Optimistic Investors Push BEIJING CERTIFICATE AUTHORITY Co.,Ltd. (SZSE:300579) Shares Up 42% But Growth Is Lacking

BEIJING CERTIFICATE AUTHORITY Co.,Ltd. (SZSE:300579) shares have had a really impressive month, gaining 42% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.5% in the last twelve months.

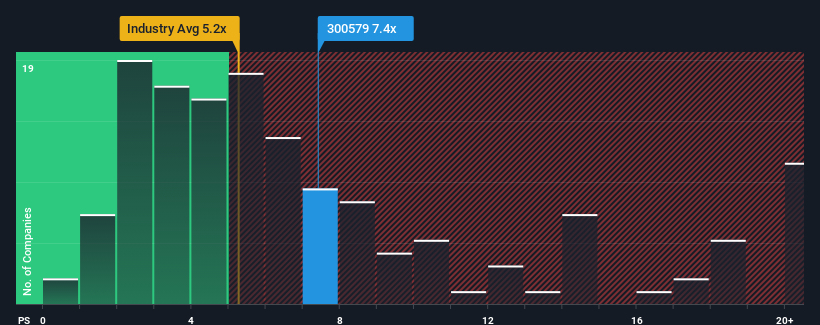

Since its price has surged higher, you could be forgiven for thinking BEIJING CERTIFICATE AUTHORITYLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 7.4x, considering almost half the companies in China's Software industry have P/S ratios below 5.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for BEIJING CERTIFICATE AUTHORITYLtd

How Has BEIJING CERTIFICATE AUTHORITYLtd Performed Recently?

For instance, BEIJING CERTIFICATE AUTHORITYLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on BEIJING CERTIFICATE AUTHORITYLtd's earnings, revenue and cash flow.How Is BEIJING CERTIFICATE AUTHORITYLtd's Revenue Growth Trending?

In order to justify its P/S ratio, BEIJING CERTIFICATE AUTHORITYLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

In light of this, it's alarming that BEIJING CERTIFICATE AUTHORITYLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

BEIJING CERTIFICATE AUTHORITYLtd's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of BEIJING CERTIFICATE AUTHORITYLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for BEIJING CERTIFICATE AUTHORITYLtd that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BEIJING CERTIFICATE AUTHORITYLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300579

BEIJING CERTIFICATE AUTHORITYLtd

Provides network trust and data security solutions in China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives