As global markets experience varied performance, with U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, Asian tech stocks are drawing attention for their potential in a dynamic economic landscape. In this context, identifying high growth tech stocks involves assessing factors such as innovation capacity, market adaptability, and resilience to economic shifts that align with current trends in the broader market environment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 28.67% | 35.10% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Shenzhen Transsion Holdings (SHSE:688036)

Simply Wall St Growth Rating: ★★★★☆☆

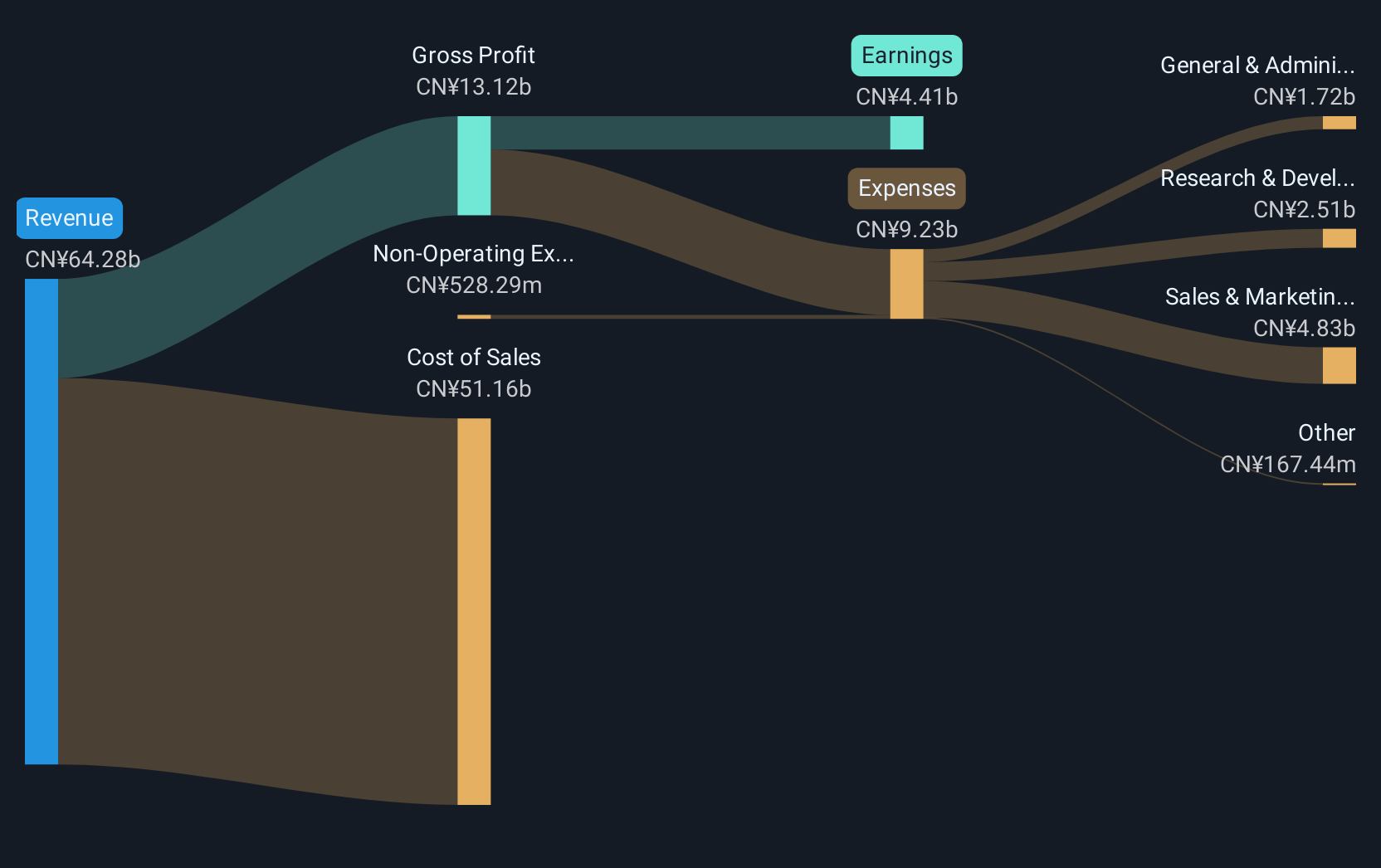

Overview: Shenzhen Transsion Holdings Co., Ltd. is a company that manufactures and sells smart devices across Africa and other international markets, with a market cap of CN¥88.22 billion.

Operations: Transsion Holdings focuses on the production and distribution of smart devices, primarily targeting African markets along with other international regions. The company operates with a market capitalization of CN¥88.22 billion, leveraging its manufacturing capabilities to cater to diverse consumer needs in these areas.

Shenzhen Transsion Holdings, despite recent challenges such as being dropped from the Shanghai Stock Exchange 180 Value Index, shows a robust growth trajectory with forecasted earnings growth of 20.77% per year. The company's revenue growth at 13.2% annually outpaces the broader Chinese market's 12.4%, underscoring its competitive edge in tech innovation despite a significant earnings dip last year by 33.5%. With high-quality past earnings and a positive free cash flow status, Transsion is navigating through turbulent waters, marked by a sharp decline in net income to CNY 490.09 million from CNY 1,626.47 million year-over-year as per Q1 results of 2025. This resilience is pivotal as it continues to adapt and potentially capitalize on emerging tech trends in Asia.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

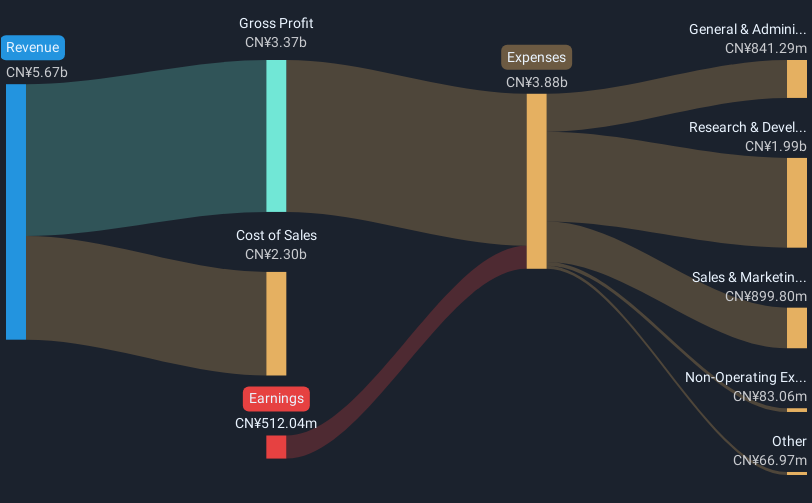

Overview: Perfect World Co., Ltd. is involved in the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥30.52 billion.

Operations: Perfect World Co., Ltd. generates revenue primarily through its online gaming operations, both domestically and internationally. The company focuses on the research, development, distribution, and operation of these games.

Perfect World Co., Ltd. has demonstrated resilience and adaptability in a challenging market, with a notable recovery in its first quarter of 2025 where revenue surged to CNY 2.02 billion from CNY 1.33 billion year-over-year, and net income flipped from a loss of CNY 29.76 million to a gain of CNY 302.19 million. Despite this rebound, the company faced an overall net loss in 2024, reflecting volatility but also potential for growth as annual revenue is expected to increase by an impressive 17% per year. This growth trajectory is further underscored by the company's commitment to innovation and market expansion, evidenced by its R&D investments which are crucial for sustaining long-term competitiveness in the tech sector.

- Unlock comprehensive insights into our analysis of Perfect World stock in this health report.

Assess Perfect World's past performance with our detailed historical performance reports.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

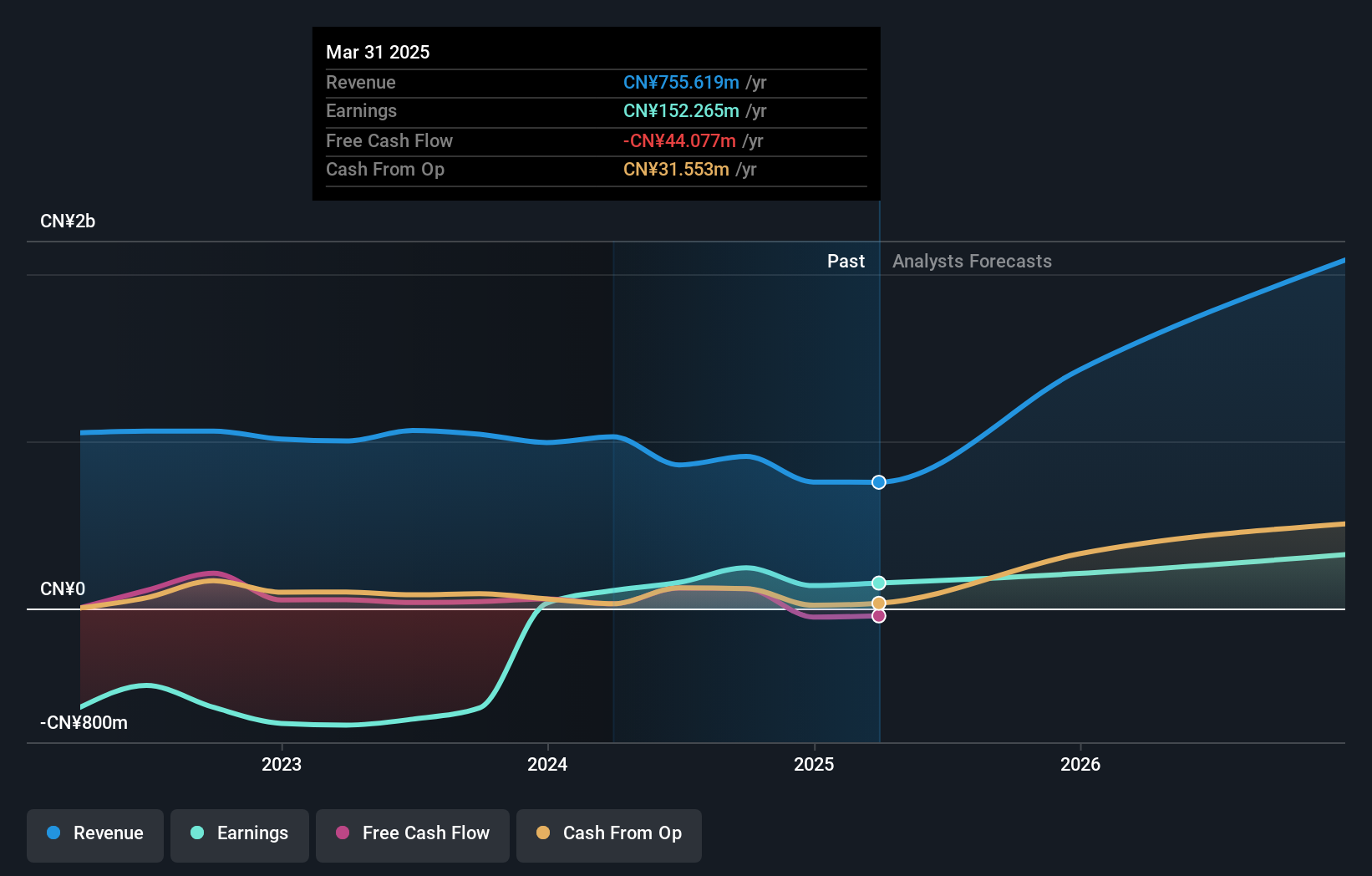

Overview: Doushen (Beijing) Education & Technology INC. operates in the education and technology sector, with a market cap of CN¥18.31 billion.

Operations: The company generates revenue primarily from its Information Technology Service segment, amounting to approximately CN¥755.62 million.

Doushen (Beijing) Education & Technology has shown remarkable resilience, with its revenue expected to grow at an annual rate of 52.9%, outpacing the broader Chinese market's 12.4%. This growth is underpinned by a significant increase in earnings, which surged by 41.7% over the past year and are projected to rise by 42.9% annually. Despite recent challenges highlighted by auditor concerns regarding its ongoing viability, Doushen continues to invest in innovation, as evidenced by its robust R&D spending which remains crucial for maintaining competitiveness in the rapidly evolving educational tech sector.

- Navigate through the intricacies of Doushen (Beijing) Education & Technology with our comprehensive health report here.

Understand Doushen (Beijing) Education & Technology's track record by examining our Past report.

Make It Happen

- Delve into our full catalog of 484 Asian High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives