Zhengyuan Zhihui GroupLtd's (SZSE:300645) Shareholders Have More To Worry About Than Lackluster Earnings

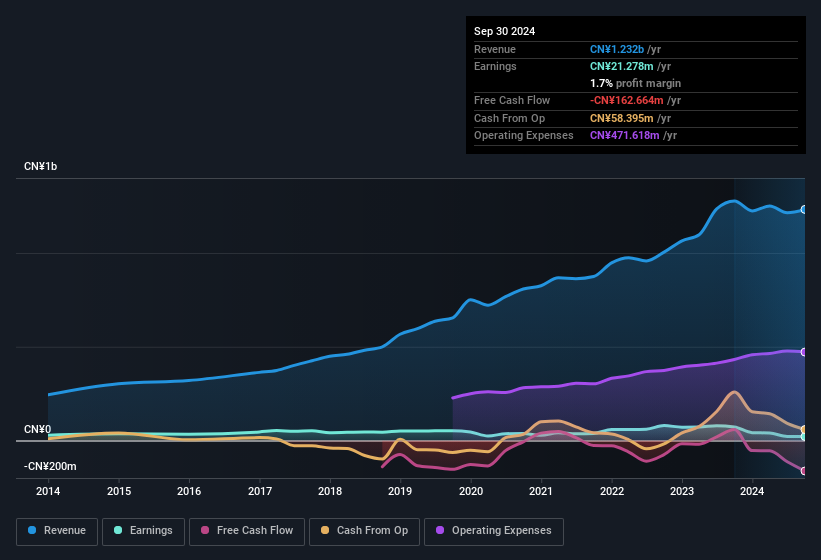

Zhengyuan Zhihui Group Co.,Ltd.'s (SZSE:300645) lackluster earnings announcement last week disappointed investors. We looked deeper and believe that there is even more to be worried about, beyond the soft profit numbers.

View our latest analysis for Zhengyuan Zhihui GroupLtd

How Do Unusual Items Influence Profit?

For anyone who wants to understand Zhengyuan Zhihui GroupLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥23m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Zhengyuan Zhihui GroupLtd had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Zhengyuan Zhihui GroupLtd.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Zhengyuan Zhihui GroupLtd received a tax benefit of CN¥26m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Zhengyuan Zhihui GroupLtd's Profit Performance

In its last report Zhengyuan Zhihui GroupLtd received a tax benefit which might make its profit look better than it really is on a underlying level. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. Considering all this we'd argue Zhengyuan Zhihui GroupLtd's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, Zhengyuan Zhihui GroupLtd has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Our examination of Zhengyuan Zhihui GroupLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhengyuan Zhihui GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300645

Zhengyuan Zhihui GroupLtd

Engages in the provision of solutions and service operators for smart campuses in China.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion