AVIT Ltd.'s (SZSE:300264) Shares Climb 29% But Its Business Is Yet to Catch Up

Despite an already strong run, AVIT Ltd. (SZSE:300264) shares have been powering on, with a gain of 29% in the last thirty days. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.7% over the last year.

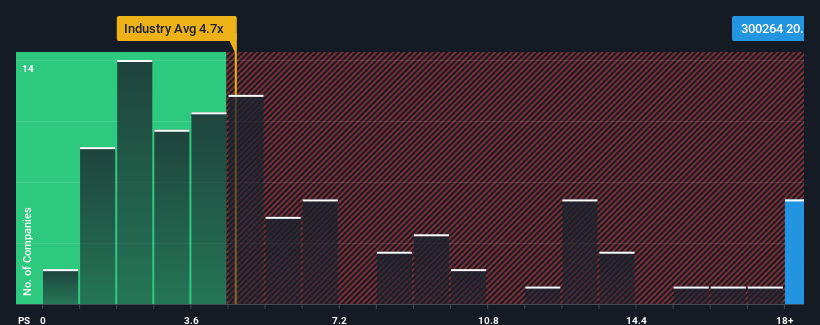

Since its price has surged higher, AVIT's price-to-sales (or "P/S") ratio of 20.8x might make it look like a strong sell right now compared to other companies in the IT industry in China, where around half of the companies have P/S ratios below 4.7x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for AVIT

How Has AVIT Performed Recently?

With revenue growth that's exceedingly strong of late, AVIT has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AVIT's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For AVIT?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like AVIT's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 82% last year. Revenue has also lifted 21% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

In light of this, it's alarming that AVIT's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

AVIT's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that AVIT currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - AVIT has 1 warning sign we think you should be aware of.

If you're unsure about the strength of AVIT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300264

AVIT

Provides audio and video content and application solutions to network operators in China.

Worrying balance sheet with minimal risk.

Market Insights

Community Narratives