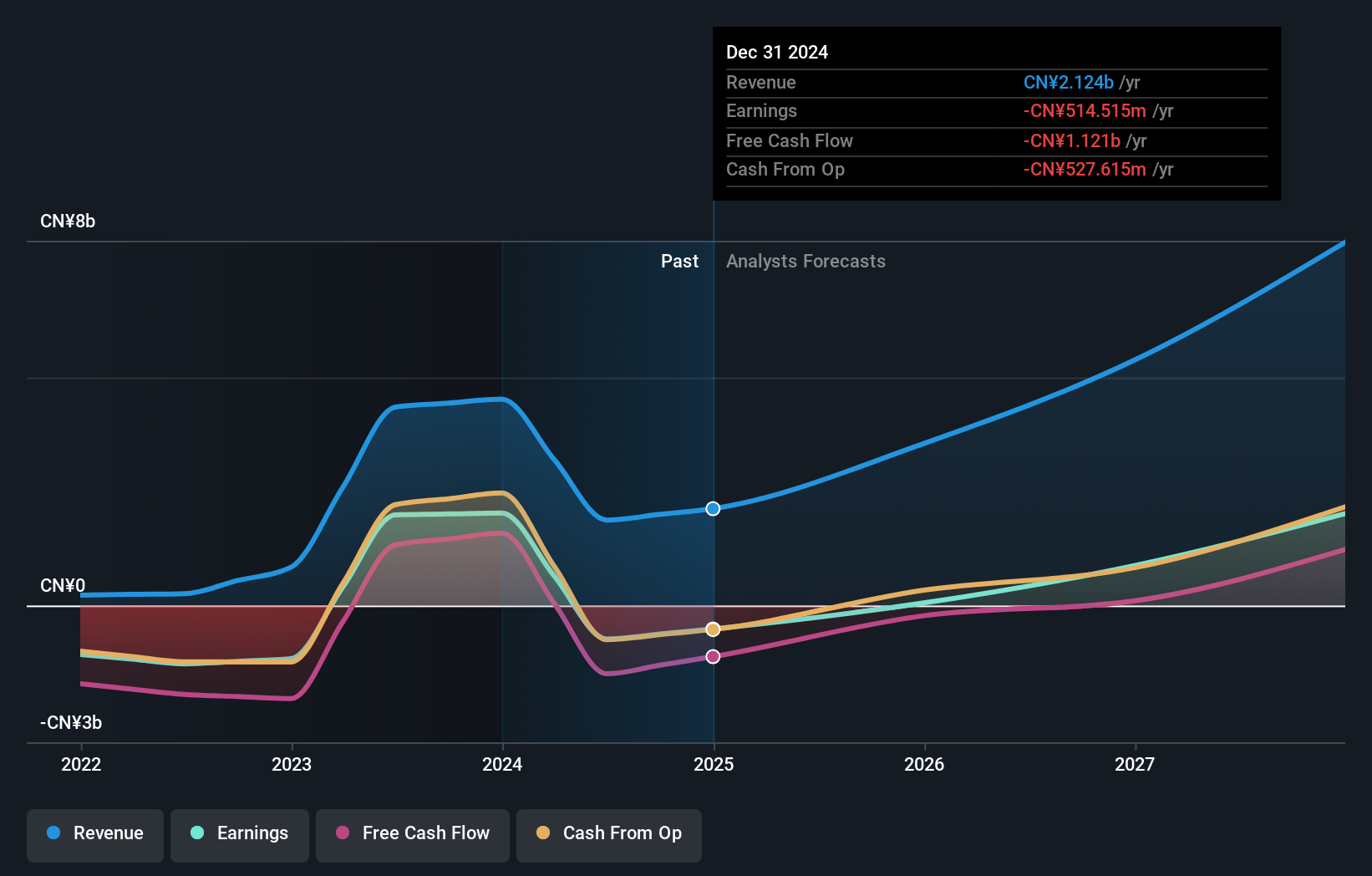

Operations: The company generates revenue primarily from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥2.12 billion.

Akeso, Inc. is setting benchmarks in the biopharmaceutical sector with its innovative approach to cancer treatment, particularly through its recent advancements in bispecific antibodies and antibody-drug conjugates (ADCs). The company's R&D commitment is underscored by a robust pipeline of over 50 innovative assets, with significant investments that align well with industry demands for next-generation therapies. Notably, Akeso has achieved compelling clinical outcomes; for instance, their PD-1/VEGF bispecific antibody ivonescimab showed a median progression-free survival (mPFS) that significantly outperformed competitors in recent trials. With revenue growth forecasted at 32% annually and earnings expected to surge by approximately 41.6% per year, Akeso is strategically positioned to meet the growing global need for effective cancer treatments while enhancing its market presence aggressively.

- Delve into the full analysis health report here for a deeper understanding of Akeso.

Examine Akeso's past performance report to understand how it has performed in the past.

Tsinghua Tongfang (SHSE:600100)

Simply Wall St Growth Rating: ★★★★☆☆

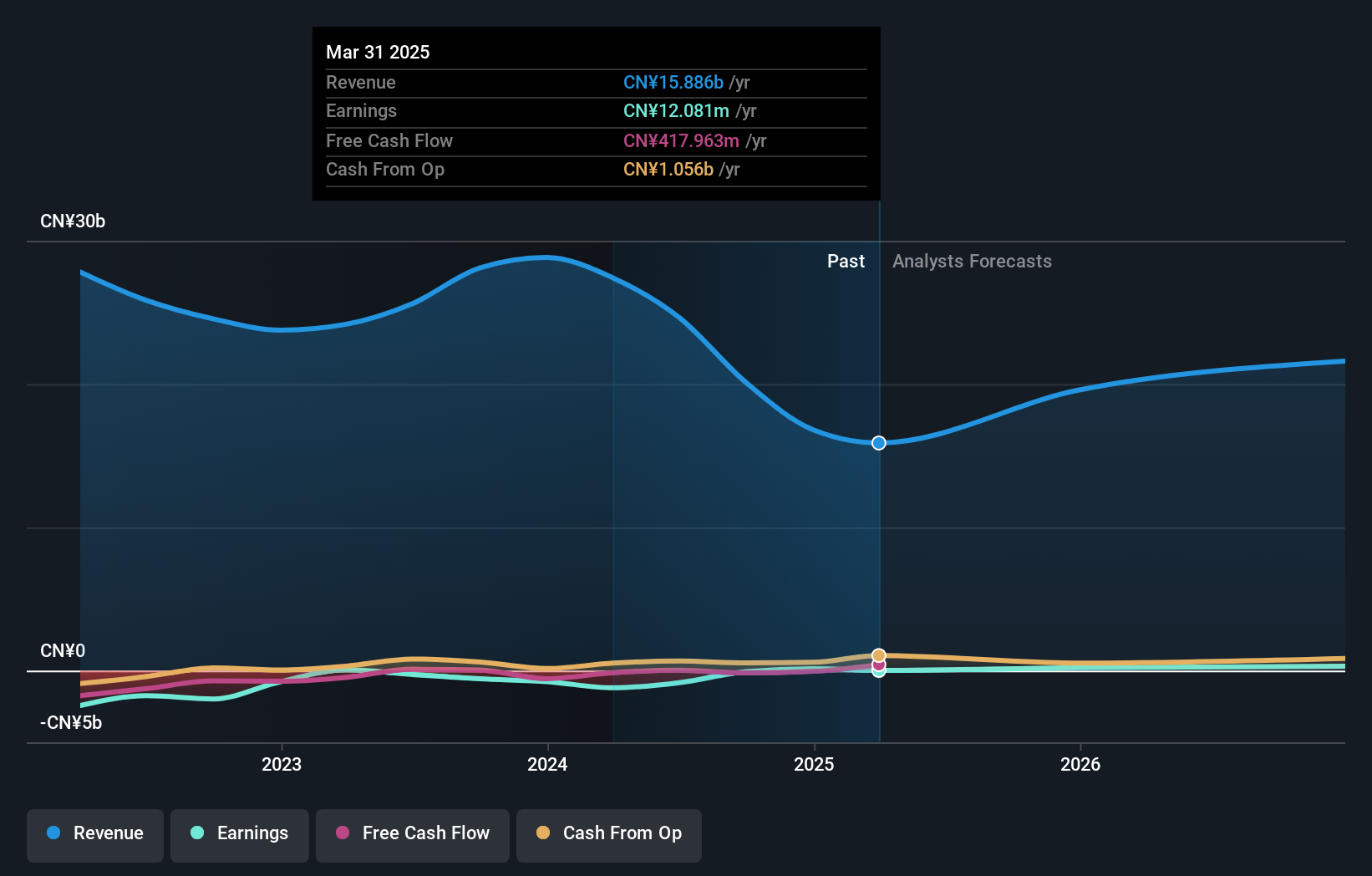

Overview: Tsinghua Tongfang Co., Ltd. operates in digital information, civil nuclear technology, energy conservation and environmental protection, and technology and finance sectors with a market cap of approximately CN¥24.96 billion.

Operations: The company generates revenue through its involvement in digital information, civil nuclear technology, energy conservation and environmental protection, and technology and finance sectors. Its market cap is approximately CN¥24.96 billion.

Tsinghua Tongfang is navigating the competitive landscape of Asia's tech sector with a focus on innovation and market adaptation. Despite a challenging quarter, with revenue dropping to CNY 2.02 billion from CNY 2.93 billion year-over-year and a widening net loss of CNY 287.6 million, the company's commitment to research and development remains unwavering. This dedication is evident in their strategic investments in emerging technologies, which could bolster future performance as evidenced by an impressive forecasted annual earnings growth of 93.8%. With recent corporate activities including an earnings call and annual general meeting, Tsinghua Tongfang is actively engaging with stakeholders to refine strategies and enhance its market position in high-growth tech sectors across Asia.

- Dive into the specifics of Tsinghua Tongfang here with our thorough health report.

Gain insights into Tsinghua Tongfang's past trends and performance with our Past report.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★☆☆

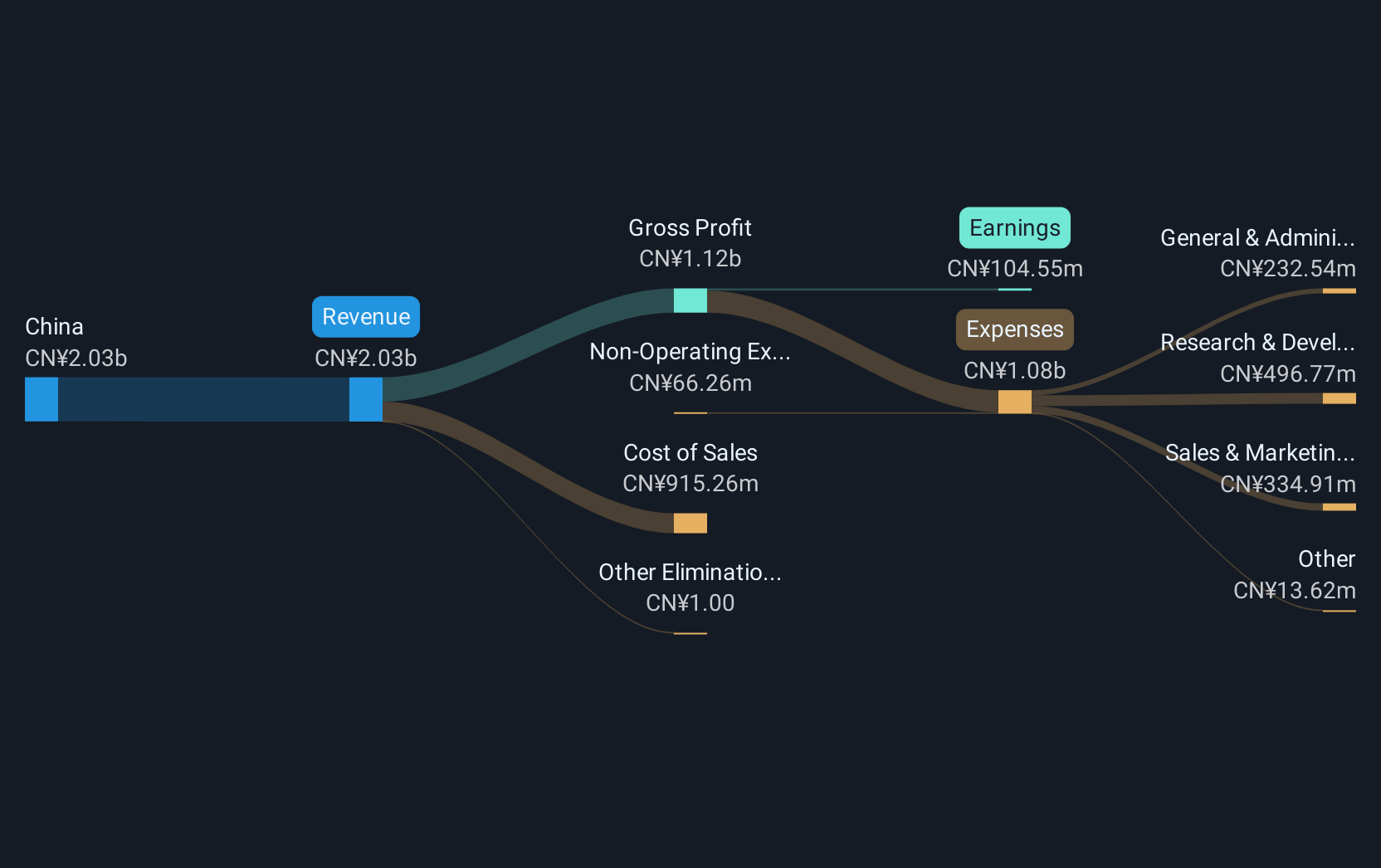

Overview: Servyou Software Group Co., Ltd. operates in China, offering financial and tax information services, with a market cap of CN¥19.54 billion.

Operations: The company focuses on providing financial and tax information services across China. It generates revenue primarily through its software solutions tailored for tax compliance and financial management.

Servyou Software Group is distinguishing itself in the high-growth tech sector in Asia, showcasing a robust annual revenue increase of 19.5% and an even more impressive earnings growth at 46.9%. This trajectory is supported by strategic R&D investments, which have amounted to significant yearly expenditures, aligning with industry demands for constant innovation and adaptation. The firm's recent financials reveal a Q1 revenue jump to CNY 448.74 million from CNY 362.7 million year-over-year, although net income slightly dipped to CNY 24.75 million from CNY 32.78 million, reflecting ongoing reinvestment into business capabilities and market expansion efforts. With these dynamics at play, Servyou is poised to maintain its competitive edge by leveraging technological advancements and expanding its market footprint.

- Click to explore a detailed breakdown of our findings in Servyou Software Group's health report.

Evaluate Servyou Software Group's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 479 Asian High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives