As global markets experience broad-based gains, with smaller-cap indexes outperforming large-caps and the S&P MidCap 400 Index showing significant growth, investors are closely watching economic indicators such as initial jobless claims and existing home sales that have driven positive sentiment. In this environment of cautious optimism, a good high-growth tech stock is often characterized by its ability to innovate and adapt to market demands while maintaining solid financial health amidst evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.44% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market capitalization of SEK30.60 billion.

Operations: Vitrolife AB's revenue streams are derived from three main segments: Genetics (SEK1.23 billion), Consumables (SEK1.61 billion), and Technologies (SEK721 million). The company focuses on the assisted reproduction market, leveraging these segments to support its operations and growth strategy.

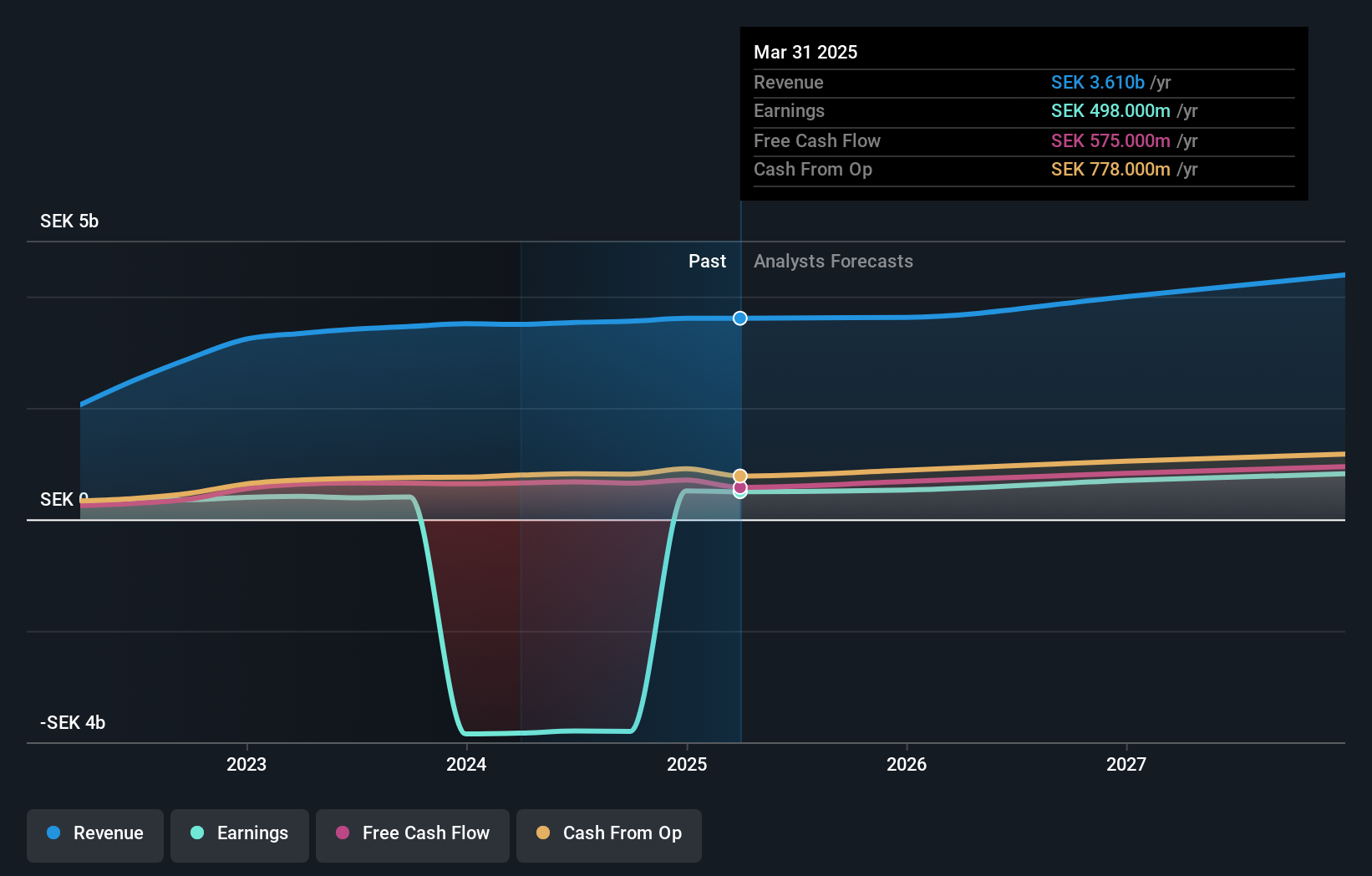

Vitrolife, a company navigating the complex biotech landscape, has shown resilience with an 8.2% annual revenue growth projection, outpacing Sweden's market average significantly. Despite current unprofitability, its trajectory towards profitability within three years is bolstered by an anticipated earnings growth of 96.77% per year. Recent activities including presentations at prominent healthcare conferences underscore its active engagement with the investment community and commitment to growth amidst challenging market conditions. These developments highlight Vitrolife's potential in transforming its financial health and industry standing through strategic R&D investments and market engagement.

- Click to explore a detailed breakdown of our findings in Vitrolife's health report.

Examine Vitrolife's past performance report to understand how it has performed in the past.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market capitalization of approximately HK$67.70 billion.

Operations: Sunny Optical Technology generates revenue primarily from three segments: optical components, optical instruments, and optoelectronic products. The optoelectronic products segment is the largest contributor with CN¥25.10 billion in revenue, followed by optical components at CN¥12.32 billion.

Sunny Optical Technology has demonstrated robust growth dynamics, outpacing the Hong Kong market with a forecasted revenue increase of 10.2% per year and an earnings surge of 20.9% annually. This performance is notably superior to the broader Electronic industry's growth rate of 11.7%. The company's commitment to innovation is evident from its R&D investments, which have strategically fueled these financial achievements and solidified its competitive edge in optical technologies. Recent leadership changes, with Mr. Wang Wenjie stepping in as CEO, could signal a continued strategic focus on enhancing technological capabilities and expanding market reach, ensuring Sunny Optical remains pivotal in the optics sector despite recent executive shifts.

- Get an in-depth perspective on Sunny Optical Technology (Group)'s performance by reading our health report here.

Learn about Sunny Optical Technology (Group)'s historical performance.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. is a Chinese company specializing in software, artificial intelligence, big data, and data security products and services with a market cap of CN¥16.79 billion.

Operations: TRS focuses on delivering a range of technology solutions including software, artificial intelligence, big data analytics, and data security services within China. The company's revenue is derived from these diversified tech offerings, reflecting its engagement in multiple high-demand sectors.

TRS Information Technology has shown a promising trajectory with its earnings growing by 23.9% over the past year, outpacing the software industry's decline of 11.2%. This growth is underpinned by significant R&D investments, which have not only enhanced product offerings but also positioned the company well above industry standards in innovation. The recent private placement and subsequent capital infusion of CNY 890.36 million underscore a strategic push to leverage financial flexibility for further technological advancements and market expansion. With revenue and earnings forecasted to grow annually at 17.4% and 40.2%, respectively, TRS is setting a robust pace in the tech sector, despite its share price volatility over the last three months indicating potential risks in market perception.

Next Steps

- Embark on your investment journey to our 1288 High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Good value with reasonable growth potential.