- China

- /

- Consumer Durables

- /

- SHSE:600983

Discover These 3 Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets experience broad-based gains and smaller-cap indexes outperform larger counterparts, investors are increasingly eyeing opportunities in the small-cap sector. With U.S. initial jobless claims at a seven-month low and positive sentiment driven by strong labor market reports, now might be an opportune time to explore lesser-known stocks that have the potential to enhance portfolio diversification. In this environment, a good stock is often characterized by its resilience amid economic shifts and its ability to capitalize on emerging trends within its industry.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S. is an investment company focusing on industries such as steel, automotive, logistics, automotive supply, informatics and telecommunications, and e-commerce with a market cap of TRY61.79 billion.

Operations: Borusan Yatirim ve Pazarlama generates revenue through its investments across diverse sectors, including steel, automotive, logistics, and e-commerce. The company focuses on optimizing its investment portfolio to enhance profitability. Its financial performance is influenced by the varying dynamics of each industry it invests in.

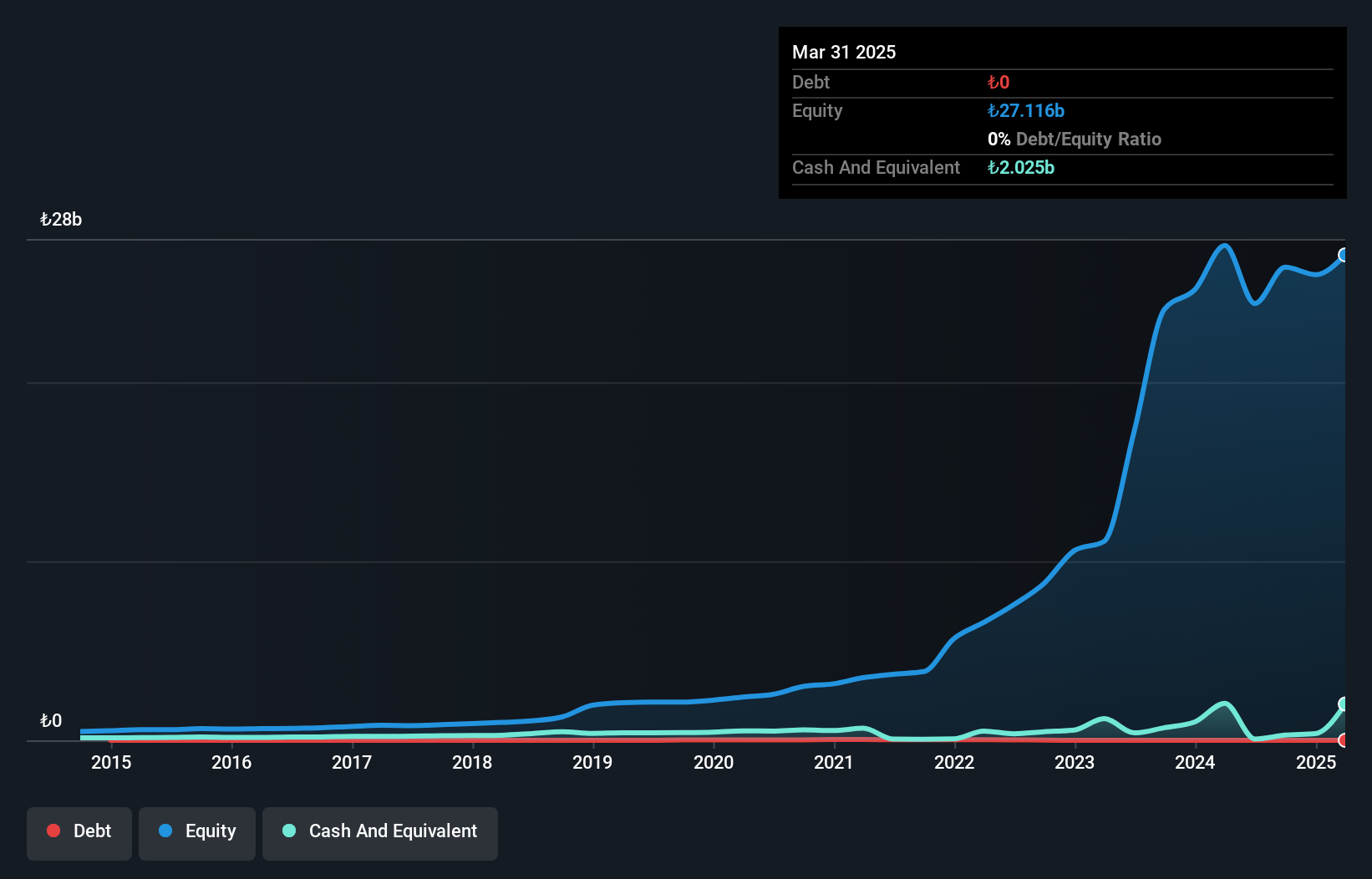

Borusan Yatirim ve Pazarlama, a modest player in the financial sector, reported TRY 501 million net income for Q3 2024, down from TRY 604 million last year. Despite negative earnings growth of -20.9% compared to the industry average of 42.2%, it boasts high-quality past earnings and remains debt-free, marking a significant improvement from five years ago when its debt-to-equity ratio was 1.1%. The company generated levered free cash flow of TRY 1.13 billion as of September 2024, indicating positive cash flow despite highly volatile share prices recently and limited revenue streams at TRY91 million annually.

- Get an in-depth perspective on Borusan Yatirim ve Pazarlama's performance by reading our health report here.

Gain insights into Borusan Yatirim ve Pazarlama's past trends and performance with our Past report.

Whirlpool China (SHSE:600983)

Simply Wall St Value Rating: ★★★★★★

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both domestically and internationally, with a market capitalization of CN¥7.20 billion.

Operations: Whirlpool China's primary revenue stream is from the manufacture and sale of consumer electrical appliances, totaling CN¥3.56 billion. The company's market capitalization stands at CN¥7.20 billion.

Whirlpool China stands out with its debt-free status, a notable shift from a 1.5 debt-to-equity ratio five years ago. Despite sales dipping to CNY 2.52 billion from CNY 2.96 billion over the past nine months, net income surged to CNY 53.07 million from CNY 14.15 million, reflecting strong operational performance and benefiting from a CN¥39.8M one-off gain in the last year’s results ending September 2024. Earnings per share rose to CNY 0.07 compared to last year's CNY 0.02, underlining profitability despite revenue challenges and showcasing resilience in outperforming industry growth rates by achieving earnings growth of 2.3%.

- Click to explore a detailed breakdown of our findings in Whirlpool China's health report.

Assess Whirlpool China's past performance with our detailed historical performance reports.

Azorim-Investment Development & Construction (TASE:AZRM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Azorim-Investment Development & Construction Co. is a company engaged in real estate development and construction activities, with a market cap of ₪4.33 billion.

Operations: Azorim-Investment Development & Construction primarily generates revenue from its Residential Construction segment in Israel, amounting to ₪1.38 billion. The company also earns from Residences for Rent in Israel and the USA, with revenues of ₪79.59 million and ₪29.16 million respectively.

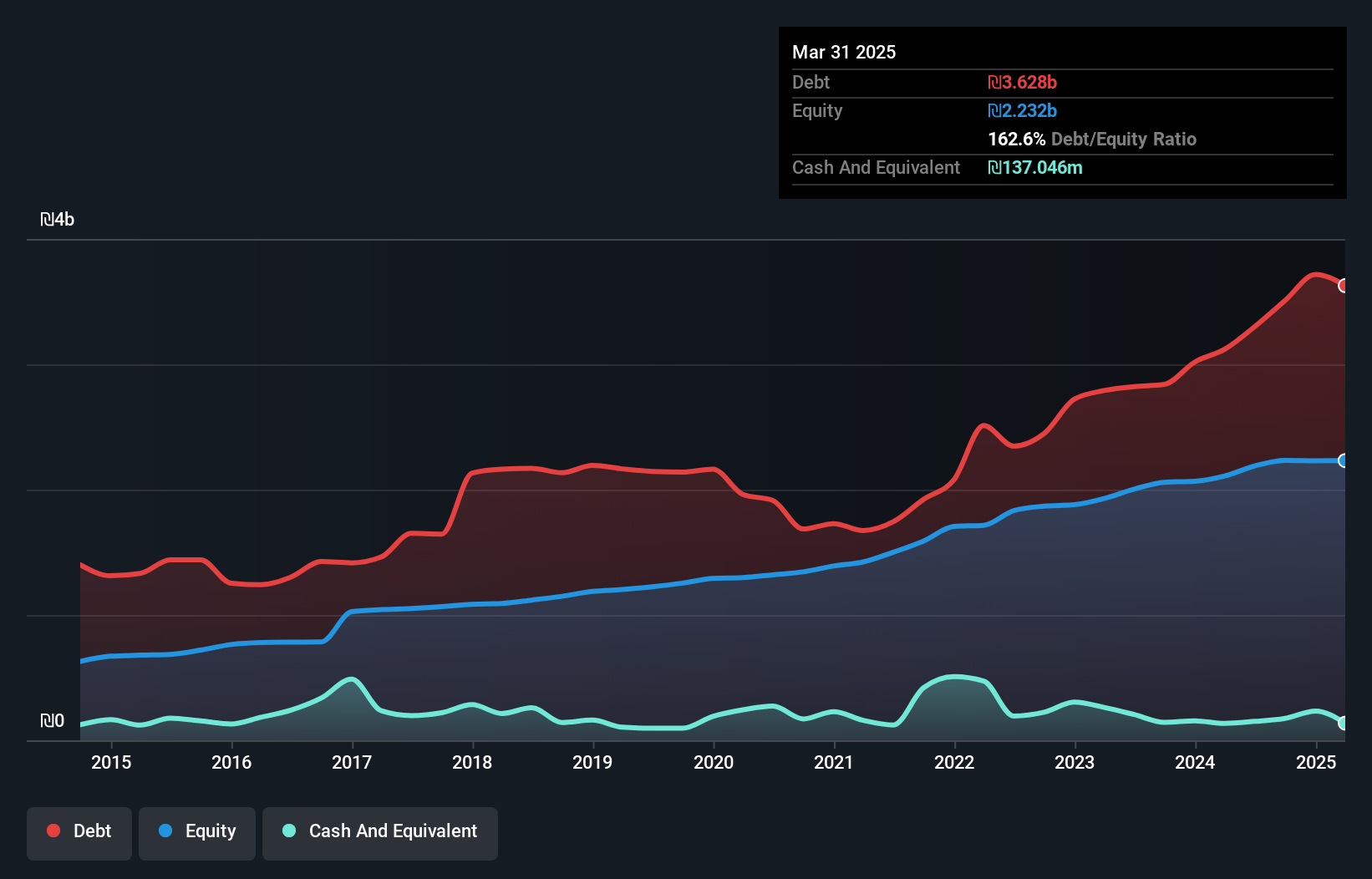

Azorim, a player in the investment development and construction sector, showcases a mix of strengths and challenges. Its earnings surged by 21% over the past year, outpacing the Consumer Durables industry which saw a 16% drop. However, this growth was partly due to a one-off gain of ₪45M impacting its recent financial results up to June 2024. The company's interest payments are well covered with EBIT at 3.4 times interest repayments, indicating solid management of debt obligations despite having a high net debt to equity ratio of approximately 144%. While profitability is not an issue for Azorim, its free cash flow remains negative.

- Dive into the specifics of Azorim-Investment Development & Construction here with our thorough health report.

Understand Azorim-Investment Development & Construction's track record by examining our Past report.

Summing It All Up

- Embark on your investment journey to our 4621 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600983

Whirlpool China

Engages in the research, development, procurement, production, and sale of kitchen appliances in China and internationally.

Flawless balance sheet average dividend payer.