Beijing Sinnet Technology Co.,Ltd's (SZSE:300383) Price Is Right But Growth Is Lacking After Shares Rocket 28%

Despite an already strong run, Beijing Sinnet Technology Co.,Ltd (SZSE:300383) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 52%.

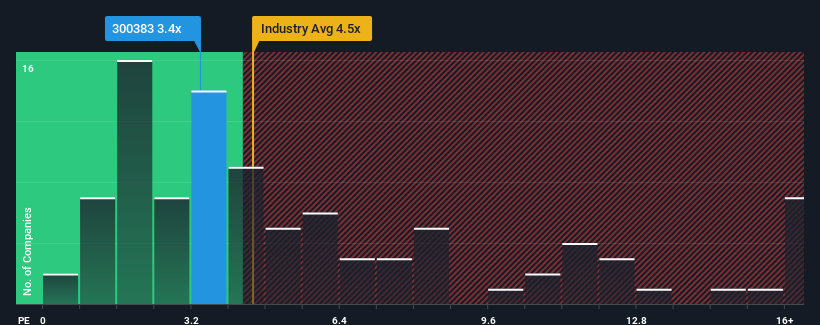

In spite of the firm bounce in price, Beijing Sinnet TechnologyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.4x, considering almost half of all companies in the IT industry in China have P/S ratios greater than 4.5x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Sinnet TechnologyLtd

What Does Beijing Sinnet TechnologyLtd's P/S Mean For Shareholders?

Beijing Sinnet TechnologyLtd could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Sinnet TechnologyLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Beijing Sinnet TechnologyLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next three years should generate growth of 8.1% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 16% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Beijing Sinnet TechnologyLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift Beijing Sinnet TechnologyLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Beijing Sinnet TechnologyLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Beijing Sinnet TechnologyLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sinnet TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300383

Beijing Sinnet TechnologyLtd

Provides internet data center (IDC), cloud computing, and internet access services in China and Hong Kong.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives