Bonree Data Technology And 2 More High Growth Tech Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of U.S. trade policies and AI enthusiasm, major indices like the S&P 500 and Nasdaq Composite have recently experienced gains, reflecting positive investor sentiment. In this environment of optimism, identifying high-growth tech stocks that can capitalize on technological advancements and favorable economic conditions becomes crucial for investors seeking potential opportunities in the market.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd specializes in providing application performance management services for enterprises in China and has a market cap of CN¥1.94 billion.

Operations: Bonree Data Technology focuses on delivering application performance management solutions to enterprises across China. The company generates revenue primarily through its software and service offerings, catering to the needs of businesses seeking to optimize their digital infrastructure.

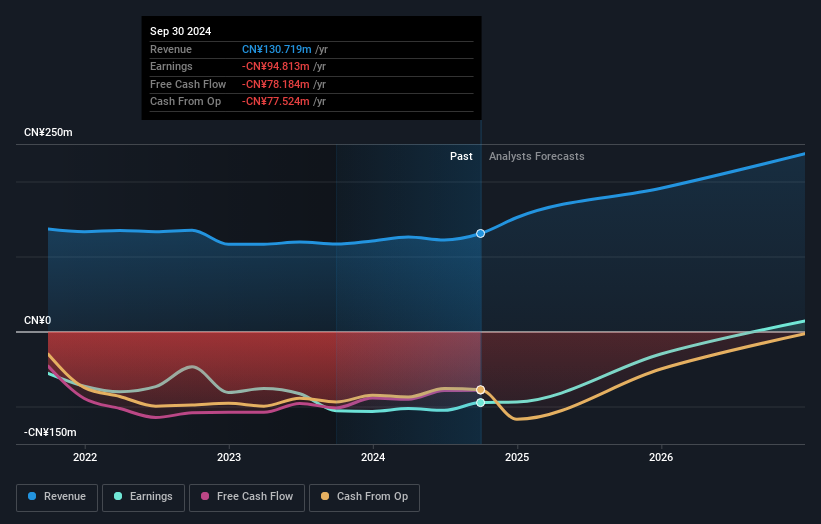

Bonree Data Technology, navigating through a challenging landscape, has shown promising signs with an annual revenue growth forecast at 25.5%, notably outpacing the CN market's 13.4%. Despite current unprofitability, the company is on a trajectory towards profitability within three years, buoyed by an impressive projected earnings growth of 88.0% per year. Recent financial disclosures reveal a narrowing net loss from CNY 74.98 million to CNY 63.16 million year-over-year and a reduction in loss per share, indicating operational improvements and cost management efficacy that could be pivotal as it transitions into profitability.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) in China and internationally, with a market capitalization of CN¥18.73 billion.

Operations: Fastprint Circuit Tech focuses on the production and sale of printed circuit boards (PCBs) both domestically and internationally. The company generates revenue through its PCB manufacturing operations, which form the core of its business activities.

Shenzhen Fastprint Circuit TechLtd, amid a competitive landscape, is making strides with a robust forecast in annual revenue growth at 17.6%, surpassing the broader CN market's average of 13.4%. This growth trajectory is supported by an anticipated shift to profitability within the next three years, driven by an impressive expected annual earnings increase of 64.98%. Despite current challenges in covering debt with operating cash flow, the company's strategic focus on R&D investments and expanding market share hold promise for its future performance in the tech sector.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market cap of CN¥5.74 billion.

Operations: The company's primary revenue stream is from the Information Security Industry, generating CN¥1.75 billion.

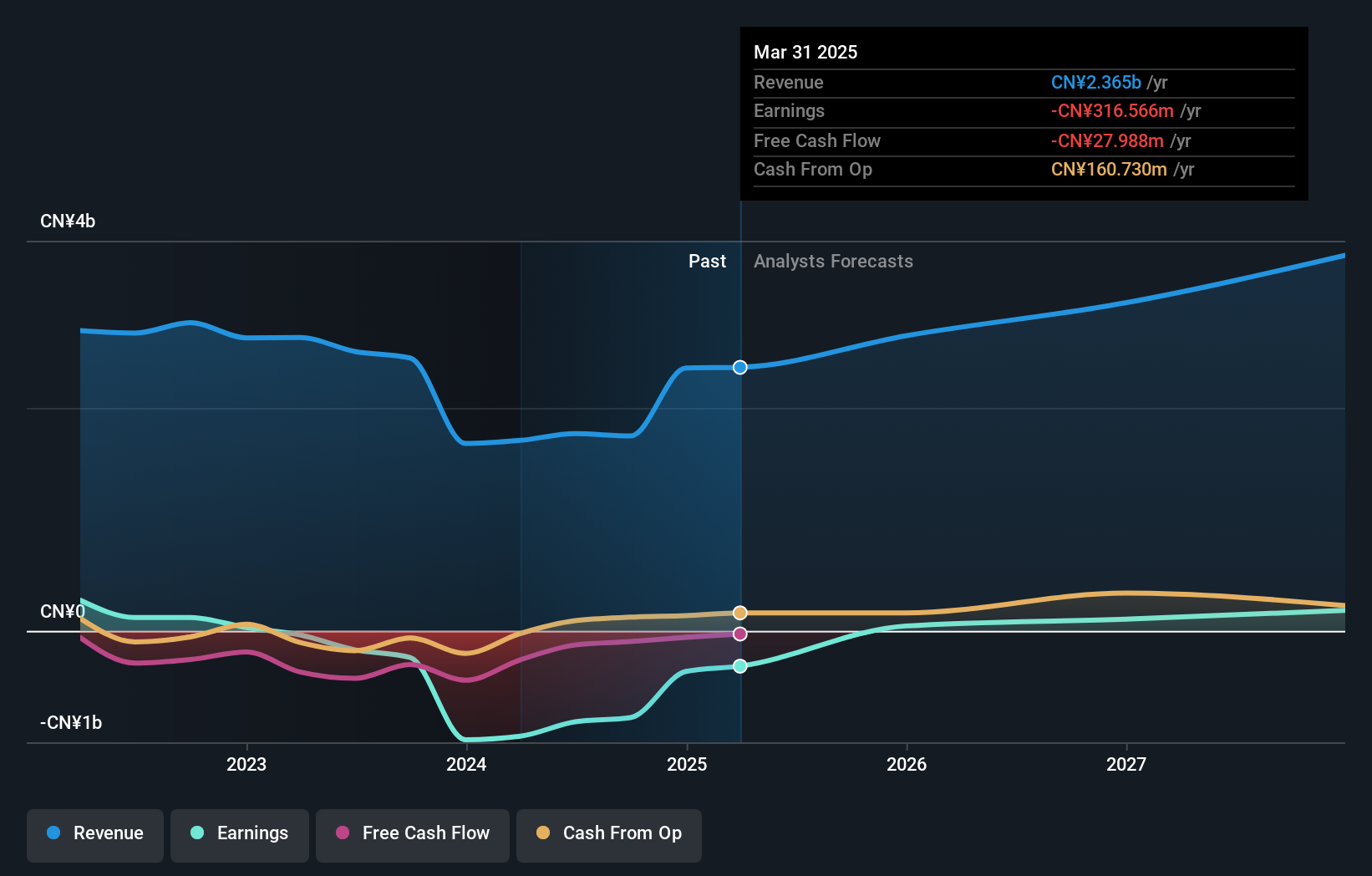

NSFOCUS Technologies Group has demonstrated resilience with its recent earnings report, showing a significant reduction in net loss to CNY 326.02 million from CNY 524.28 million year-over-year, alongside stable revenue growth at CNY 1,274 million. Despite current unprofitability, the company is poised for a turnaround with an expected profit growth forecasted at an impressive annual rate of 127.3%. This potential shift towards profitability is underpinned by strategic R&D investments that are crucial for future innovations and market competitiveness in the tech sector. With revenue growing faster than the CN market average at 18.1% annually, NSFOCUS's focus on enhancing technological capabilities could well position it as a stronger player in its industry despite past challenges.

- Dive into the specifics of NSFOCUS Technologies Group here with our thorough health report.

Gain insights into NSFOCUS Technologies Group's past trends and performance with our Past report.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1226 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonree Data Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688229

Bonree Data Technology

Provides application performance management services for enterprises in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives