In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals, with U.S. stocks experiencing slight declines amid concerns over new trade policies and cooling job growth. As investors assess these dynamics, identifying high growth tech stocks requires careful consideration of companies that can demonstrate resilience and adaptability in the face of shifting economic conditions and policy changes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

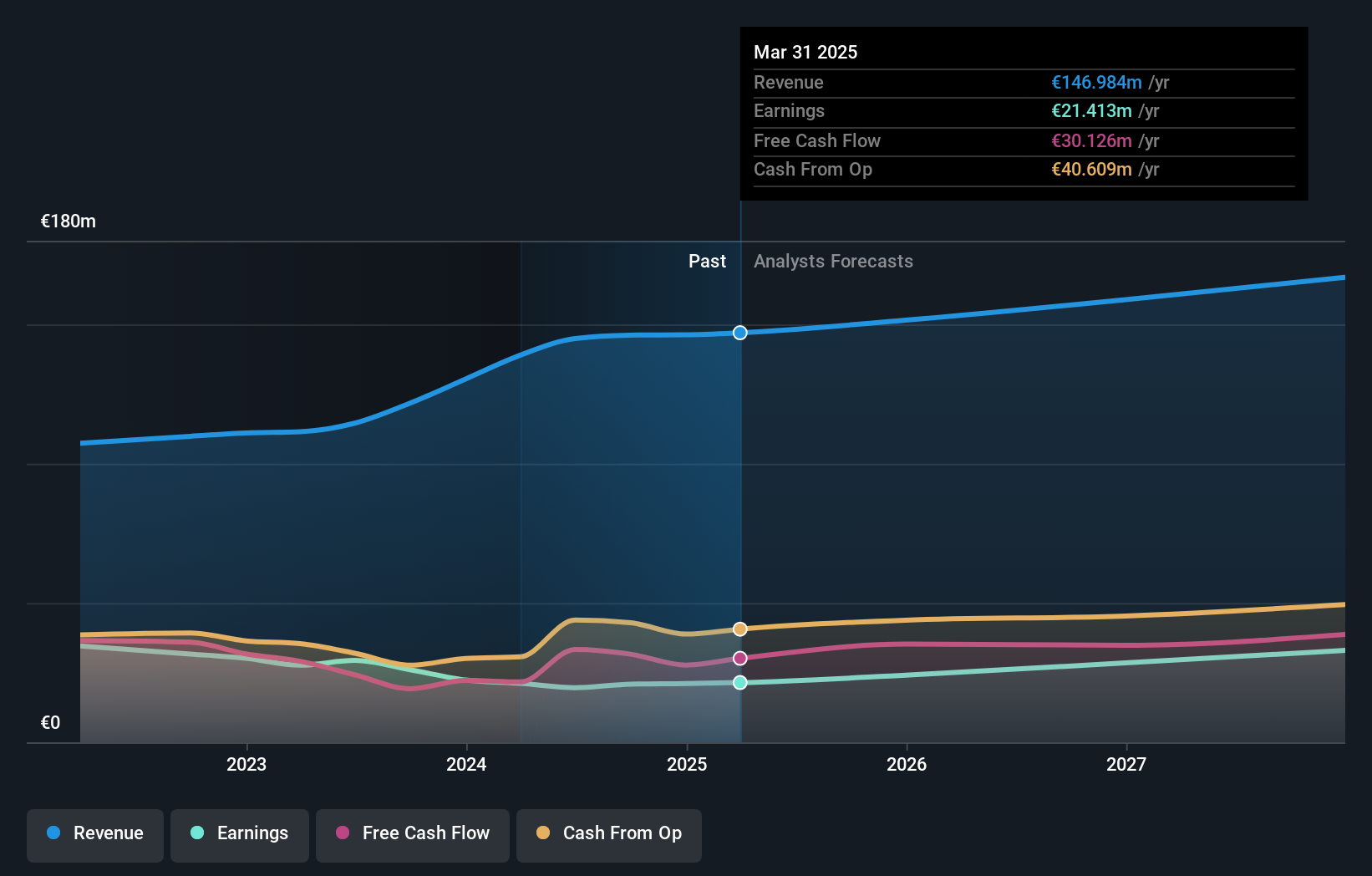

Overview: F-Secure Oyj is a cybersecurity company based in Finland that provides security solutions both domestically and internationally, with a market cap of €303.93 million.

Operations: The company generates revenue primarily from its Consumer Security segment, amounting to €146.26 million.

F-Secure Oyj, amidst a competitive tech landscape, has shown resilience with a revenue increase to EUR 146.26 million from EUR 130.37 million year-over-year, although net income slightly dipped to EUR 21.07 million from EUR 22.36 million. The firm's commitment to growth is evident in its updated financial targets and dividend policy aimed at bolstering strategic directions and enhancing shareholder value. Despite a challenging environment with earnings growth lagging at -5.8% compared to the industry average of -4.7%, F-Secure's robust annual profit forecast of 13.3% surpasses the Finnish market's expectation of 13.2%. This positions the company favorably as it plans for accelerated progress post-2025, supported by significant investments in R&D that promise innovation and potential market leadership in cybersecurity solutions.

- Unlock comprehensive insights into our analysis of F-Secure Oyj stock in this health report.

Examine F-Secure Oyj's past performance report to understand how it has performed in the past.

Pansoft (SZSE:300996)

Simply Wall St Growth Rating: ★★★★★☆

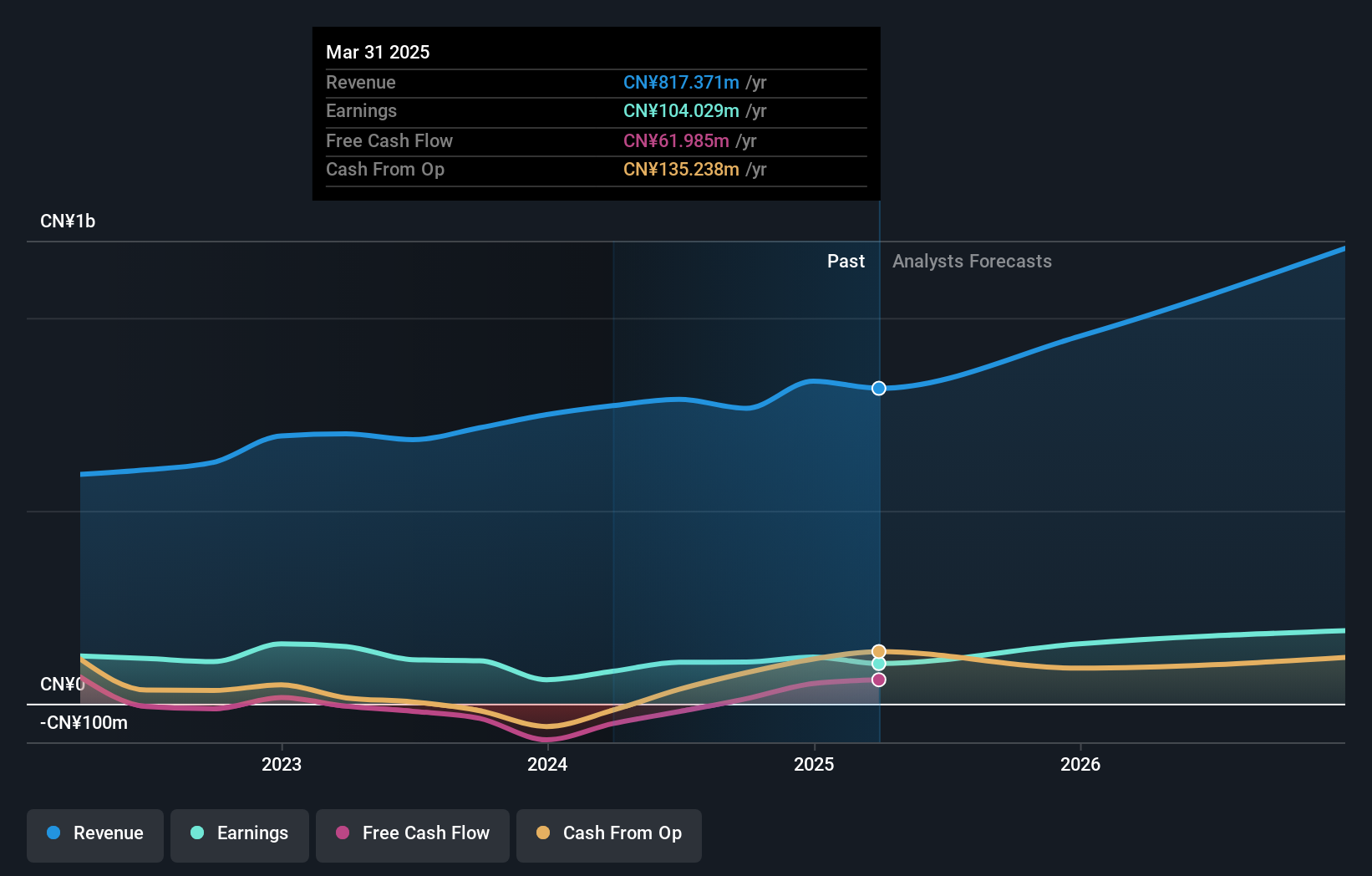

Overview: Pansoft Company Limited offers management information solutions and IT integrated services to large enterprises in China, with a market cap of CN¥5.27 billion.

Operations: The company generates revenue primarily through management information solutions and IT integrated services targeted at large enterprises in China. Its market cap stands at CN¥5.27 billion.

Pansoft stands out in the tech sector with its robust annual revenue growth of 22.2% and an impressive earnings increase projected at 27.8% per year, outpacing the broader Chinese market's expectations. These figures are bolstered by strategic amendments to its business operations, including a focus on enhancing working capital efficiency as evidenced in recent shareholder meetings. The company has also committed significant resources to R&D, maintaining a strong investment ratio that aligns with its innovative trajectory in software development, ensuring it remains competitive despite market volatility and regulatory changes.

- Click here to discover the nuances of Pansoft with our detailed analytical health report.

Understand Pansoft's track record by examining our Past report.

Nexwise Intelligence China (SZSE:301248)

Simply Wall St Growth Rating: ★★★★☆☆

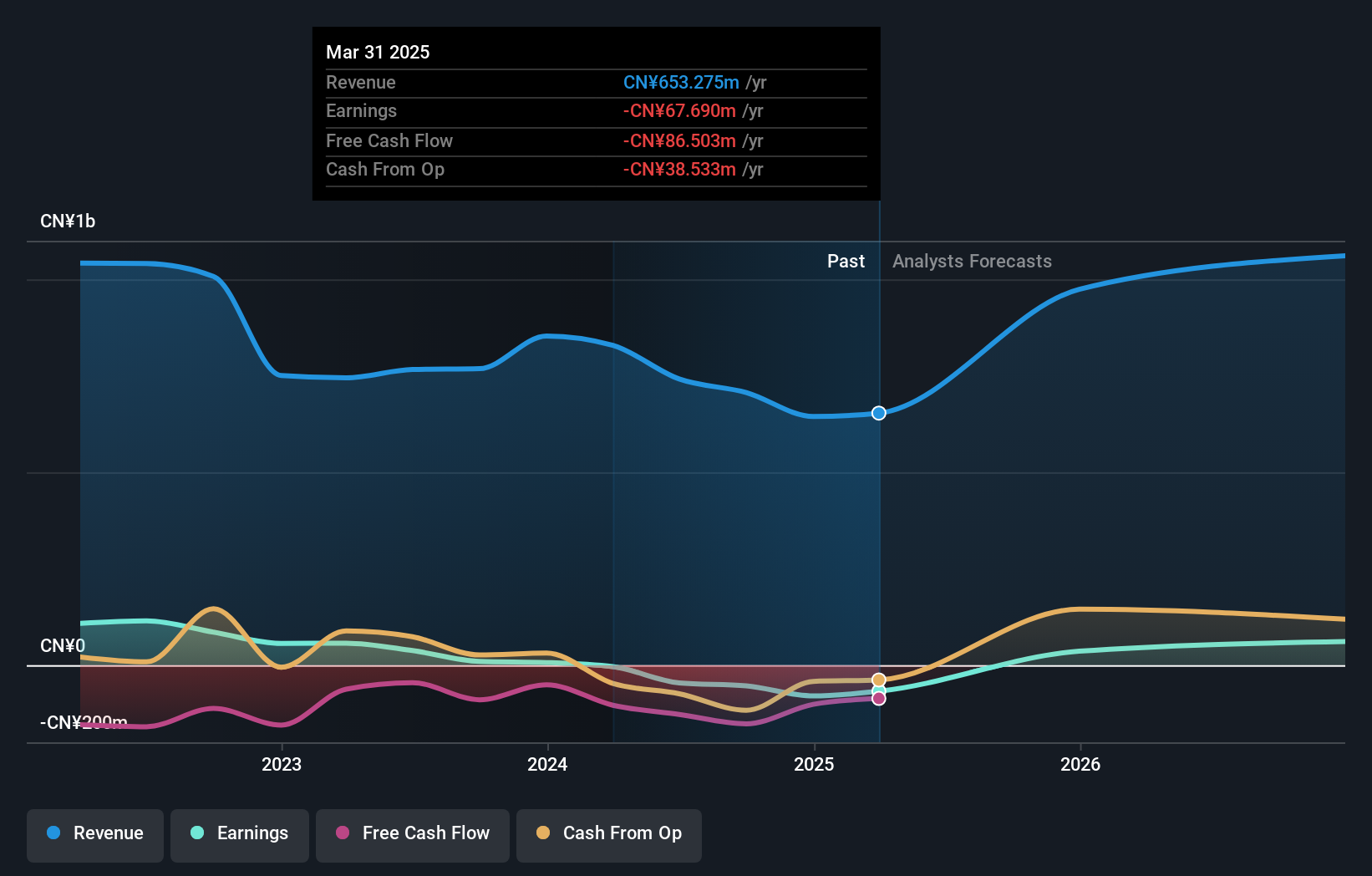

Overview: Nexwise Intelligence China Limited provides security and intelligent systems globally, with a market capitalization of CN¥2.93 billion.

Operations: The company generates revenue primarily from its Appliance & Tool segment, which contributed CN¥706.52 million.

Nexwise Intelligence China is navigating the competitive tech landscape with a strategic pivot in its business model, underscored by recent amendments to its articles of association and board changes. Despite a highly volatile share price, the company's revenue growth at 14.2% annually outpaces the Chinese market average of 13.6%. Notably, it's poised for profitability with earnings expected to surge by 107% annually over the next three years. This growth trajectory is complemented by a focus on R&D, crucial for sustaining innovation and competitiveness in evolving markets.

- Click to explore a detailed breakdown of our findings in Nexwise Intelligence China's health report.

Key Takeaways

- Gain an insight into the universe of 1212 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexwise Intelligence China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301248

Nexwise Intelligence China

Engages in the provision of security and intelligent systems worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives