The global markets recently experienced volatility, with U.S. technology stocks facing pressure from competitive concerns in the AI sector and mixed corporate earnings reports. Amid this backdrop, investors are closely watching economic indicators such as inflation rates and central bank policies, which continue to shape market sentiment. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate innovation and resilience in the face of emerging challenges like new AI developments and fluctuating interest rates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 24.52% | 34.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Beijing Infosec TechnologiesLtd (SHSE:688201)

Simply Wall St Growth Rating: ★★★★☆☆

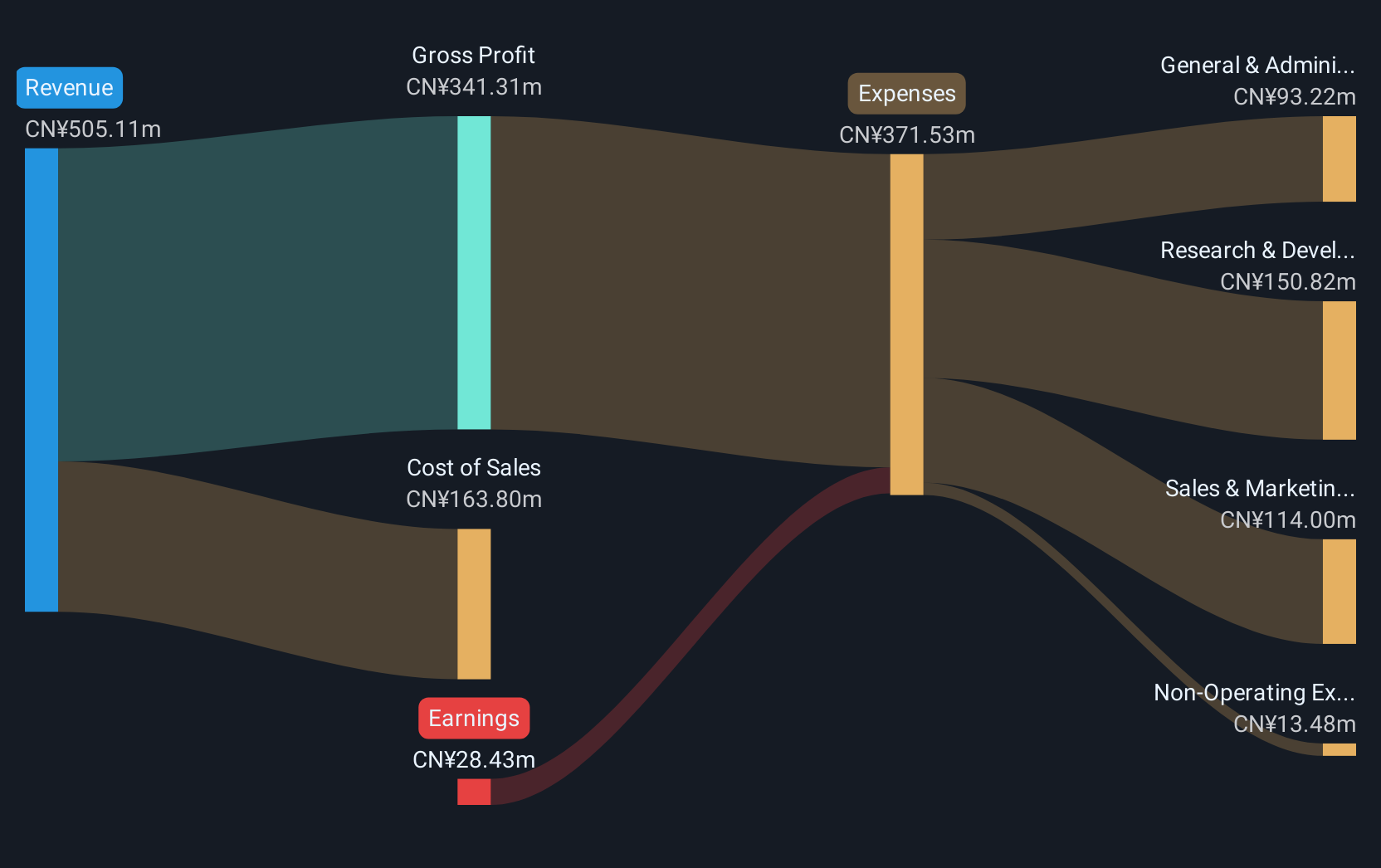

Overview: Beijing Infosec Technologies Co., Ltd. is a company that develops and provides application security products in China, with a market capitalization of CN¥2.59 billion.

Operations: The company focuses on developing and providing application security products within China. It generates revenue primarily through the sale of these security solutions, catering to various sectors that require robust cybersecurity measures.

Beijing Infosec Technologies Ltd, amidst a challenging tech landscape, is anticipated to pivot from unprofitability with an impressive projected annual earnings growth of 124.6%. This growth trajectory is notably above the software industry's average decline of 11.2% in earnings. The firm's revenue growth also outpaces the Chinese market forecast, with an expected increase of 19.5% annually compared to the market's 13.3%. Despite current challenges, such as lacking free cash flow and high-quality past earnings, these projections suggest a robust potential for turnaround and profitability within three years. The recent shareholders' meeting underscores strategic shifts likely aimed at capitalizing on these growth forecasts.

- Navigate through the intricacies of Beijing Infosec TechnologiesLtd with our comprehensive health report here.

Understand Beijing Infosec TechnologiesLtd's track record by examining our Past report.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★★☆

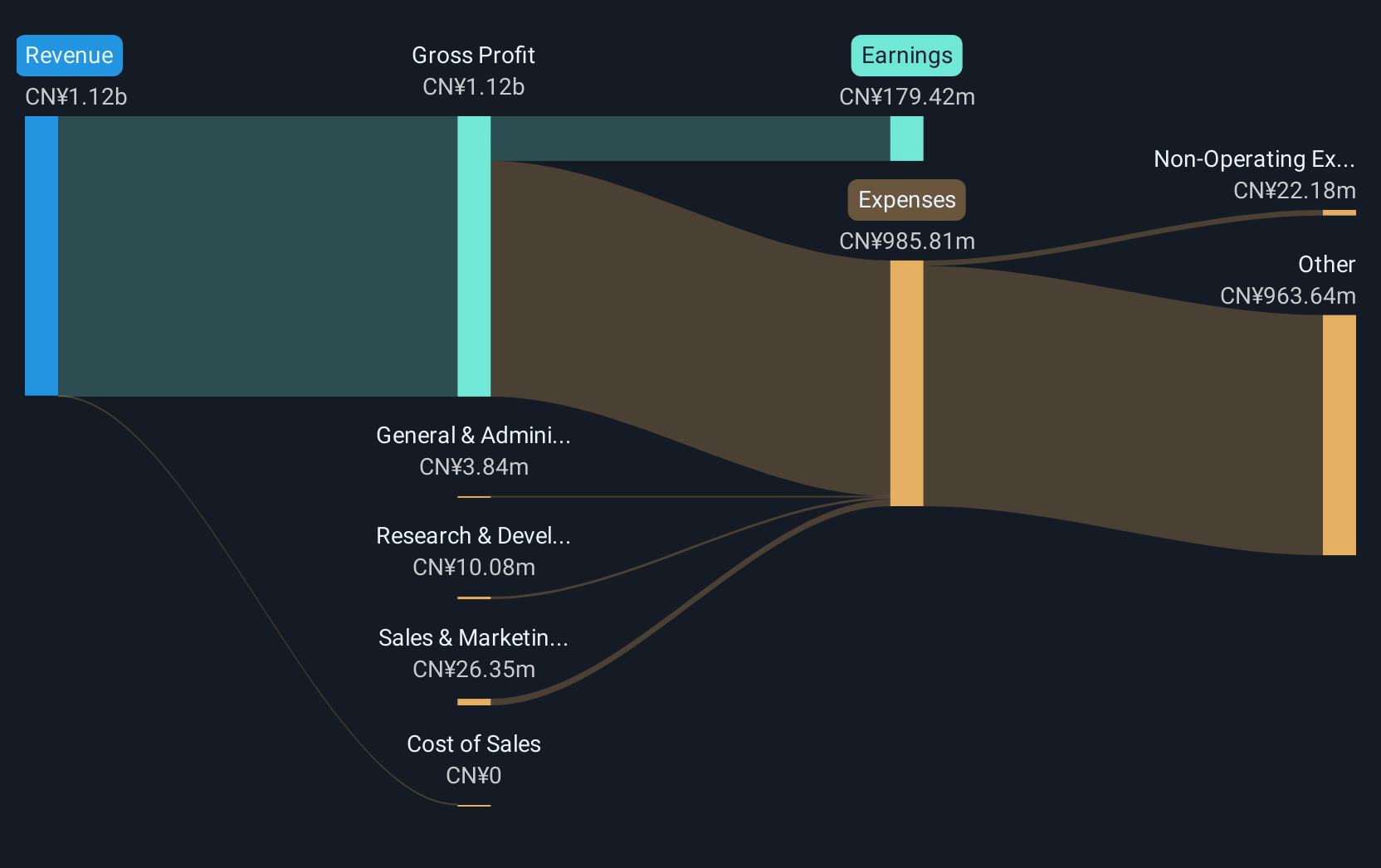

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of human vaccines both in China and internationally, with a market cap of CN¥9.19 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥1.61 billion.

Changchun BCHT Biotechnology is navigating a dynamic biotech landscape with its robust R&D investment strategy, which has seen an annual increase to $150 million, representing 15% of its revenue. This commitment to innovation underpins its notable revenue growth of 25.8% per year, surpassing the Chinese market average of 13.3%. Despite challenges like negative free cash flow, the company's earnings have surged by 36.8% annually, eclipsing the industry growth rate and positioning it well for future advancements in biotechnology sectors reliant on cutting-edge research and development efforts.

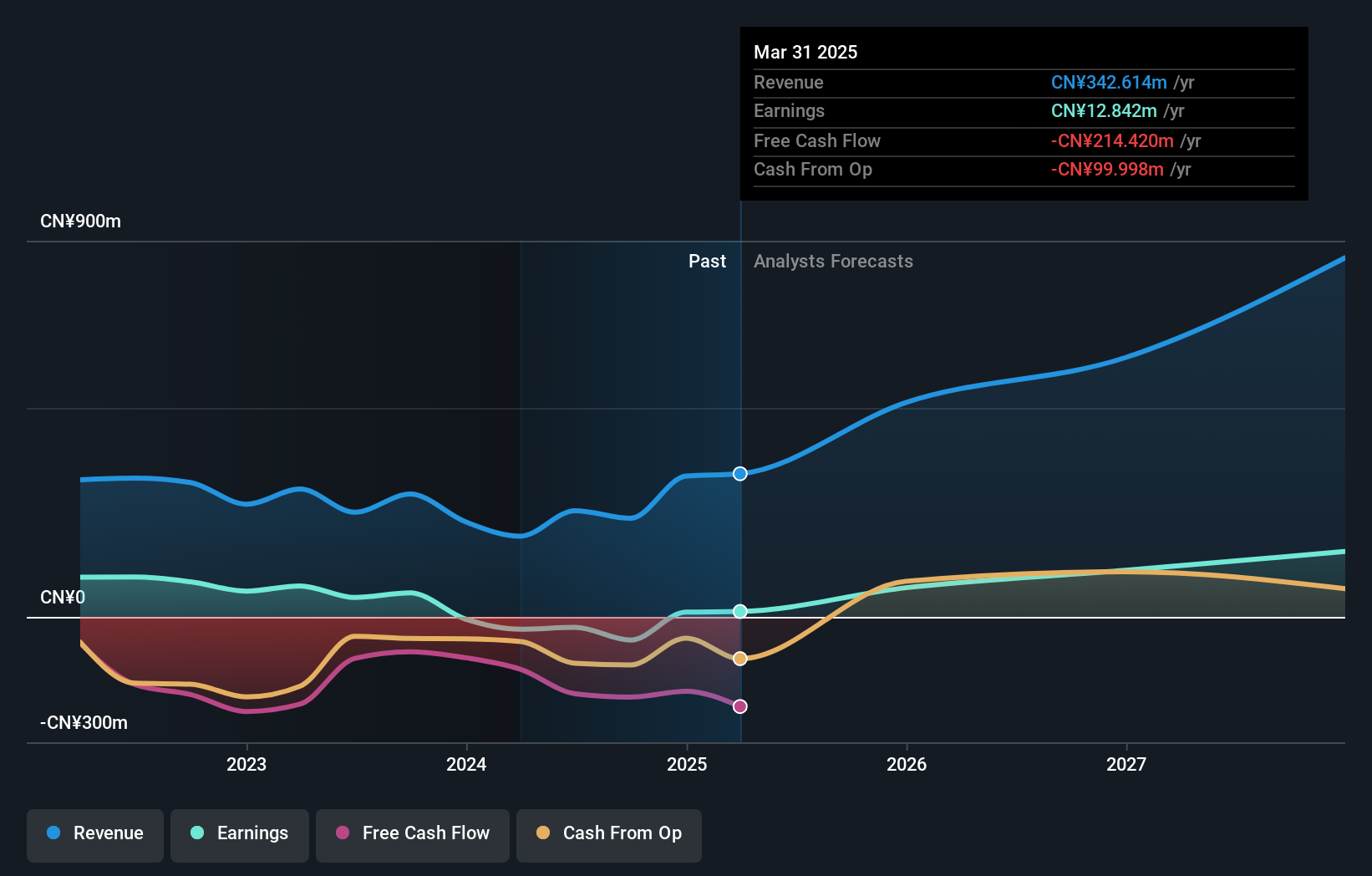

Jiayuan Science and TechnologyLtd (SZSE:301117)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiayuan Science and Technology Co., Ltd. specializes in network information security products and comprehensive information solutions, with a market cap of CN¥3.04 billion.

Operations: Jiayuan Science and Technology Co., Ltd. focuses on delivering network information security products and comprehensive information solutions. The company generates revenue primarily through its diverse range of security offerings, catering to various sectors requiring robust information protection.

Jiayuan Science and Technology Ltd. is distinguishing itself in the tech sector with an impressive annual revenue growth rate of 34.9%, significantly outpacing the Chinese market average of 13.3%. This growth is supported by a robust research and development (R&D) commitment, which has escalated to represent 15% of its total revenue, aligning with its strategy to lead in innovation-driven markets. Despite currently being unprofitable, Jiayuan's earnings are projected to surge by 105.5% annually, positioning it for profitability within three years. The company's recent approval of amendments to its articles of association underscores a proactive approach in governance that may further enhance its operational agility and market responsiveness.

Summing It All Up

- Explore the 1228 names from our High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and sells application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion