- China

- /

- Semiconductors

- /

- SZSE:300708

Discovering China's Undiscovered Gems In October 2024

Reviewed by Simply Wall St

Amidst the backdrop of escalating geopolitical tensions and fluctuating oil prices, Chinese stocks have seen a notable surge, driven by Beijing’s comprehensive support measures. The Shanghai Composite Index and the CSI 300 Index both posted significant gains in early October 2024, signaling renewed investor optimism despite ongoing economic challenges. In this environment, identifying promising stocks involves looking for companies that can capitalize on government initiatives and demonstrate resilience amid broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HangZhou Everfine Photo-e-info | NA | 1.86% | 38.27% | ★★★★★★ |

| Tibet Weixinkang Medicine | NA | 15.57% | 36.17% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | -1.18% | -11.24% | ★★★★★★ |

| Hangzhou Biotest BiotechLtd | 0.02% | -46.81% | -19.87% | ★★★★★★ |

| Sublime China Information | NA | 6.24% | 1.49% | ★★★★★★ |

| IFE Elevators | NA | 14.47% | 19.78% | ★★★★★★ |

| Power HF | 2.38% | -7.39% | -24.40% | ★★★★★★ |

| ShenZhen QiangRui Precision Technology | 2.29% | 24.35% | -0.93% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 1.48% | 22.33% | -6.24% | ★★★★★☆ |

| Wuxi Delinhai Environmental TechnologyLtd | 4.33% | -16.56% | -40.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Forms Syntron InformationLtd (SZSE:300468)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Forms Syntron Information Co., Ltd. (SZSE:300468) is a company engaged in software and information services, with a market capitalization of CN¥8.57 billion.

Operations: Forms Syntron generates revenue primarily from its software and information services segment, amounting to CN¥725.52 million.

Shenzhen Forms Syntron Information Ltd., a nimble player in the IT sector, has shown resilience despite recent earnings challenges. Over the past year, earnings grew by 12.4%, outpacing the industry average of -11.5%. The company remains debt-free and boasts high-quality earnings, with net income reaching CNY 36.8 million for the half-year ending June 2024. Despite a slight dip in revenue to CNY 342.63 million, its basic EPS improved to CNY 0.0694 from CNY 0.0668 last year, reflecting operational efficiency amid market volatility.

Focus Lightings Tech (SZSE:300708)

Simply Wall St Value Rating: ★★★★★★

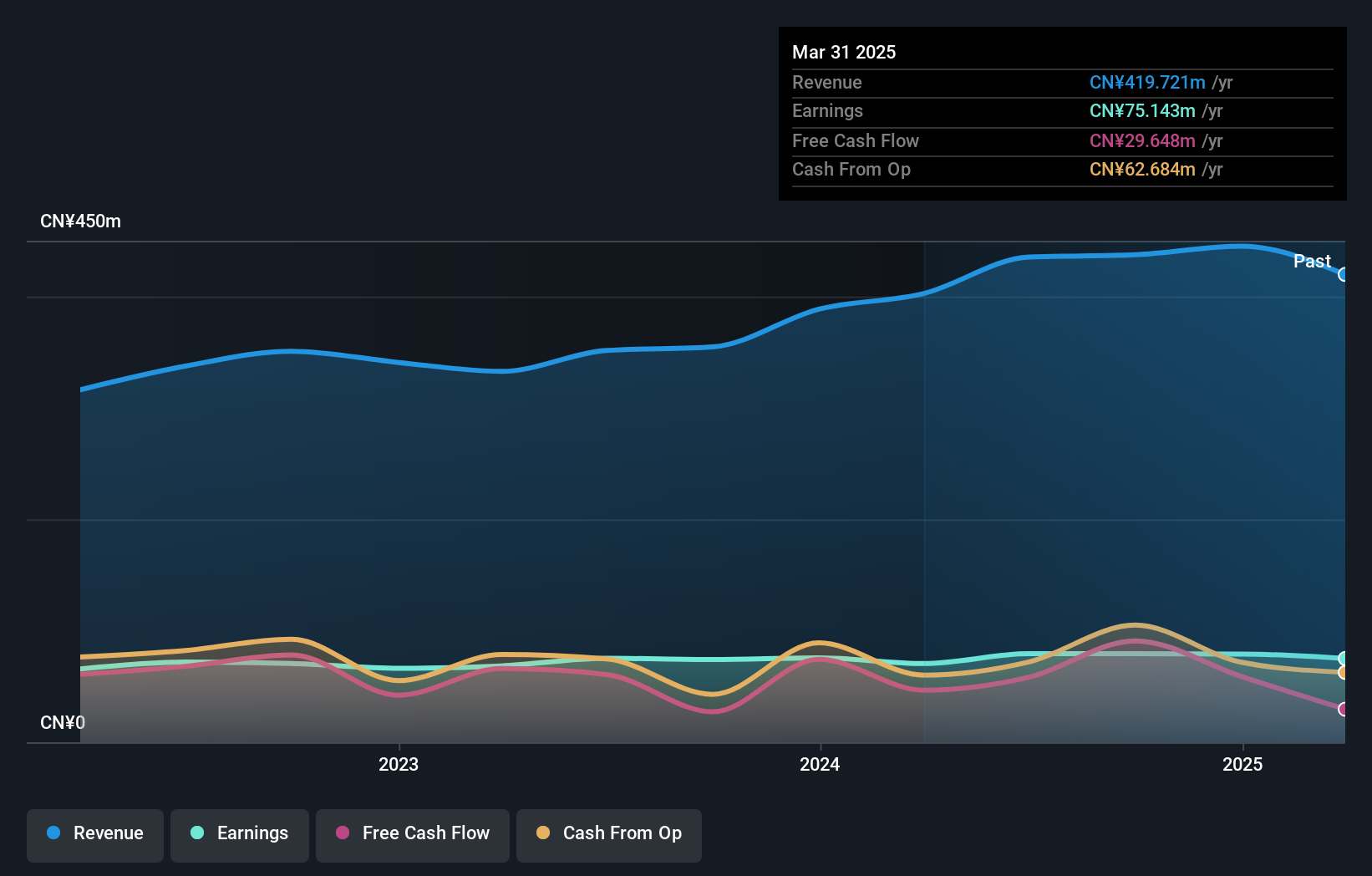

Overview: Focus Lightings Tech Co., Ltd. specializes in the research, development, production, and sale of compound optoelectronic semiconductor materials both in China and internationally, with a market cap of CN¥8.21 billion.

Operations: Focus Lightings Tech generates revenue primarily through the sale of compound optoelectronic semiconductor materials. The company's cost structure includes expenses related to research, development, and production. It has reported a net profit margin of 15% in recent financial periods.

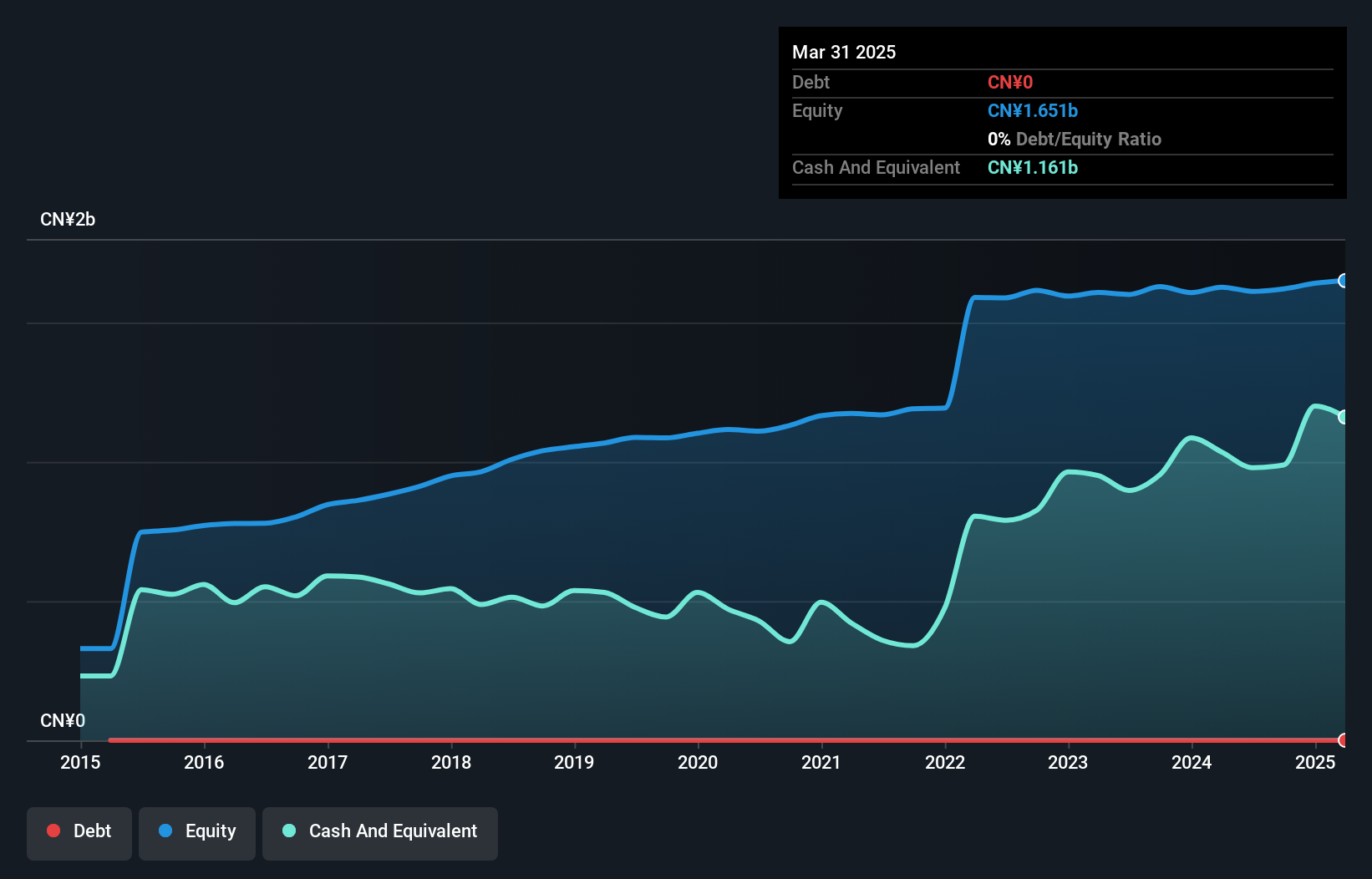

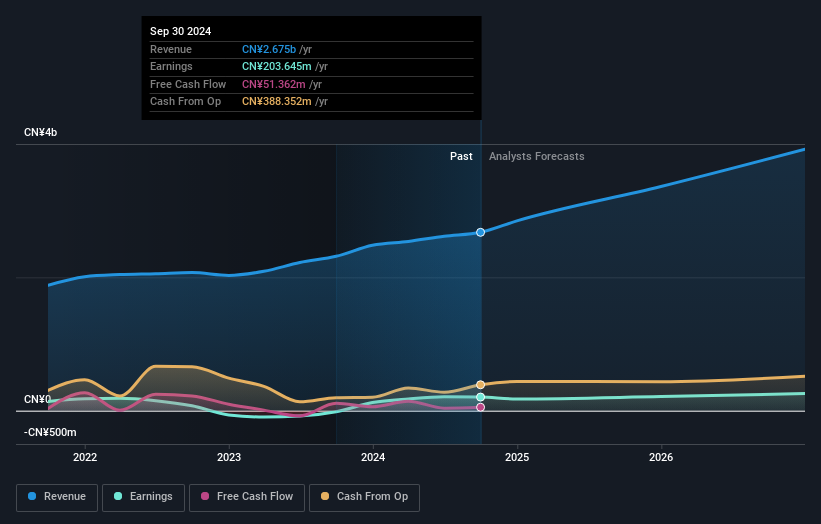

Focus Lightings Tech, a promising player in China's semiconductor sector, has shown impressive growth. The company reported sales of CNY 2.02 billion for the first nine months of 2024, up from CNY 1.83 billion the previous year, while net income nearly doubled to CNY 159.57 million from CNY 77.08 million. With a price-to-earnings ratio of 39x below the industry average and reduced debt-to-equity ratio from 92% to 29% over five years, it seems well-positioned for future expansion.

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd is engaged in the manufacturing and sale of military products, with a market capitalization of CN¥8.53 billion.

Operations: Xinyu Guoke Technology generates revenue primarily from the sale of military products. The company's financial performance is reflected in its market capitalization of CN¥8.53 billion.

Jiangxi Xinyu Guoke Technology, a smaller player in the Aerospace & Defense sector, has shown promising growth with earnings increasing by 5.4% over the past year, outpacing the industry average of -15.7%. The company is debt-free and boasts high-quality earnings, which bolsters its financial stability. Recent half-year results reported sales of CNY 214 million and net income of CNY 44 million, reflecting improved profitability compared to last year.

Make It Happen

- Take a closer look at our Chinese Undiscovered Gems With Strong Fundamentals list of 891 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300708

Focus Lightings Tech

Engages in the research and development, production, and sale of compound optoelectronic semiconductor materials in China and internationally.

Flawless balance sheet with acceptable track record.