Beijing Trust&Far TechnologyLTD (SZSE:300231) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Beijing Trust&Far Technology CO.,LTD (SZSE:300231) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Beijing Trust&Far TechnologyLTD

What Is Beijing Trust&Far TechnologyLTD's Net Debt?

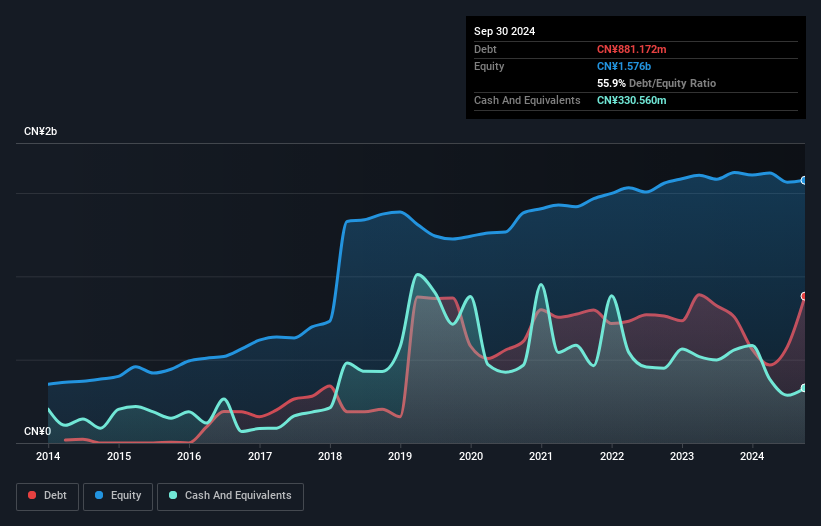

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Beijing Trust&Far TechnologyLTD had CN¥881.2m of debt, an increase on CN¥755.2m, over one year. However, it also had CN¥330.6m in cash, and so its net debt is CN¥550.6m.

How Healthy Is Beijing Trust&Far TechnologyLTD's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Beijing Trust&Far TechnologyLTD had liabilities of CN¥829.6m due within 12 months and liabilities of CN¥382.8m due beyond that. Offsetting these obligations, it had cash of CN¥330.6m as well as receivables valued at CN¥958.3m due within 12 months. So it can boast CN¥76.4m more liquid assets than total liabilities.

This state of affairs indicates that Beijing Trust&Far TechnologyLTD's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the CN¥5.28b company is struggling for cash, we still think it's worth monitoring its balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Strangely Beijing Trust&Far TechnologyLTD has a sky high EBITDA ratio of 5.8, implying high debt, but a strong interest coverage of 11.1. So either it has access to very cheap long term debt or that interest expense is going to grow! Shareholders should be aware that Beijing Trust&Far TechnologyLTD's EBIT was down 67% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Beijing Trust&Far TechnologyLTD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Beijing Trust&Far TechnologyLTD recorded free cash flow of 32% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Both Beijing Trust&Far TechnologyLTD's EBIT growth rate and its net debt to EBITDA were discouraging. But at least its interest cover is a gleaming silver lining to those clouds. Taking the abovementioned factors together we do think Beijing Trust&Far TechnologyLTD's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Beijing Trust&Far TechnologyLTD you should be aware of, and 3 of them are concerning.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Trust & Far TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300231

Beijing Trust & Far TechnologyLtd

Provides data center information technology infrastructure operation and maintenance services in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026