- China

- /

- Electronic Equipment and Components

- /

- SZSE:301051

High Growth Tech Features These 3 Promising Stocks

Reviewed by Simply Wall St

As global markets wrapped up the year with moderate gains, driven initially by large-cap growth stocks before a mid-week reversal, the spotlight remains on economic indicators such as declining consumer confidence and manufacturing figures that could signal challenges ahead for small-cap companies. In this environment, identifying high-growth tech stocks requires careful consideration of their potential to innovate and adapt amidst fluctuating market sentiments and economic pressures.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd specializes in the manufacturing and sale of precision components, with a market capitalization of CN¥4.89 billion.

Operations: Ningbo Sunrise Elc Technology Co., Ltd focuses on producing and selling precision components. The company operates with a market capitalization of approximately CN¥4.89 billion, indicating its significant presence in the industry.

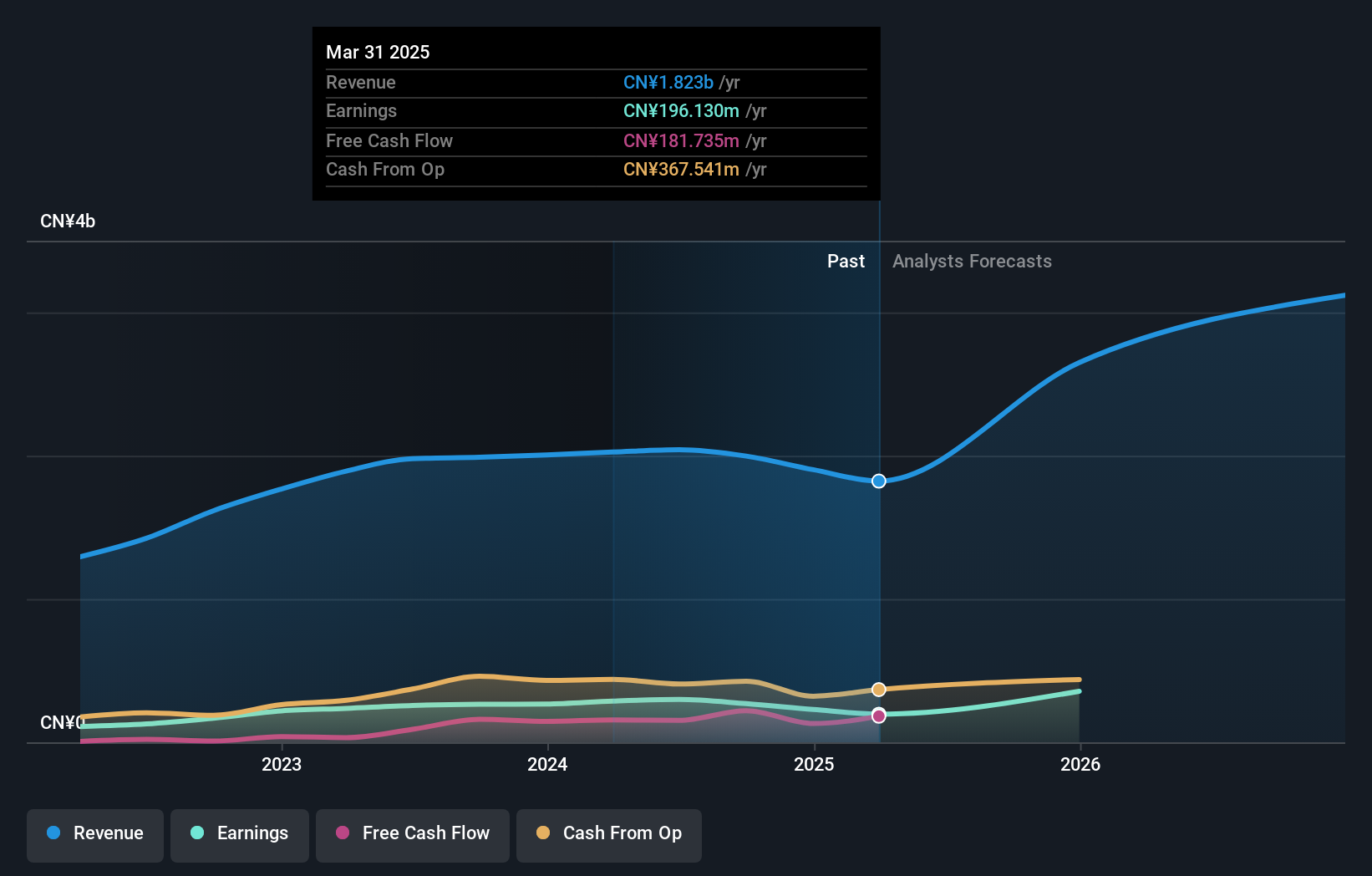

Ningbo Sunrise Elc TechnologyLtd, amidst a challenging market, reported a slight dip in revenue to CNY 1.48 billion from CNY 1.49 billion year-over-year for the nine months ended September 2024, yet managed to increase its net income to CNY 192.44 million from CNY 189.92 million. This resilience is underscored by an impressive forecast of annual earnings growth at 35.1% and revenue growth at 32.6%, significantly outpacing the broader Chinese market's expectations of 25.2% and 13.6%, respectively. The company's commitment to innovation is evident as it continues investing in R&D, crucial for sustaining its competitive edge in the high-tech industry.

Shenzhen Xinhao Photoelectricity Technology (SZSE:301051)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Xinhao Photoelectricity Technology Co., Ltd focuses on the research, development, manufacture, and sale of precision optical components and modules in China with a market capitalization of CN¥4.45 billion.

Operations: Xinhao Photoelectricity specializes in precision optical components and modules, emphasizing research, development, manufacturing, and sales within China. The company operates with a market capitalization of approximately CN¥4.45 billion.

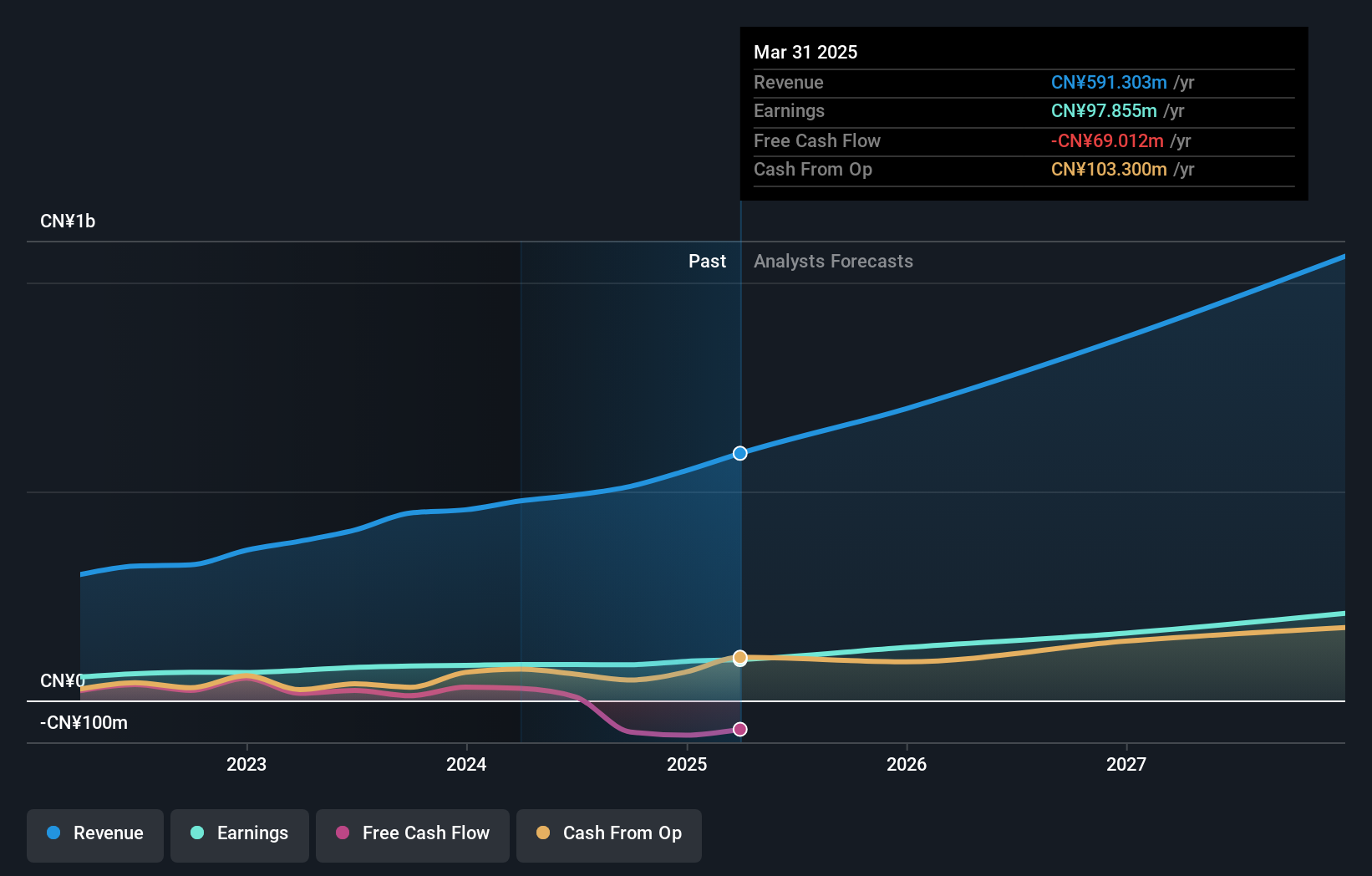

Shenzhen Xinhao Photoelectricity Technology, amidst a dynamic tech landscape, is navigating through substantial transformation. Despite a net loss of CNY 206.71 million for the nine months ending September 2024, contrasting last year's CNY 27.06 million profit, the company's revenue slightly increased to CNY 1,234.29 million from CNY 1,220.75 million year-over-year. This resilience in revenue amidst losses highlights its potential pivot towards profitability with an anticipated explosive annual earnings growth of 146%. The firm’s commitment to innovation and adaptation is underscored by recent shareholder meetings focused on strategic amendments and operational adjustments aimed at enhancing governance and financial agility.

State Power Rixin Technology (SZSE:301162)

Simply Wall St Growth Rating: ★★★★★☆

Overview: State Power Rixin Technology Co., Ltd. offers data services and application solutions for the global energy industry, with a market cap of CN¥4.30 billion.

Operations: The company specializes in delivering data services and application solutions tailored for the energy sector globally. With a market cap of CN¥4.30 billion, it focuses on leveraging technology to enhance efficiency and innovation within the industry.

Amidst a challenging tech landscape, State Power Rixin Technology has demonstrated robust growth and resilience. With an annual revenue increase of 25.4% and earnings growth forecasted at 31.4%, the company outpaces the broader Chinese market's growth rates of 13.6% in revenue and 25.2% in earnings respectively. This performance is bolstered by its strategic focus on research and development, which has seen a significant allocation of resources, underscoring its commitment to innovation in a highly competitive sector. Recent events like being dropped from the S&P Global BMI Index could be seen as setbacks, yet the firm continues to push forward with substantial capital directed towards enhancing operational capabilities as evidenced in their latest shareholders meeting discussing financial strategies for 2025.

Where To Now?

- Investigate our full lineup of 1263 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301051

Shenzhen Xinhao Photoelectricity Technology

Engages in the research and development, manufacture, and sale of precision optical components and module field in China.

Slightly overvalued very low.

Market Insights

Community Narratives