As global markets react positively to the recent U.S.-China tariff suspension, Asian tech stocks are capturing attention with their potential for high growth amidst easing trade tensions. In this dynamic environment, investors often look for companies that demonstrate innovation and adaptability, key traits that can help navigate the evolving economic landscape and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.64% | 30.42% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.42% | ★★★★★★ |

| Cowell e Holdings | 20.16% | 24.57% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.10% | ★★★★★★ |

| PharmaResearch | 25.85% | 28.36% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Alibaba Pictures Group (SEHK:1060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Pictures Group Limited is an investment holding company engaged in content creation, technology services, and IP merchandising and commercialization in Hong Kong and the People's Republic of China, with a market cap of HK$18.22 billion.

Operations: Alibaba Pictures Group focuses on content creation, technology services, and IP merchandising in Hong Kong and China. The company generates revenue through these core segments, leveraging its expertise in the entertainment industry to expand its market presence.

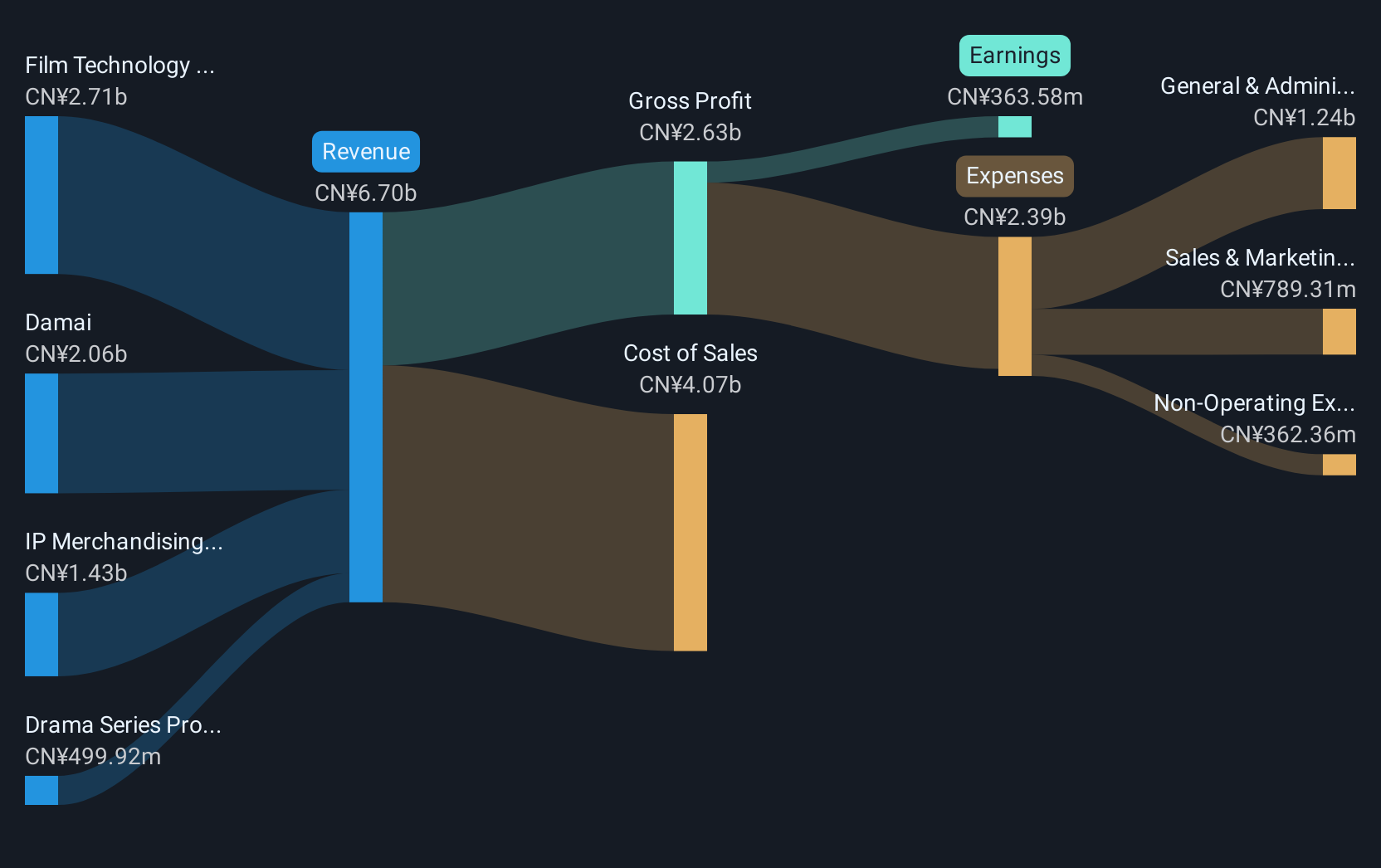

Alibaba Pictures Group, a player in the high-growth tech sector in Asia, showcased a robust performance with its latest earnings report marking a significant year-over-year increase. Sales surged to CNY 6.7 billion from CNY 5 billion, while net income rose to CNY 363.58 million from CNY 284.79 million previously. This reflects an annualized revenue growth of 9.7% and earnings growth of approximately 44.9%, underscoring its potential in the entertainment industry despite market challenges like high volatility in share price and one-off losses impacting financial results (CNY 315.4M). The firm's commitment to innovation is evident from its strategic alliances and digital initiatives, such as the recent renewal of agreements for digital collectibles leveraging blockchain technology, which could redefine content monetization strategies moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Alibaba Pictures Group.

Learn about Alibaba Pictures Group's historical performance.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NanJi E-Commerce Co., LTD operates in China offering brand authorization, retail, and mobile Internet marketing services with a market cap of CN¥12.09 billion.

Operations: NanJi E-Commerce Co., LTD generates revenue primarily through brand authorization, retail, and mobile Internet marketing services in China. The company's market cap stands at CN¥12.09 billion.

Despite a challenging quarter marked by a shift from profit to a CNY 13.63 million net loss, NanJi E-Commerce remains poised for recovery with its revenue slightly increasing to CNY 729.12 million from CNY 714.6 million year-over-year. This resilience is underscored by an expected annual revenue growth of 18.2%, outpacing the broader Chinese market's growth rate of 12.4%. The company's strategic focus may soon pivot as earnings are forecasted to surge by an impressive 74.54% annually, suggesting potential for significant financial turnaround despite current volatility and recent dividend cuts signaling short-term cash flow considerations.

- Unlock comprehensive insights into our analysis of NanJi E-Commerce stock in this health report.

Explore historical data to track NanJi E-Commerce's performance over time in our Past section.

Hydsoft TechnologyLtd (SZSE:301316)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hydsoft Technology Co., Ltd. offers professional IT services both in China and internationally, with a market cap of CN¥14.06 billion.

Operations: Hydsoft Technology Co., Ltd. specializes in delivering IT services across domestic and international markets. The company generates revenue through its professional IT service offerings, focusing on diverse client needs in various regions.

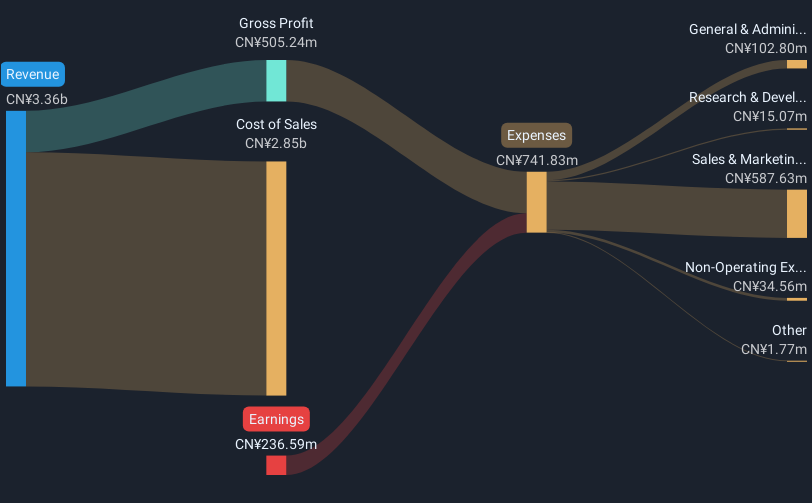

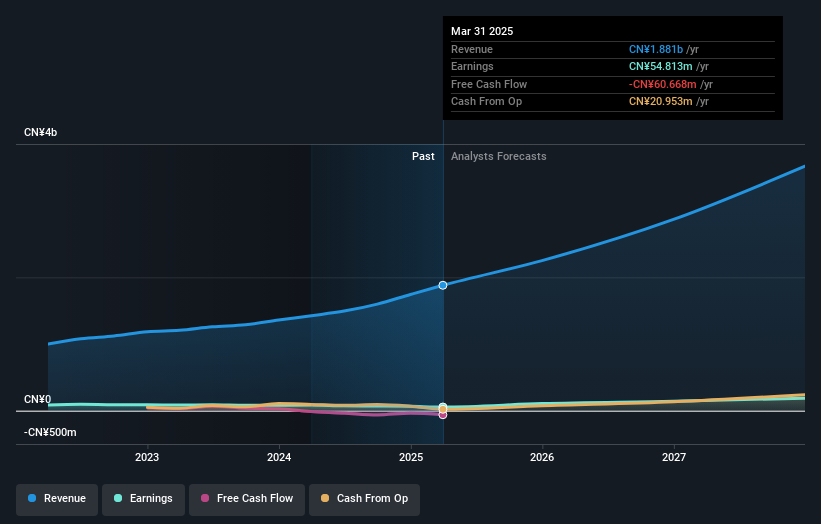

Hydsoft TechnologyLtd, amidst a robust Asian tech landscape, reported a significant revenue jump to CNY 505.76 million in Q1 2025 from CNY 367.92 million the previous year, marking a growth of 37.5%. This surge is backed by an aggressive R&D investment strategy, with recent figures showing an expenditure increase that aligns with their innovation-driven market approach. Despite a dip in net income to CNY 4.16 million from CNY 14.94 million, the firm's commitment to expanding its technological capabilities suggests potential for future earnings resilience and market competitiveness. Moreover, the company's strategic dividends and detailed corporate governance discussions at its upcoming Annual General Meeting underscore a structured plan for sustained growth and shareholder engagement.

- Take a closer look at Hydsoft TechnologyLtd's potential here in our health report.

Understand Hydsoft TechnologyLtd's track record by examining our Past report.

Taking Advantage

- Get an in-depth perspective on all 494 Asian High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hydsoft TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301316

Hydsoft TechnologyLtd

Hydsoft Technology Co., Ltd. provides professional information technology (IT) services in China and internationally.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives