As global markets navigate a complex landscape marked by mixed performances in U.S. stock indexes and steady interest rates from the Federal Reserve, smaller-cap indexes have shown resilience, outperforming larger benchmarks amid geopolitical tensions and economic uncertainties. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage innovation and adaptability to thrive despite broader market volatility, making them intriguing options for investors seeking potential growth opportunities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 66.21% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Business-intelligence of Oriental Nations (SZSE:300166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Business-intelligence of Oriental Nations Corporation Ltd. operates in the business intelligence sector and has a market capitalization of CN¥11.44 billion.

Operations: The company generates revenue primarily through its business intelligence services. With a market capitalization of CN¥11.44 billion, it operates in a sector that involves data analysis and strategic insights for various industries.

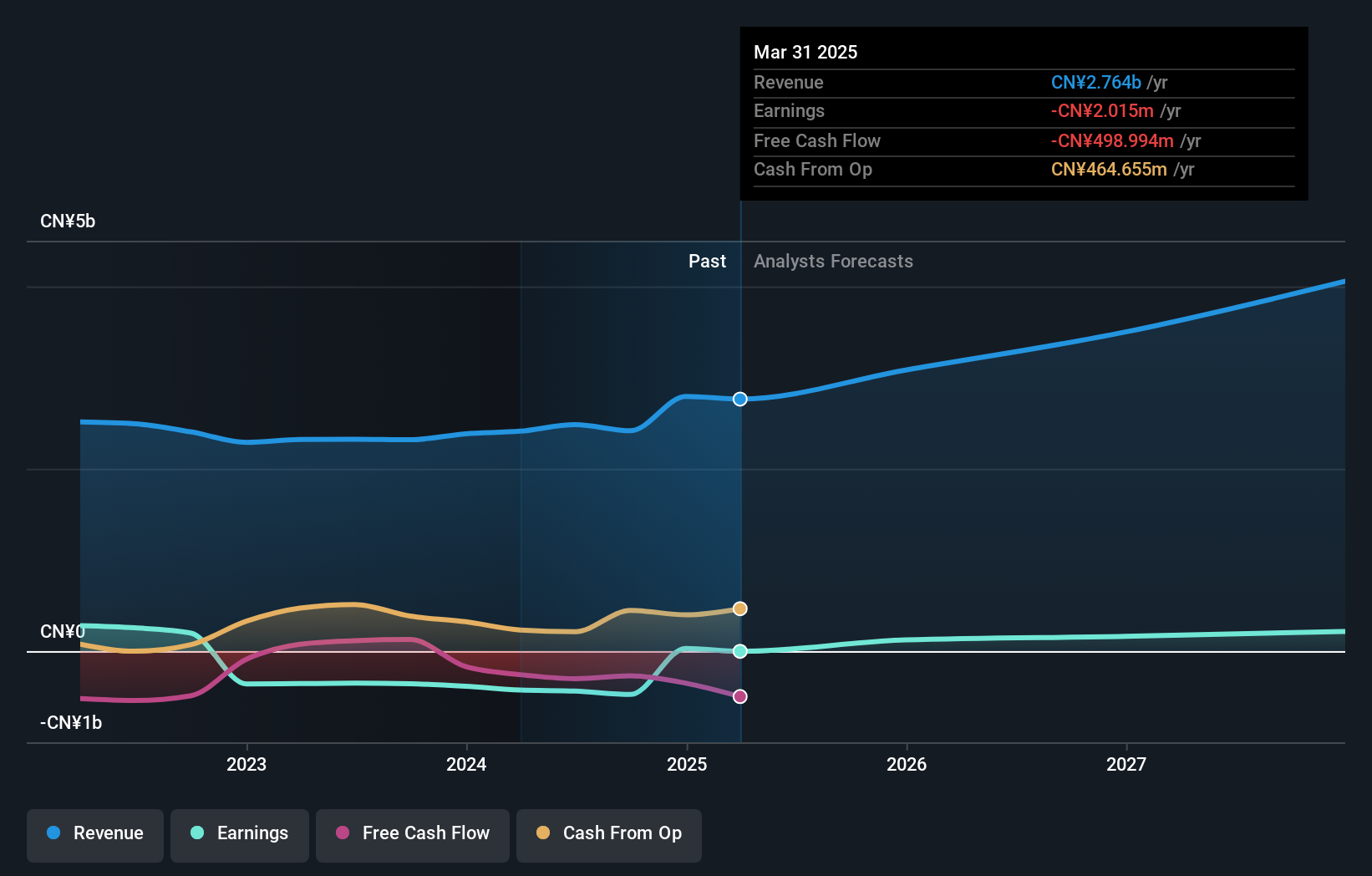

Despite a challenging fiscal quarter where Business-intelligence of Oriental Nations reported a net loss of CNY 27.26 million, the company's commitment to innovation is evident from its R&D investments, aligning with its strategic focus on enhancing business intelligence solutions. The firm's revenue growth forecast at 13.9% annually outpaces the broader Chinese market projection of 12.4%, highlighting potential in a competitive landscape. With earnings expected to surge by 58.31% annually, the trajectory suggests an optimistic outlook as it moves towards profitability within three years, supported by robust development initiatives and strategic market positioning in tech-intensive sectors.

- Click here to discover the nuances of Business-intelligence of Oriental Nations with our detailed analytical health report.

Learn about Business-intelligence of Oriental Nations' historical performance.

Guangdong Aofei Data Technology (SZSE:300738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Aofei Data Technology Co., Ltd. operates in the data technology sector and has a market capitalization of CN¥19.89 billion.

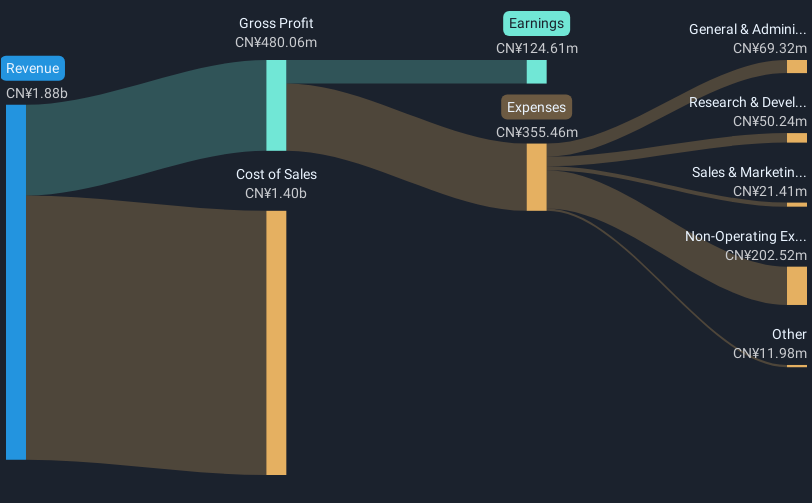

Operations: Aofei Data Technology focuses on the data technology sector, with its operations primarily revolving around providing data services and solutions. The company generates revenue through various segments within this industry, although specific segment details are not provided in the available information.

Guangdong Aofei Data Technology is capturing attention with its robust financial performance, evidenced by a 21.9% annual revenue growth rate, outpacing the broader Chinese market's 12.4%. This surge is supported by a significant 38.7% expected annual earnings growth, reflecting strong operational efficiency and market demand for their tech solutions. Recent strategic amendments in company bylaws and proactive shareholder meetings underscore a forward-looking governance approach that aligns with its aggressive R&D investments, which are pivotal in sustaining innovation and competitive edge in the fast-evolving tech landscape.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. is engaged in the development, manufacturing, and sale of electronic components across Japan, China, Hong Kong, and international markets with a market cap of ¥311.96 billion.

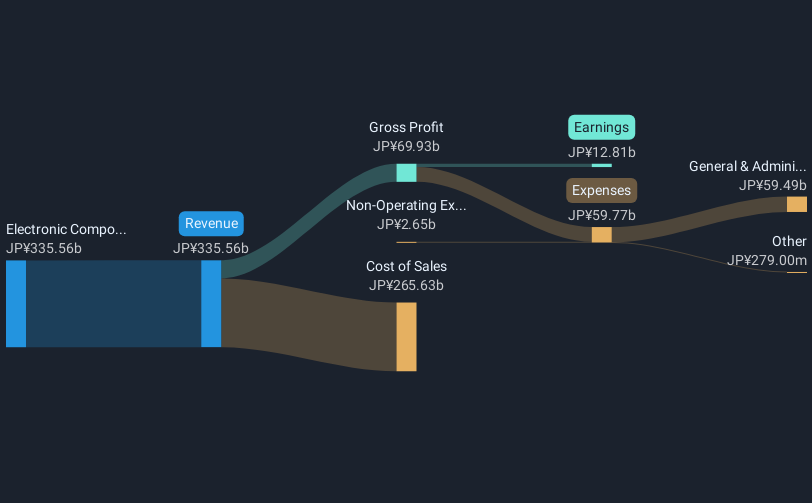

Operations: Taiyo Yuden generates revenue primarily from its Electronic Components Business, which accounted for ¥341.44 billion. The company's operations span multiple regions, including Japan, China, and Hong Kong.

Taiyo Yuden has shown resilience with its latest product innovations, such as the LCQPB series power inductors, enhancing its automotive electronics offerings. Despite a challenging fiscal year with earnings revised down due to foreign exchange losses, the company's commitment to R&D remains robust. With an impressive 34.9% forecasted annual earnings growth and a strategic focus on high-demand automotive components, Taiyo Yuden is positioning itself strongly within the tech sector. This approach is underscored by their active participation in major industry events like COMPUTEX Taipei and PCIM Europe 2025, signaling ongoing engagement with market trends and customer needs.

- Get an in-depth perspective on Taiyo Yuden's performance by reading our health report here.

Explore historical data to track Taiyo Yuden's performance over time in our Past section.

Key Takeaways

- Investigate our full lineup of 758 Global High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300738

Guangdong Aofei Data Technology

Guangdong Aofei Data Technology Co., Ltd.

High growth potential low.

Market Insights

Community Narratives