Beijing Sinnet Technology Co.,Ltd (SZSE:300383) Held Back By Insufficient Growth Even After Shares Climb 29%

Despite an already strong run, Beijing Sinnet Technology Co.,Ltd (SZSE:300383) shares have been powering on, with a gain of 29% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

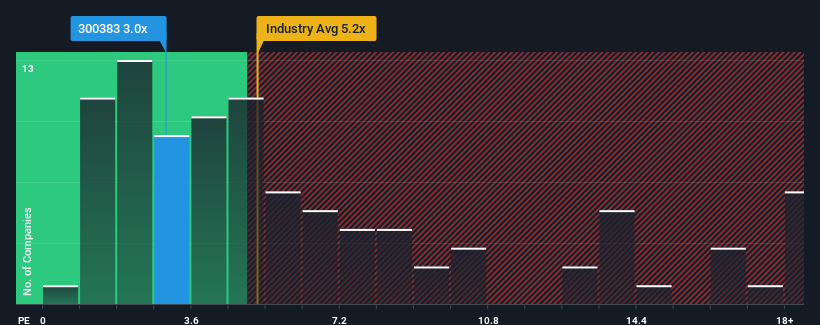

Although its price has surged higher, Beijing Sinnet TechnologyLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3x, considering almost half of all companies in the IT industry in China have P/S ratios greater than 5.2x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Sinnet TechnologyLtd

What Does Beijing Sinnet TechnologyLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Beijing Sinnet TechnologyLtd has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Sinnet TechnologyLtd.Is There Any Revenue Growth Forecasted For Beijing Sinnet TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as low as Beijing Sinnet TechnologyLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

Turning to the outlook, the next three years should generate growth of 8.1% per year as estimated by the eleven analysts watching the company. With the industry predicted to deliver 15% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why Beijing Sinnet TechnologyLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Beijing Sinnet TechnologyLtd's P/S Mean For Investors?

Beijing Sinnet TechnologyLtd's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Beijing Sinnet TechnologyLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 1 warning sign for Beijing Sinnet TechnologyLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sinnet TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300383

Beijing Sinnet TechnologyLtd

Provides internet data center (IDC), cloud computing, and internet access services in China and Hong Kong.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives