- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

High Growth Tech Stocks In Asia Featuring Ningbo Yunsheng And Two More

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, the Asian tech sector is capturing attention with its dynamic growth potential amidst mixed economic signals. In this context, identifying promising stocks involves looking for companies that demonstrate resilience and innovation, such as Ningbo Yunsheng and others that thrive despite broader market fluctuations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| PharmaResearch | 26.50% | 29.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China with a market capitalization of CN¥12.67 billion.

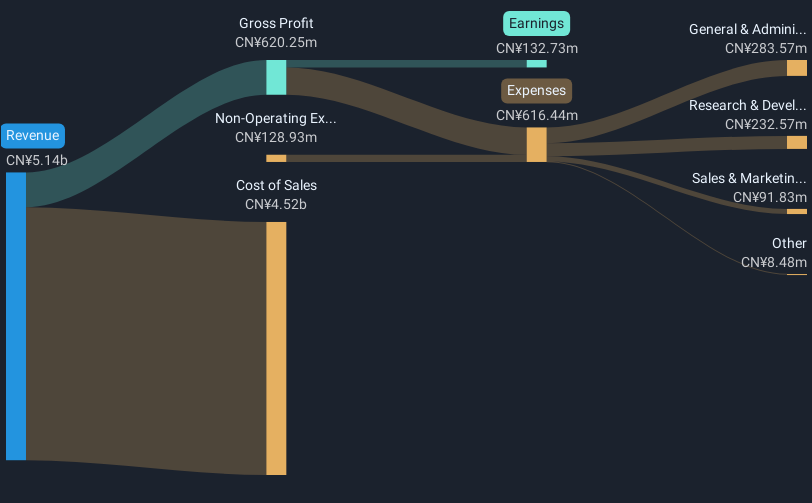

Operations: The company generates revenue primarily from the sale of Neodymium Iron Boron materials, totaling CN¥5.14 billion.

Ningbo Yunsheng's recent pivot into profitability, with a net income of CN¥95.08 million from a prior loss, underscores its resilience and adaptability in the tech sector. This turnaround is highlighted by an impressive annual revenue growth rate of 17.8% and even more robust earnings growth at 39.8% per year, outpacing the broader Chinese market's average. The firm’s commitment to innovation is evident from its R&D investments, ensuring it stays relevant amidst rapid technological advancements. With these strong financials and strategic focus on research and development, Ningbo Yunsheng appears well-positioned for sustained growth in Asia’s competitive high-tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Ningbo Yunsheng.

Explore historical data to track Ningbo Yunsheng's performance over time in our Past section.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech industry with a market cap of CN¥14.79 billion.

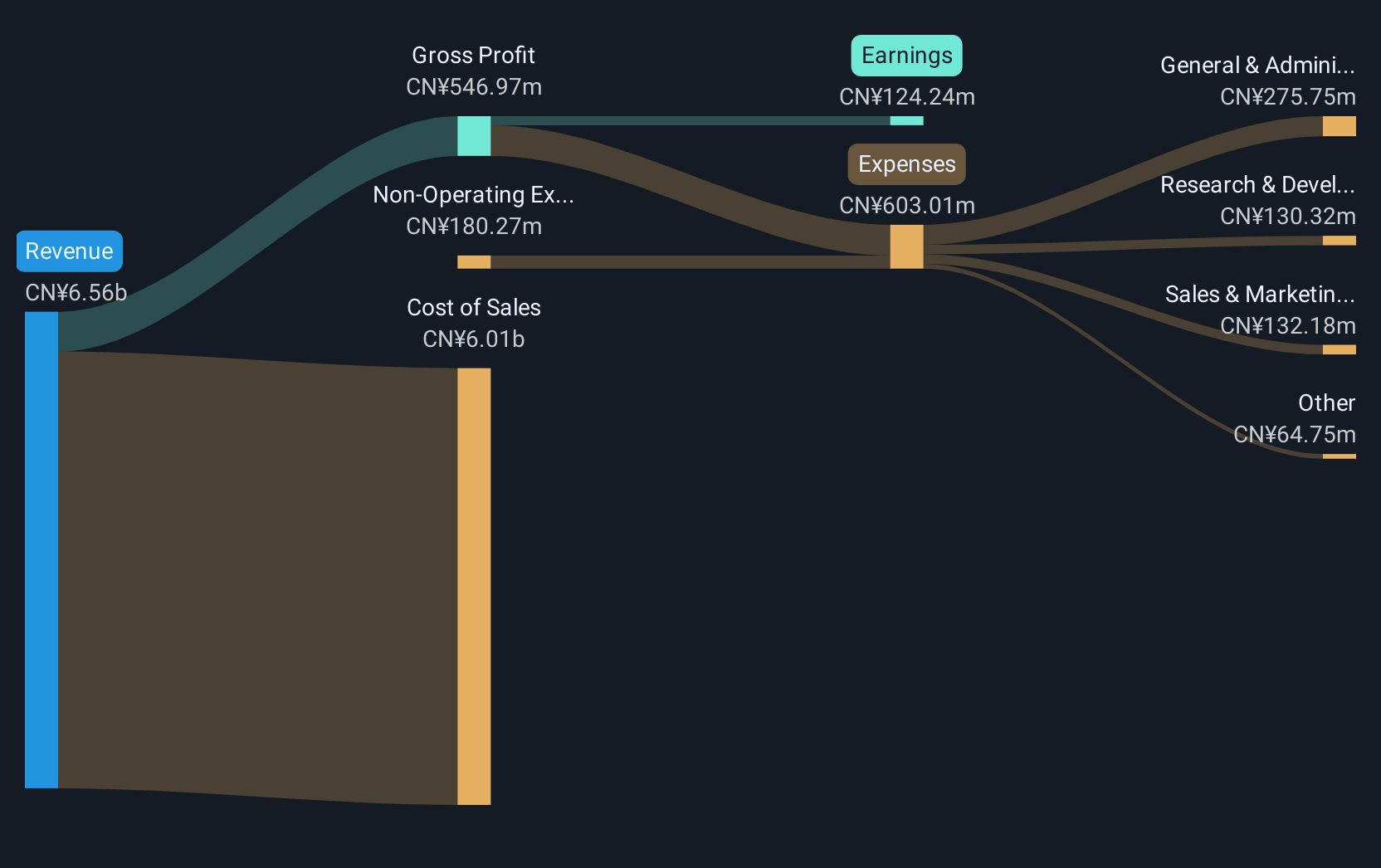

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. specializes in the high-tech sector, focusing on advanced materials and technology solutions. The company generates revenue through its diverse product offerings, catering to various industrial applications.

Beijing Zhong Ke San Huan High-Tech has demonstrated a notable turnaround, with its first-quarter net income reaching CN¥13.49 million, a significant recovery from the previous year's loss. This improvement is anchored by robust earnings growth of 43.9% annually and an impressive revenue increase of 19.9% per year, signaling strong market demand and operational efficiency. Despite facing challenges like a recent dividend cut to CN¥0.20 per share, the company's strategic focus on R&D—evident from substantial investments—positions it well within Asia’s dynamic tech landscape to leverage emerging technological trends effectively.

Pansoft (SZSE:300996)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pansoft Company Limited offers management information solutions and IT integrated services for large enterprises in China, with a market cap of CN¥5.34 billion.

Operations: Pansoft specializes in delivering management information solutions and IT integrated services to large enterprises across China. The company focuses on leveraging its expertise to support enterprise-level clients with tailored technological solutions.

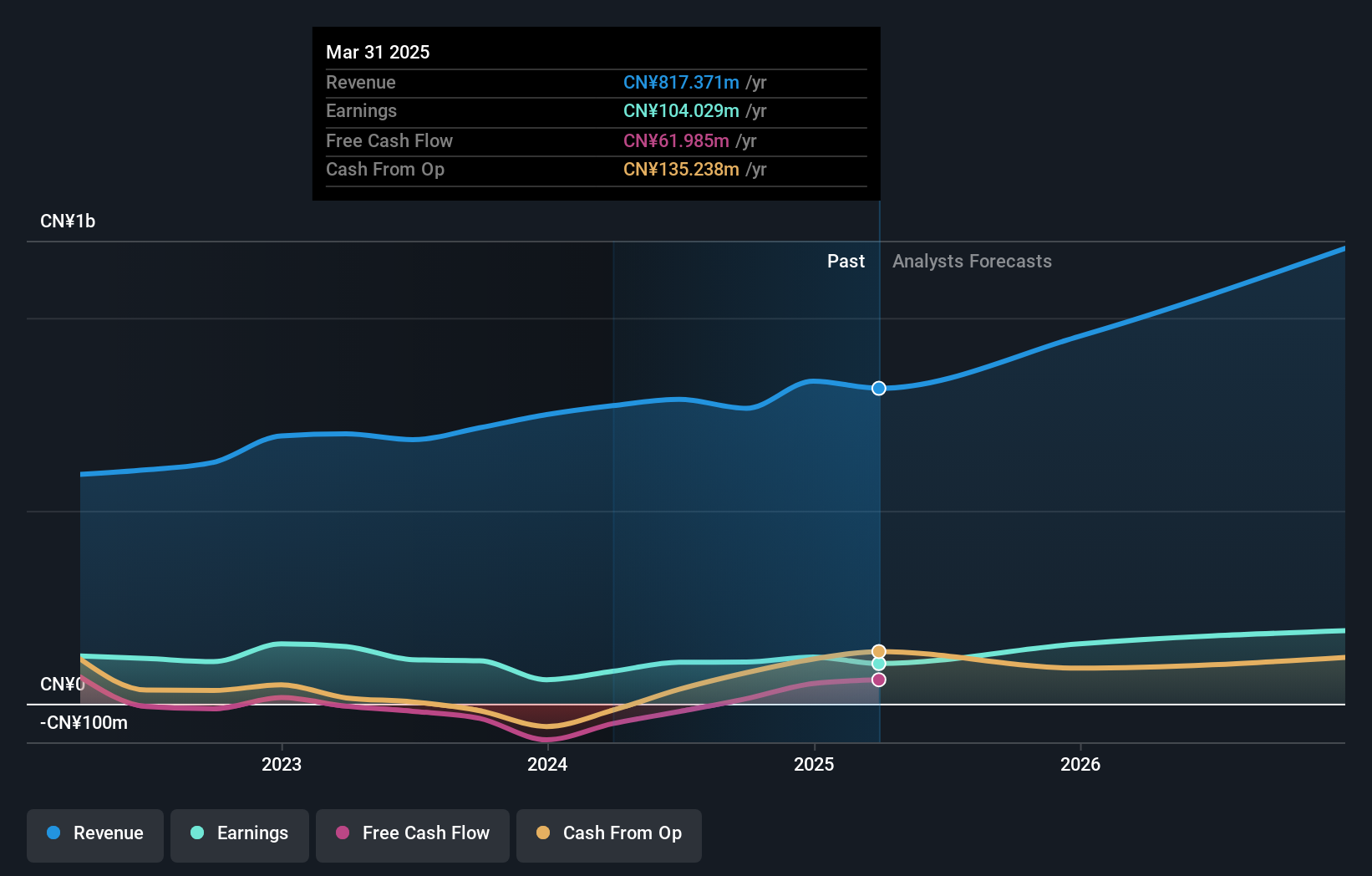

Pansoft, amidst a dynamic phase of corporate restructuring, has recently seen significant changes including amendments to its articles of association and adjustments in its registered capital, reflecting a strategic pivot aimed at enhancing governance and operational flexibility. Despite experiencing a downturn with a net loss of CN¥13.95 million in the first quarter of 2025 from a prior profit, the company's aggressive approach towards R&D investment aligns with its long-term vision to stabilize and eventually expand within the high-tech sector in Asia. Notably, Pansoft's revenue growth forecast at 21.1% annually surpasses China’s market average by nearly 9%, coupled with an anticipated earnings surge of 32.2% per year—outpacing the broader market's expectation by almost 9%. This robust financial trajectory, backed by substantial reinvestment in innovation and technology development, positions Pansoft to potentially leverage emerging tech trends effectively despite current volatility.

- Delve into the full analysis health report here for a deeper understanding of Pansoft.

Understand Pansoft's track record by examining our Past report.

Key Takeaways

- Delve into our full catalog of 478 Asian High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives