As global markets navigate geopolitical tensions and economic uncertainties, investors are closely watching major indices, which have shown volatility amid concerns over consumer spending and trade policies. In such a climate, stocks with high insider ownership can offer a unique perspective on growth potential, as insiders often have a deeper understanding of their company's prospects and may signal confidence in its future trajectory.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

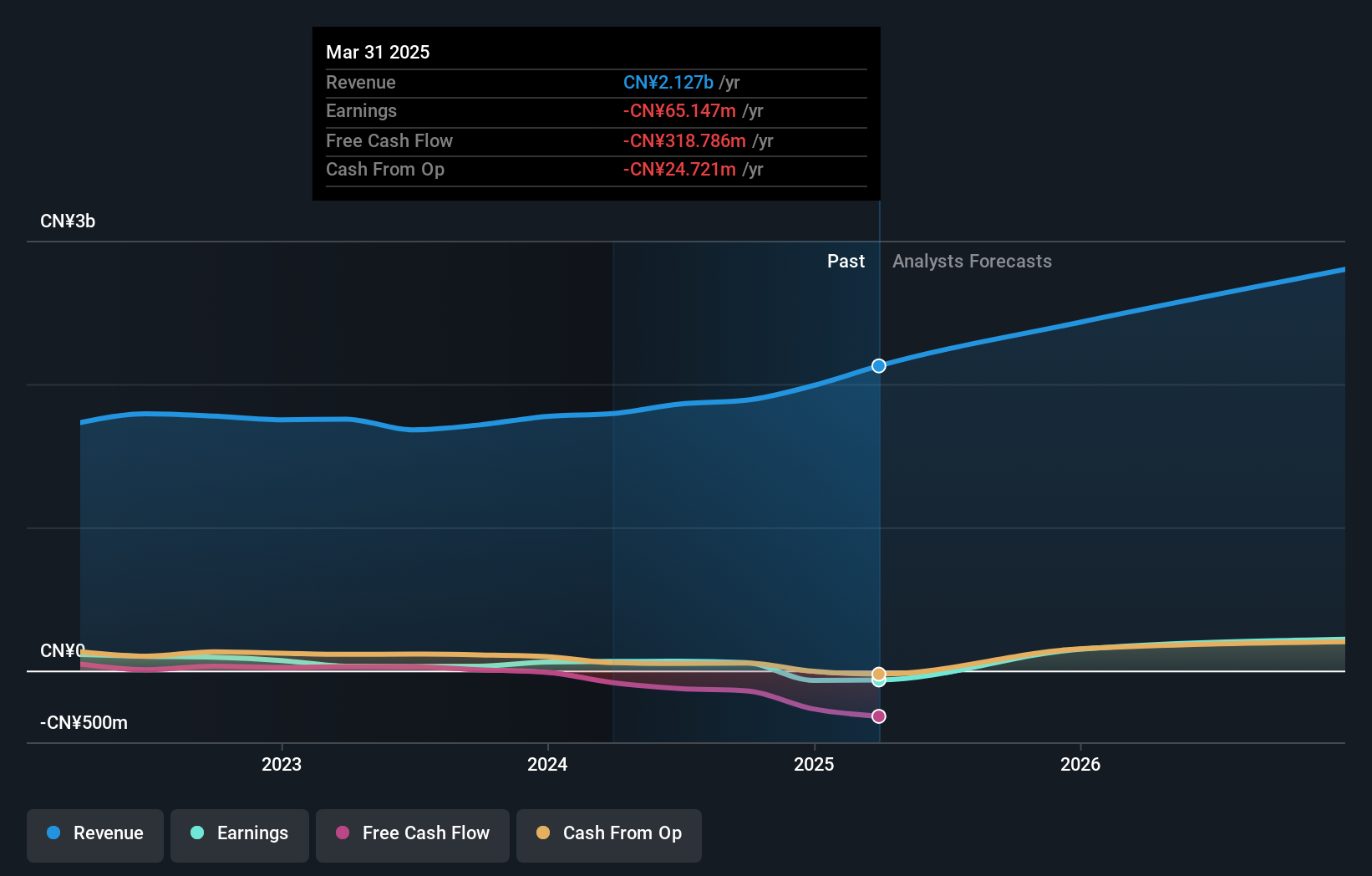

Shenzhen Prince New MaterialsLtd (SZSE:002735)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Prince New Materials Co., Ltd. produces and sells packaging materials in China, with a market cap of CN¥3.63 billion.

Operations: The company's revenue is derived from the production and sale of packaging materials within China.

Insider Ownership: 38.1%

Earnings Growth Forecast: 56.7% p.a.

Shenzhen Prince New Materials Ltd. demonstrates strong growth potential with earnings expected to increase significantly at 56.7% annually, outpacing the broader Chinese market's 25.3%. Despite revenue growth being slower than 20%, it surpasses the market average of 13.4%. However, its Return on Equity is projected to remain low at 9.4% in three years. There has been no substantial insider trading activity in recent months, indicating stable insider sentiment toward the company's future prospects.

- Unlock comprehensive insights into our analysis of Shenzhen Prince New MaterialsLtd stock in this growth report.

- Our valuation report here indicates Shenzhen Prince New MaterialsLtd may be overvalued.

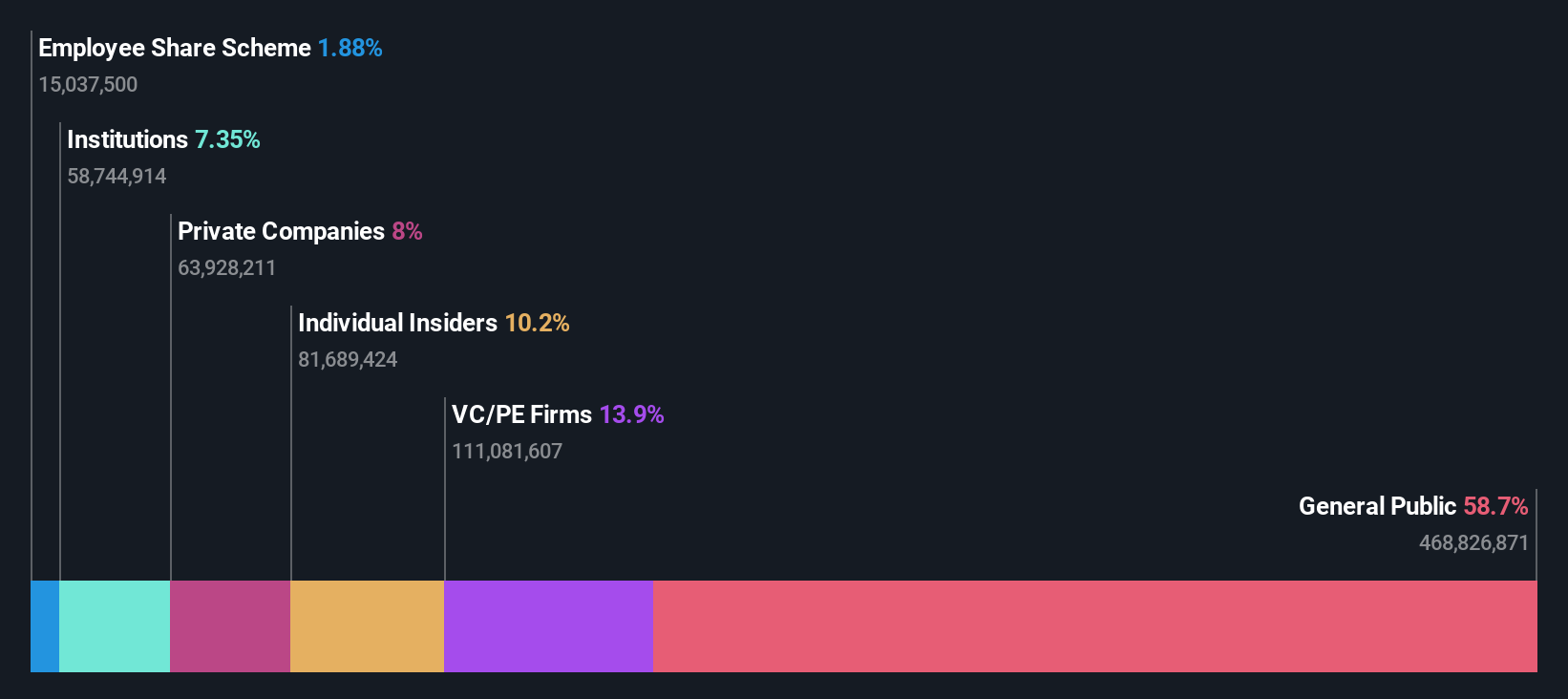

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market cap of CN¥6.99 billion.

Operations: The company's revenue primarily comes from the Information Security Industry segment, generating CN¥1.75 billion.

Insider Ownership: 10.2%

Earnings Growth Forecast: 127.3% p.a.

NSFOCUS Technologies Group shows promising growth prospects, with earnings expected to rise 127.33% annually, significantly outpacing the Chinese market's average. Revenue is forecast to grow at 18.1% per year, exceeding the market rate of 13.4%. Despite trading at a good value compared to peers and industry, its Return on Equity is projected to be low at 4% in three years. Recent months have shown no substantial insider trading activity, suggesting stable insider confidence in future growth.

- Click here to discover the nuances of NSFOCUS Technologies Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of NSFOCUS Technologies Group shares in the market.

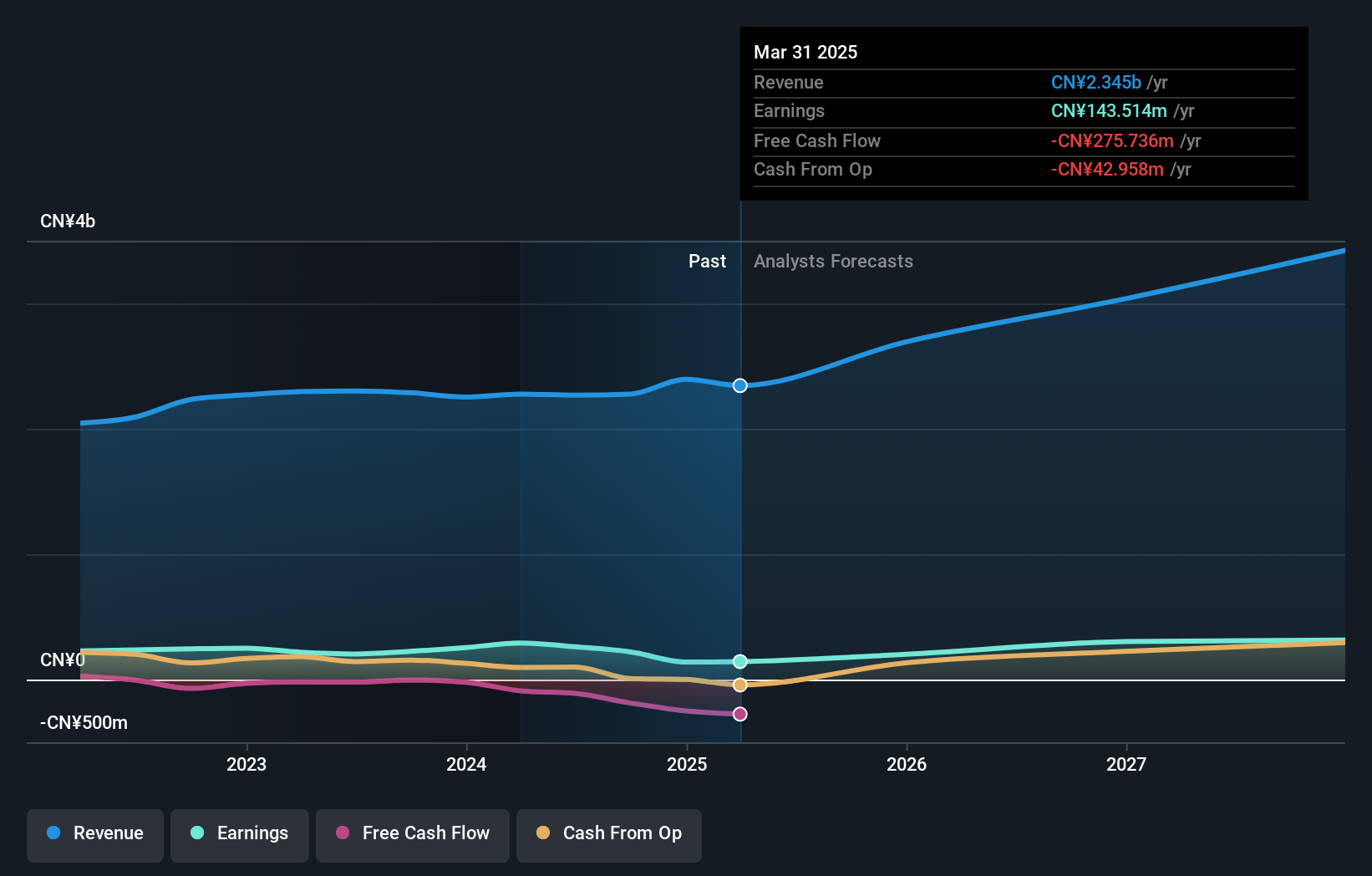

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥9.69 billion.

Operations: The company generates revenue from its Software Services segment, amounting to CN¥2.28 billion.

Insider Ownership: 29.1%

Earnings Growth Forecast: 27.5% p.a.

Guangzhou Sie Consulting is positioned for significant earnings growth of 27.5% annually, surpassing the Chinese market's average. Its revenue is projected to grow at 13.9% per year, slightly above the market pace. Trading at a favorable Price-To-Earnings ratio of 43.2x compared to the industry average, it recently completed a buyback of shares worth CNY 39.97 million, indicating confidence in its valuation despite high share price volatility and low forecasted Return on Equity at 11.8%.

- Get an in-depth perspective on Guangzhou Sie Consulting's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Guangzhou Sie Consulting's share price might be on the cheaper side.

Taking Advantage

- Reveal the 1450 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NSFOCUS Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300369

NSFOCUS Technologies Group

Provides Internet and application security services worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives