- China

- /

- Commercial Services

- /

- SZSE:300815

Exploring 3 Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating trade policies and easing inflation, Asian markets are navigating a complex landscape that has seen mixed performances across key indices. As smaller-cap stocks continue to face unique challenges and opportunities within this environment, discerning investors may find potential in lesser-known companies that exhibit strong fundamentals and resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Fortune Gas Cryogenic Group | 0.01% | 22.78% | 17.11% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Shenzhen Bsc TechnologyLtd | NA | 16.05% | 1.02% | ★★★★★★ |

| BBK Test Systems | NA | 10.95% | 9.12% | ★★★★★★ |

| Qingmu Tec | 0.74% | 13.00% | -19.41% | ★★★★★★ |

| Suzhou Sepax Technologies | 0.04% | 21.44% | 34.83% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 34.13% | 1.81% | 9.01% | ★★★★☆☆ |

| JinXianDai Information IndustryLtd | 16.46% | -0.60% | -32.74% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Anhui Guqi Down & Feather Textile (SZSE:001390)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Guqi Down & Feather Textile Incorporated focuses on the R&D, production, and sale of goose and duck down products for clothing and bedding, with a market cap of CN¥5.38 billion.

Operations: Anhui Guqi derives its revenue primarily from the sale of goose and duck down products. The company has experienced fluctuations in its net profit margin, which is currently a point of interest for stakeholders.

Anhui Guqi Down & Feather Textile, a nimble player in its field, recently completed an IPO raising CNY 604 million. Its earnings surged by 33% over the past year, outpacing the luxury industry’s downturn of 6%. The company's net income for the full year reached CNY 168.19 million from CNY 121.78 million previously, while its price-to-earnings ratio of 31x remains attractive compared to the broader CN market at 38x. With a satisfactory net debt to equity ratio of 20%, and EBIT covering interest payments by over fourteen times, it seems well-positioned financially despite illiquid shares.

Shenzhen Forms Syntron InformationLtd (SZSE:300468)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Forms Syntron Information Co., Ltd. operates in the software and information services industry with a market capitalization of CN¥13.15 billion.

Operations: The company generates revenue primarily from its software and information services segment, which reported CN¥704.55 million. The net profit margin is a key financial metric to consider when evaluating its profitability.

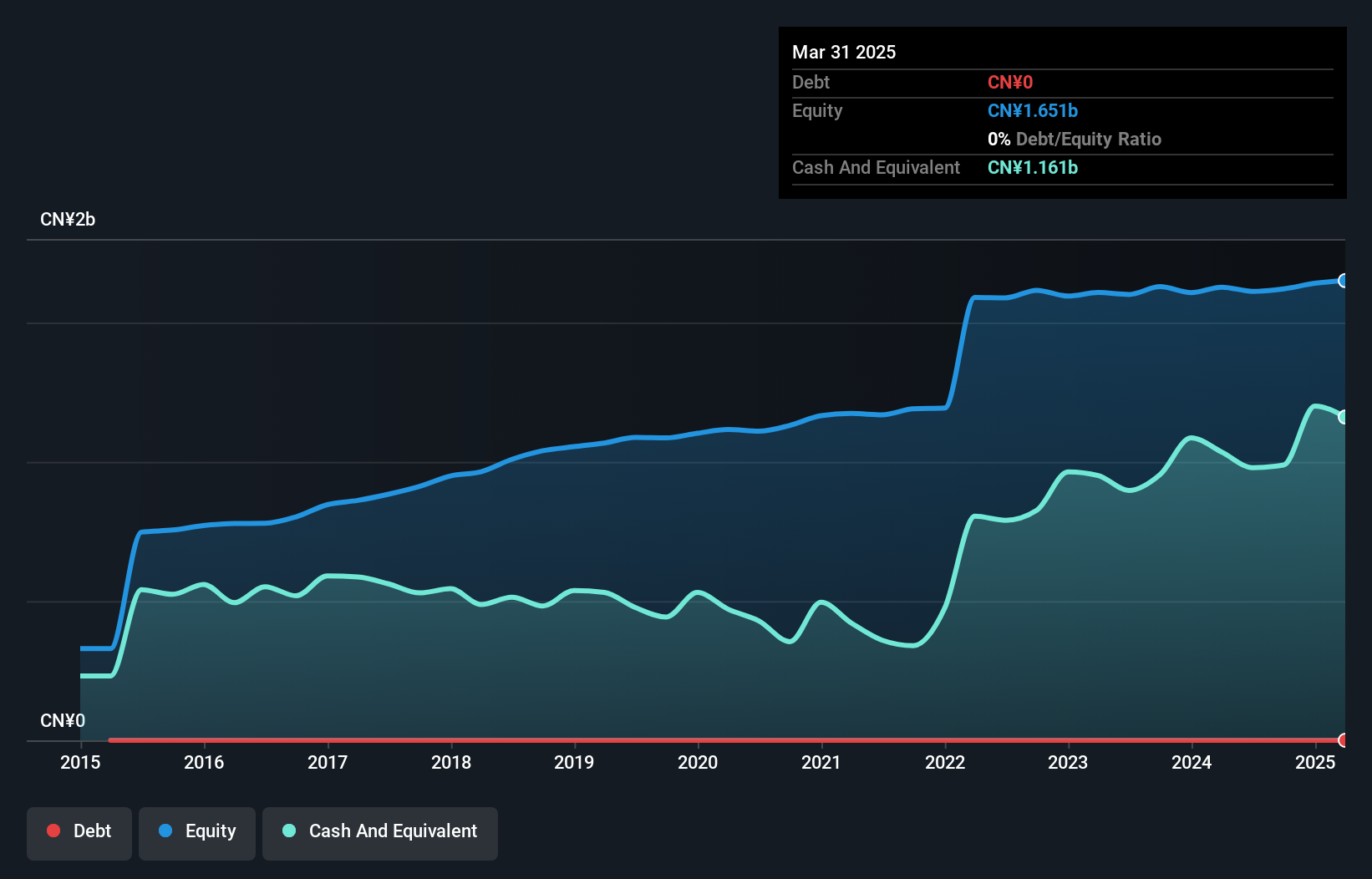

Shenzhen Forms Syntron Information, a nimble player in the tech sector, has shown resilience with earnings growth of 29.8% over the past year, outpacing the industry’s -14.8%. Despite its highly volatile share price recently, this debt-free company boasts high-quality earnings and positive free cash flow. However, its revenue for Q1 2025 was CNY 131.57 million, down from CNY 167.4 million a year ago, with net income also dipping to CNY 12.9 million from CNY 16.43 million last year. The firm has approved a dividend of CNY 1 per ten shares for shareholders as of June 3rd, reflecting confidence in future prospects despite current challenges.

EIT Environmental Development GroupLtd (SZSE:300815)

Simply Wall St Value Rating: ★★★★★☆

Overview: EIT Environmental Development Group Co., Ltd specializes in providing municipal environmental sanitation services in China, with a market capitalization of CN¥9.85 billion.

Operations: The company's primary revenue stream is derived from its municipal environmental sanitation services in China. It operates with a market capitalization of CN¥9.85 billion.

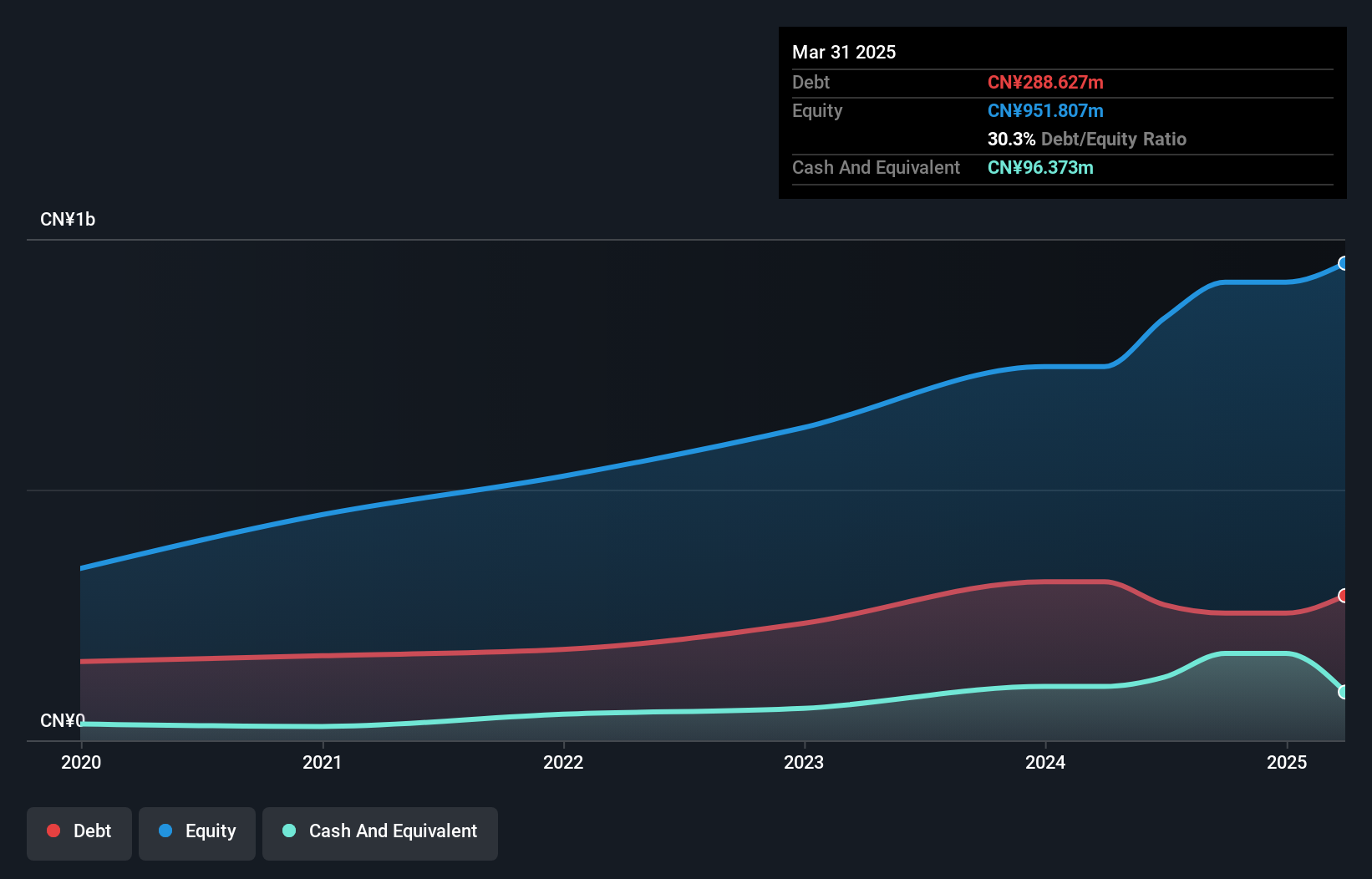

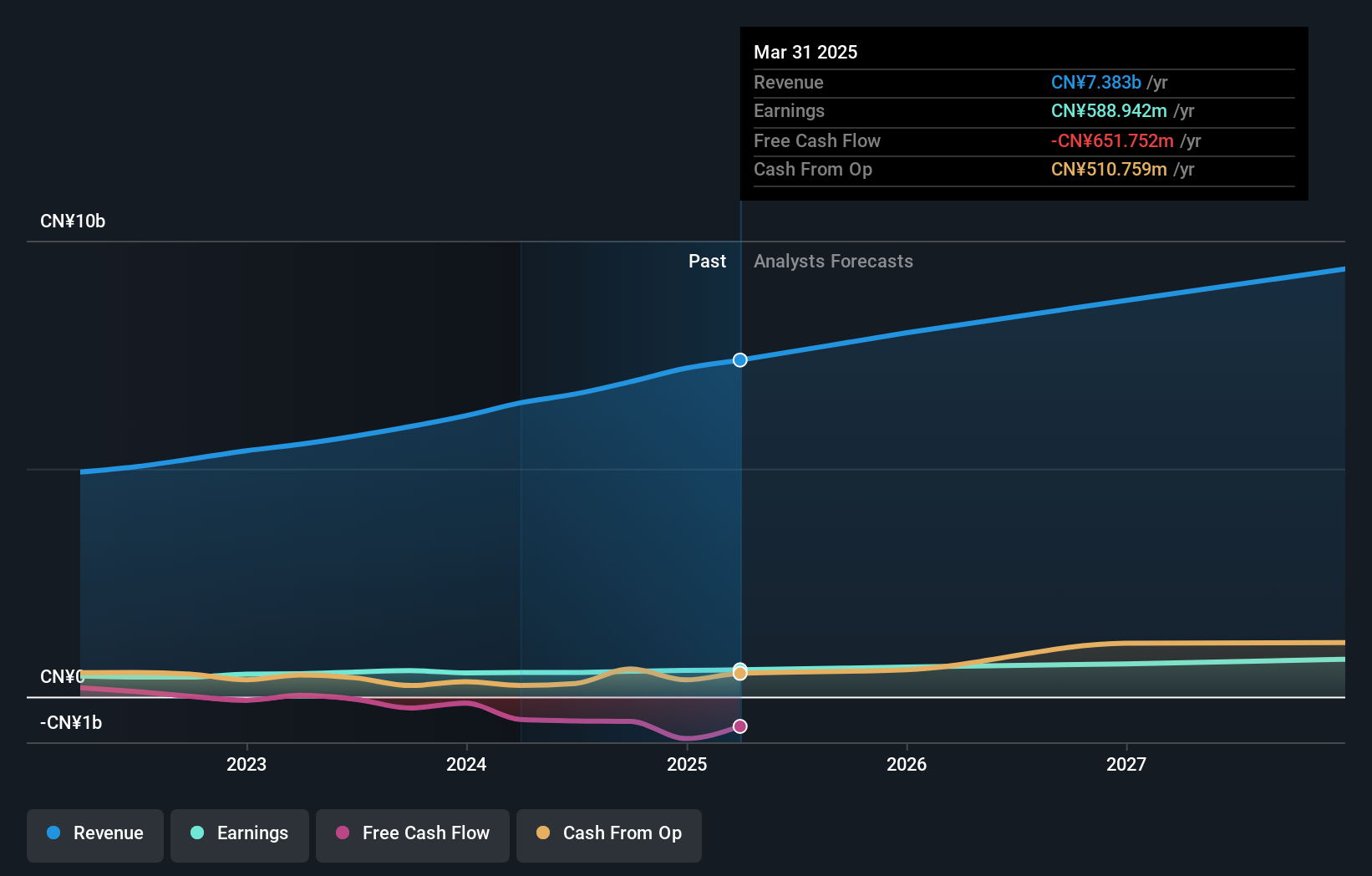

EIT Environmental Development Group, a nimble player in the environmental sector, showcases robust earnings growth of 11.3% over the past year, outpacing its industry peers. Despite a volatile share price recently, it trades at an attractive P/E ratio of 16.7x compared to the broader CN market's 37.6x. The company's debt to equity ratio has climbed from 25.5% to 46.7% over five years, yet interest payments remain comfortably covered by EBIT at a multiple of 12.7x. Recent approval for a CNY 3.75 cash dividend per ten shares highlights its commitment to shareholder returns amidst solid financial performance.

Next Steps

- Click this link to deep-dive into the 2600 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EIT Environmental Development GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300815

EIT Environmental Development GroupLtd

Offers urban integrated operation and management services.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion