As global markets grapple with rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking for stability and potential in companies that insiders trust. In this environment, stocks with high insider ownership often stand out as they suggest confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

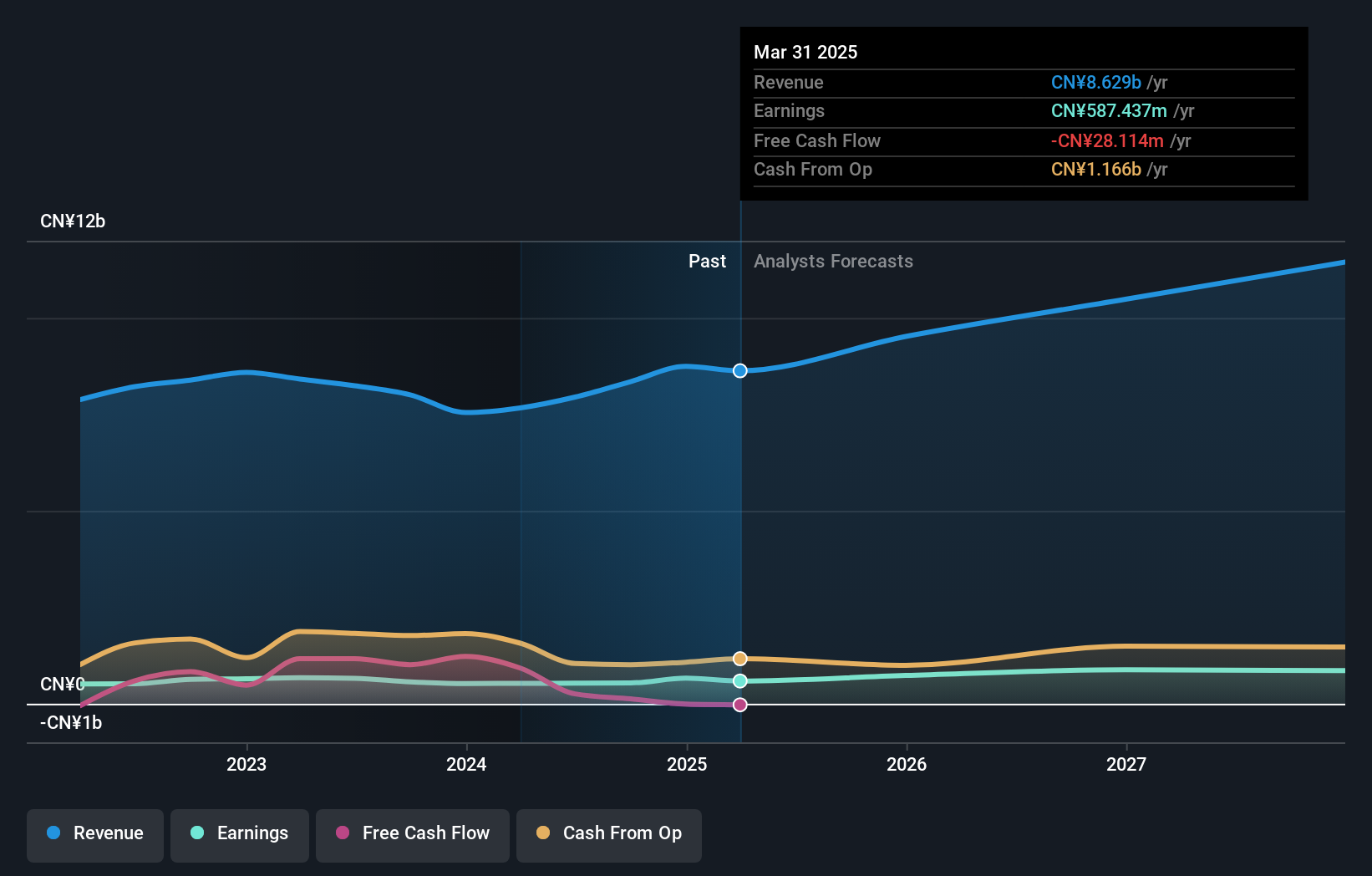

Overview: Shenzhen Sunway Communication Co., Ltd. is involved in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions both in China and internationally with a market cap of CN¥24.02 billion.

Operations: Shenzhen Sunway Communication generates revenue through the sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions in both domestic and international markets.

Insider Ownership: 20.5%

Revenue Growth Forecast: 18.8% p.a.

Shenzhen Sunway Communication shows strong growth potential, with earnings expected to grow significantly at 35.7% annually, outpacing the Chinese market. Despite a volatile share price, its price-to-earnings ratio of 44.7x is below the industry average, suggesting relative value. Recent financials indicate solid performance with nine-month revenue reaching CNY 6.39 billion and net income of CNY 533.24 million. The company also completed a share buyback worth CNY 268 million to support equity incentive plans.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Sunway Communication.

- According our valuation report, there's an indication that Shenzhen Sunway Communication's share price might be on the expensive side.

Nanfang Zhongjin Environment (SZSE:300145)

Simply Wall St Growth Rating: ★★★★☆☆

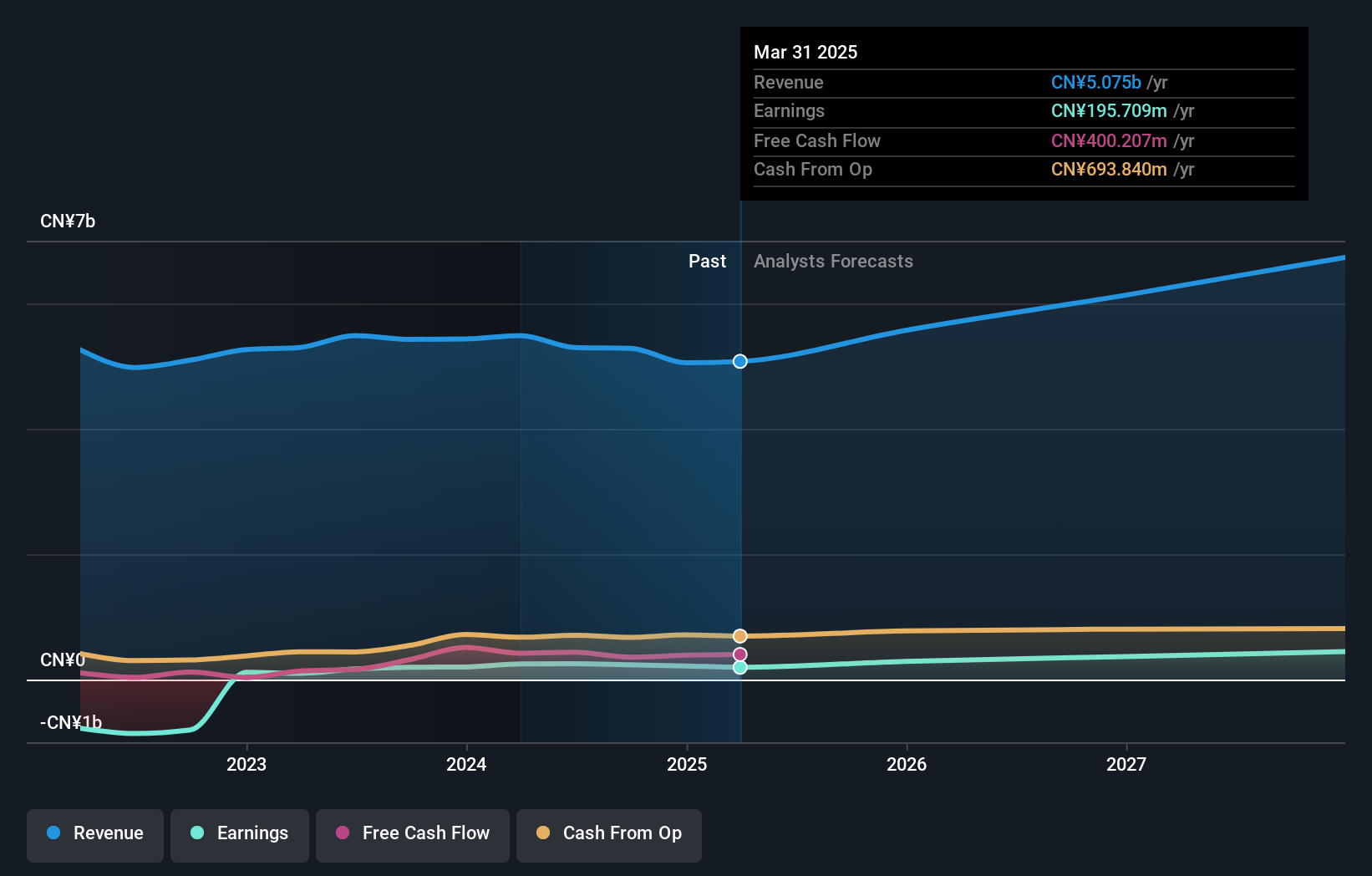

Overview: Nanfang Zhongjin Environment Co., Ltd. operates in the general equipment manufacturing sector through its subsidiaries and has a market capitalization of CN¥6.32 billion.

Operations: The company generates revenue from its operations in the general equipment manufacturing sector.

Insider Ownership: 13.7%

Revenue Growth Forecast: 14.5% p.a.

Nanfang Zhongjin Environment anticipates robust earnings growth of 35.1% annually, surpassing the Chinese market's forecast. Despite a dip in nine-month sales to CNY 3.59 billion, net income rose to CNY 251.88 million, reflecting improved profitability. Trading at a significant discount to its estimated fair value enhances its investment appeal. With no recent insider trading activity reported, the company's strong growth trajectory remains a key focus for investors seeking value and potential upside in this sector.

- Navigate through the intricacies of Nanfang Zhongjin Environment with our comprehensive analyst estimates report here.

- Our valuation report here indicates Nanfang Zhongjin Environment may be undervalued.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and internationally, with a market cap of CN¥10.92 billion.

Operations: Revenue Segments (in millions of CN¥): Characterization Solutions: 1,200; Yield Improvement Solutions: 800.

Insider Ownership: 34.1%

Revenue Growth Forecast: 36.3% p.a.

Semitronix is poised for significant growth, with earnings expected to rise 48.2% annually, outpacing the Chinese market. Despite a recent decline in net income to CNY 7.71 million for nine months and volatile share prices, revenue growth remains strong at 36.3% annually. The company has completed a substantial share buyback worth CNY 139.65 million, indicating confidence in its future prospects despite challenges such as declining profit margins and low forecasted return on equity.

- Click here and access our complete growth analysis report to understand the dynamics of Semitronix.

- Insights from our recent valuation report point to the potential overvaluation of Semitronix shares in the market.

Taking Advantage

- Get an in-depth perspective on all 1522 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanfang Pump Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300145

Nanfang Pump Industry

Through its subsidiaries, engages in the general equipment manufacturing business.

Adequate balance sheet and fair value.

Market Insights

Community Narratives