- China

- /

- Food and Staples Retail

- /

- SHSE:600113

Unearthing Hidden Gems With Potential February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating indices and economic uncertainties, small-cap stocks have faced unique challenges and opportunities. With the S&P MidCap 400 and Russell 2000 showing varied performances amid AI competition fears and steady interest rates, investors may find potential in lesser-known companies that demonstrate resilience, innovation, or strong fundamentals. Identifying these hidden gems requires a keen understanding of market dynamics and an eye for companies that can thrive despite broader volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang Dongri Limited (SHSE:600113)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Dongri Limited Company is involved in the wholesale of agricultural products in China, with a market capitalization of CN¥5.58 billion.

Operations: Zhejiang Dongri Limited generates revenue through the wholesale of agricultural products in China. The company has a market capitalization of CN¥5.58 billion.

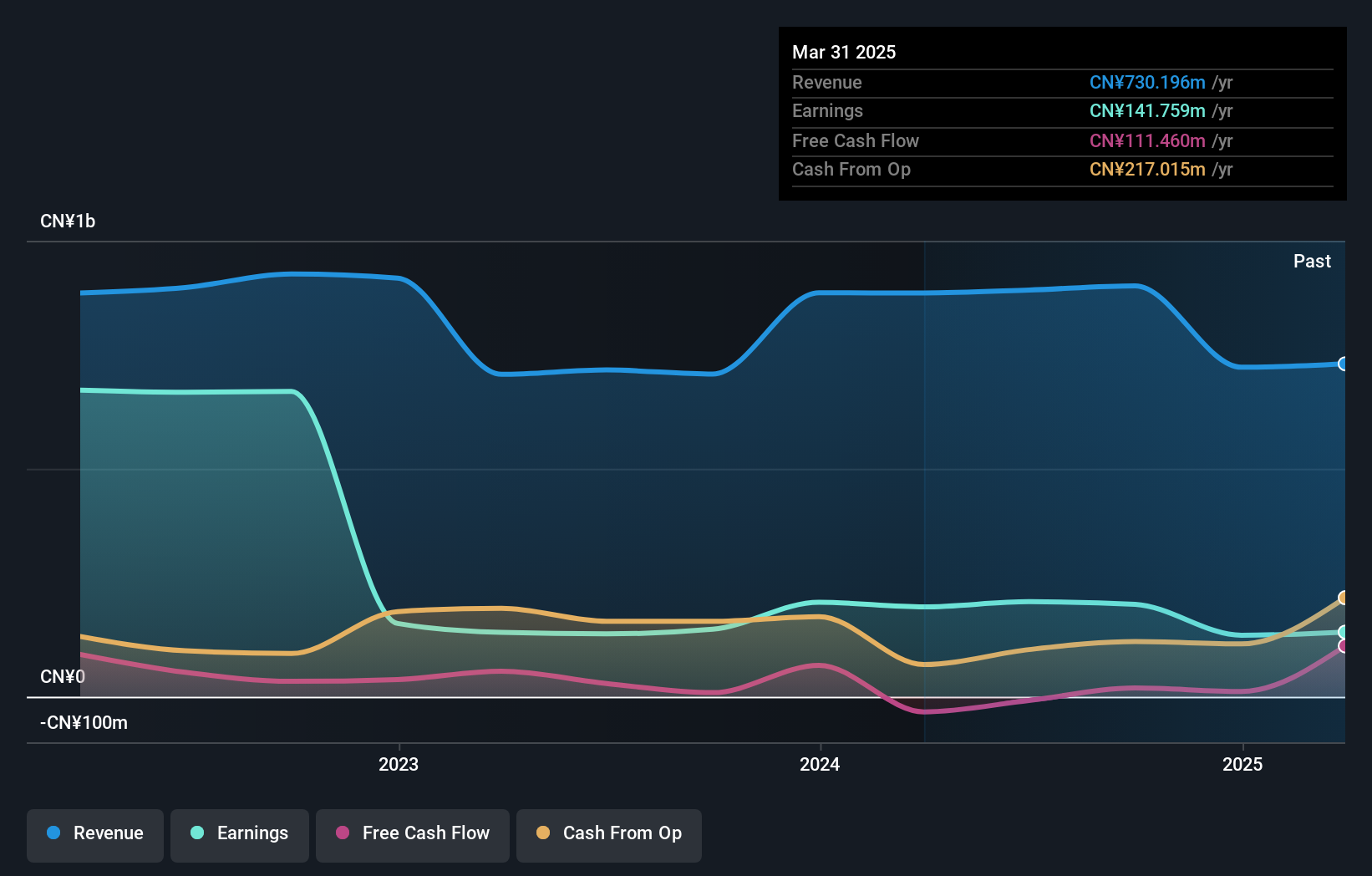

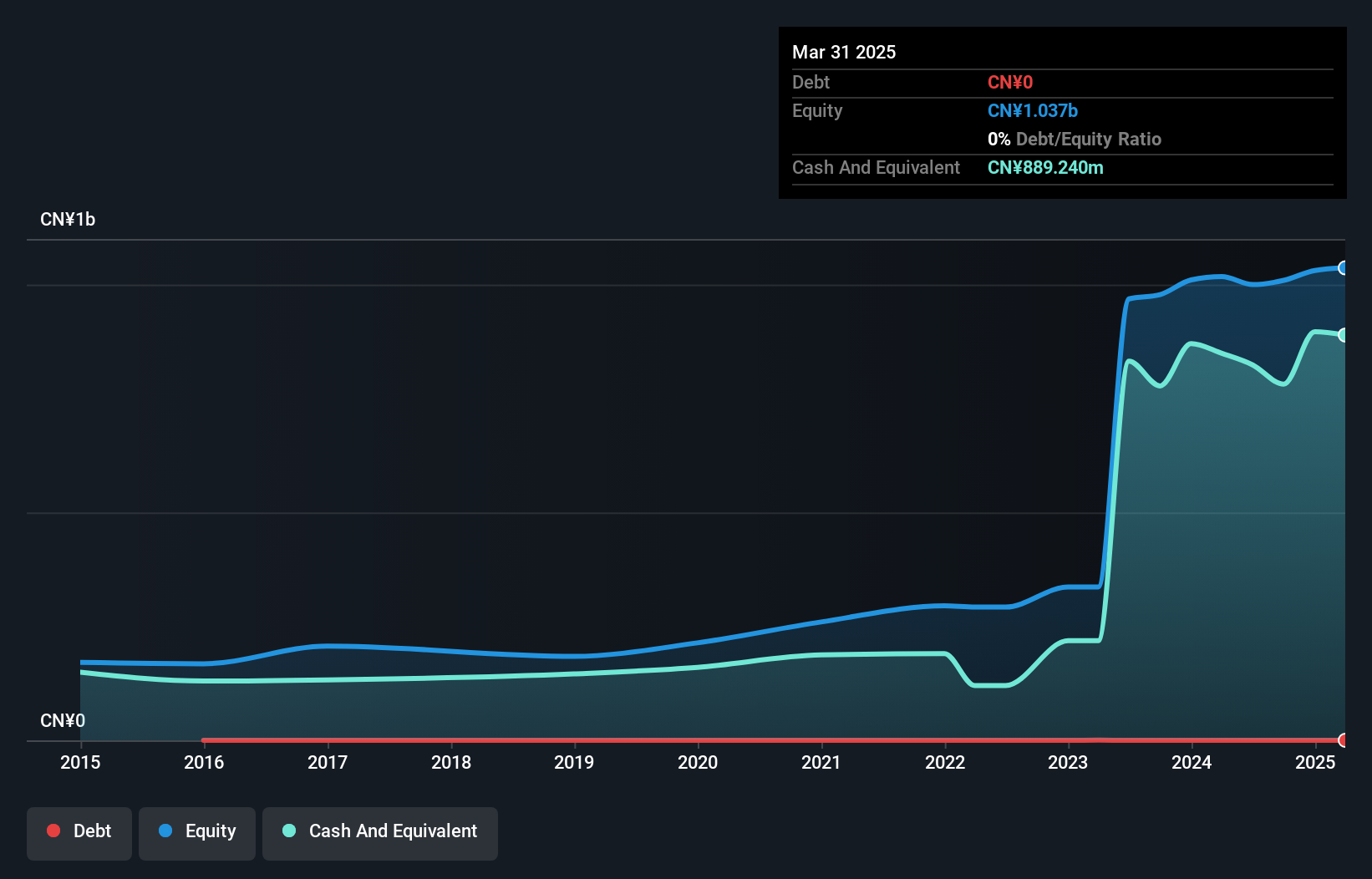

Zhejiang Dongri Limited, a noteworthy player in its sector, showcases impressive financial metrics. Over the past year, earnings surged by 39.4%, outpacing the Consumer Retailing industry’s 6% growth rate. The company’s debt-to-equity ratio has risen slightly from 9.3% to 10.9% over five years, but it holds more cash than total debt, indicating sound financial health. With a price-to-earnings ratio of 28.4x below the CN market average of 34.7x, it appears undervalued relative to peers and maintains high-quality earnings while covering interest payments comfortably without concern for cash runway issues.

Lucky Harvest (SZSE:002965)

Simply Wall St Value Rating: ★★★★★★

Overview: Lucky Harvest Co., Ltd. specializes in the research, development, production, and sale of precision stamping dies and structural metal parts in China, with a market capitalization of CN¥8.80 billion.

Operations: The company generates revenue from the sale of precision stamping dies and structural metal parts. It focuses on optimizing production costs to enhance profitability, with a notable trend in its net profit margin.

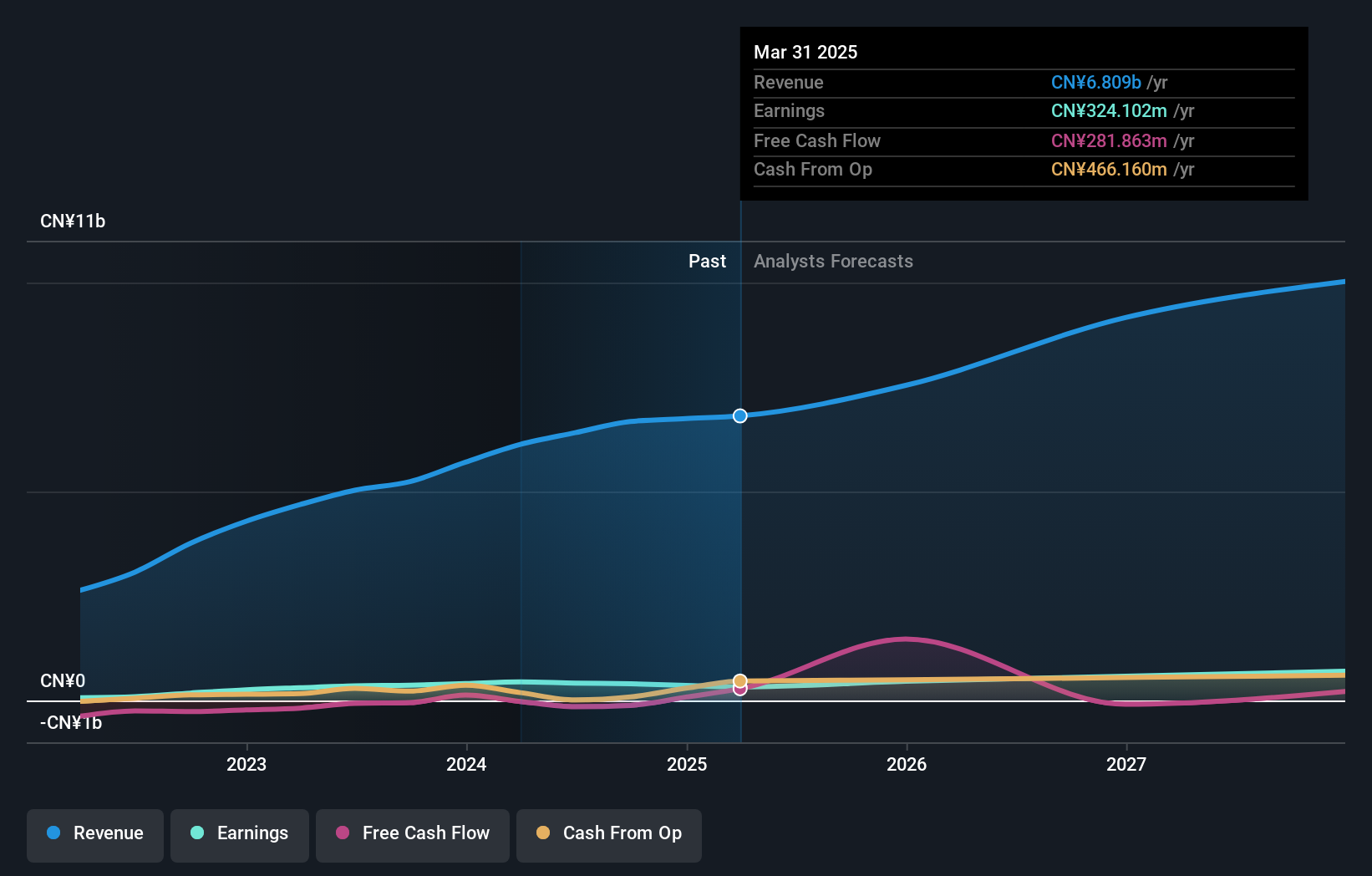

Lucky Harvest appears to be a promising contender in the market, showcasing high-quality earnings and a debt-to-equity ratio that has improved from 3.3 to 2.8 over five years. With an EBIT covering interest payments 87 times, financial stability seems strong despite free cash flow challenges. The P/E ratio of 22.7 is attractive compared to the broader CN market's 34.7, suggesting good relative value for investors eyeing growth potential in this sector. Earnings have surged by nearly 9% last year, outpacing industry averages and hinting at robust future prospects with forecasts indicating annual growth of over 23%.

- Click to explore a detailed breakdown of our findings in Lucky Harvest's health report.

Review our historical performance report to gain insights into Lucky Harvest's's past performance.

Shanghai Wisdom Information Technology (SZSE:301315)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Wisdom Information Technology Co., Ltd. (SZSE:301315) operates in the technology sector, focusing on providing information technology solutions, with a market cap of CN¥4.89 billion.

Operations: Shanghai Wisdom Information Technology generates revenue primarily through its technology solutions. The company's financial performance is highlighted by a net profit margin of 15.23%.

Shanghai Wisdom Information Technology, a nimble player in the tech sector, has shown impressive earnings growth of 10.9% over the past year, outpacing the broader IT industry's -8.1%. Despite its volatile share price recently, this debt-free company benefits from high-quality non-cash earnings. Levered free cash flow was US$75.26 million as of June 2023 but dipped to -US$2.92 million by September 2024, suggesting potential operational adjustments or investments impacting liquidity. Recently dropped from the S&P Global BMI Index, it remains focused on governance with an upcoming board election meeting scheduled for January 27th in Shanghai.

Where To Now?

- Click here to access our complete index of 4688 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dongri Limited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600113

Zhejiang Dongri Limited

Engages in wholesale of agricultural products in China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives