High Growth Tech Stocks Including Hengdian EntertainmentLTD And Two More

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience with U.S. indexes approaching record highs, driven by strong labor market data and positive home sales reports. Amidst this backdrop of broad-based gains and smaller-cap indexes outperforming large-caps, high-growth tech stocks like Hengdian Entertainment LTD are capturing investor interest due to their potential for innovation and adaptability in a dynamic economic environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market cap of CN¥9.68 billion.

Operations: The company primarily generates revenue through its theater operations across China. It has a market capitalization of CN¥9.68 billion, indicating its significant presence in the entertainment sector.

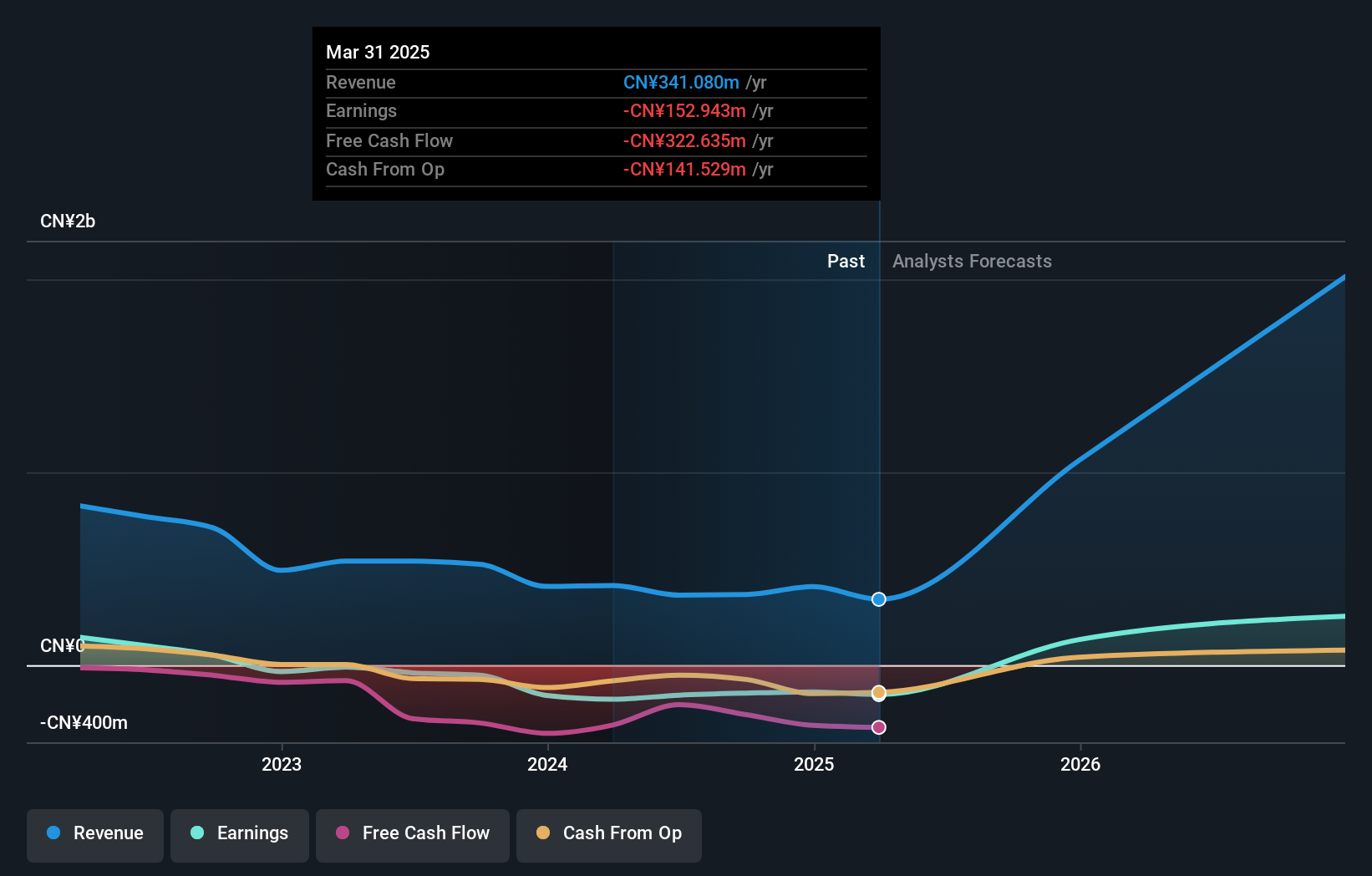

Despite recent setbacks, Hengdian EntertainmentLTD is poised for significant growth, with revenue expected to increase by 22.1% annually, outpacing the Chinese market's average of 13.8%. This growth is supported by a robust forecast in earnings, projected to surge by 110.4% per year as the company moves towards profitability within three years. These figures are particularly impressive given the firm's current unprofitable status and underscore its potential turnaround driven by strategic R&D investments which have been crucial in refining its entertainment offerings and competitive edge in a challenging industry.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector with a market cap of CN¥4.90 billion.

Operations: The company focuses on providing information technology solutions, with its primary revenue streams derived from software development and system integration services. It has experienced fluctuations in its net profit margin, which was 15% last year.

Jilin University Zhengyuan Information Technologies has demonstrated a robust commitment to innovation, with R&D expenses reaching 72.9% of its revenue, significantly enhancing its product offerings in the competitive tech landscape. Despite a recent downturn in earnings, with a net loss reducing from CNY 83.21 million to CNY 71.29 million year-over-year, the company's aggressive investment in research is poised to foster future growth. Moreover, their strategic share repurchases underscore confidence in their trajectory, having bought back shares worth CNY 72.72 million recently, reflecting a proactive approach to managing capital and potentially stabilizing equity value amidst market fluctuations.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Richinfo Technology Co., Ltd. offers industrial Internet solutions and technical services in China, with a market cap of CN¥10.40 billion.

Operations: Richinfo Technology Co., Ltd. specializes in industrial Internet solutions and technical services within China, focusing on innovative technology offerings to enhance industrial operations.

Richinfo Technology has demonstrated resilience and strategic foresight in its recent financial performance, reporting a revenue increase to CNY 1.21 billion from CNY 1.09 billion year-over-year, despite a dip in net income from CNY 306.69 million to CNY 195.17 million over the same period. This underscores a robust demand for their offerings even as earnings fluctuate, reflecting the volatile nature of tech markets but also highlighting potential for recovery and growth with smart management of resources and innovation focus. The company's commitment to returning value to shareholders is evident from its consistent dividend payouts, with the latest being CNY 0.426587 per share, signaling confidence in its financial health and operational strategy moving forward into an increasingly competitive landscape where technological advancements are pivotal.

- Click to explore a detailed breakdown of our findings in Richinfo Technology's health report.

Explore historical data to track Richinfo Technology's performance over time in our Past section.

Turning Ideas Into Actions

- Click here to access our complete index of 1288 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300634

Richinfo Technology

Provides industrial Internet solutions and technical services in China.

Flawless balance sheet with reasonable growth potential.