- China

- /

- Electronic Equipment and Components

- /

- SZSE:300188

High Growth Tech And 2 Other Promising Stocks Backed By Strong Fundamentals

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced a mixed performance with major U.S. stock indexes posting moderate gains in a holiday-shortened week, while consumer confidence and manufacturing indicators showed signs of weakening. Amid this backdrop, investors are keenly evaluating stocks that demonstrate strong fundamentals and resilience in the face of economic uncertainties; such attributes are particularly valuable for high-growth tech companies and other promising sectors poised to navigate the current market landscape effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Servyou Software Group Co., Ltd. offers financial and tax information services in China with a market capitalization of CN¥12.64 billion.

Operations: Servyou Software Group Co., Ltd. specializes in providing financial and tax information services within China. The company's revenue model focuses on delivering these specialized services, contributing to its market presence with a capitalization of CN¥12.64 billion.

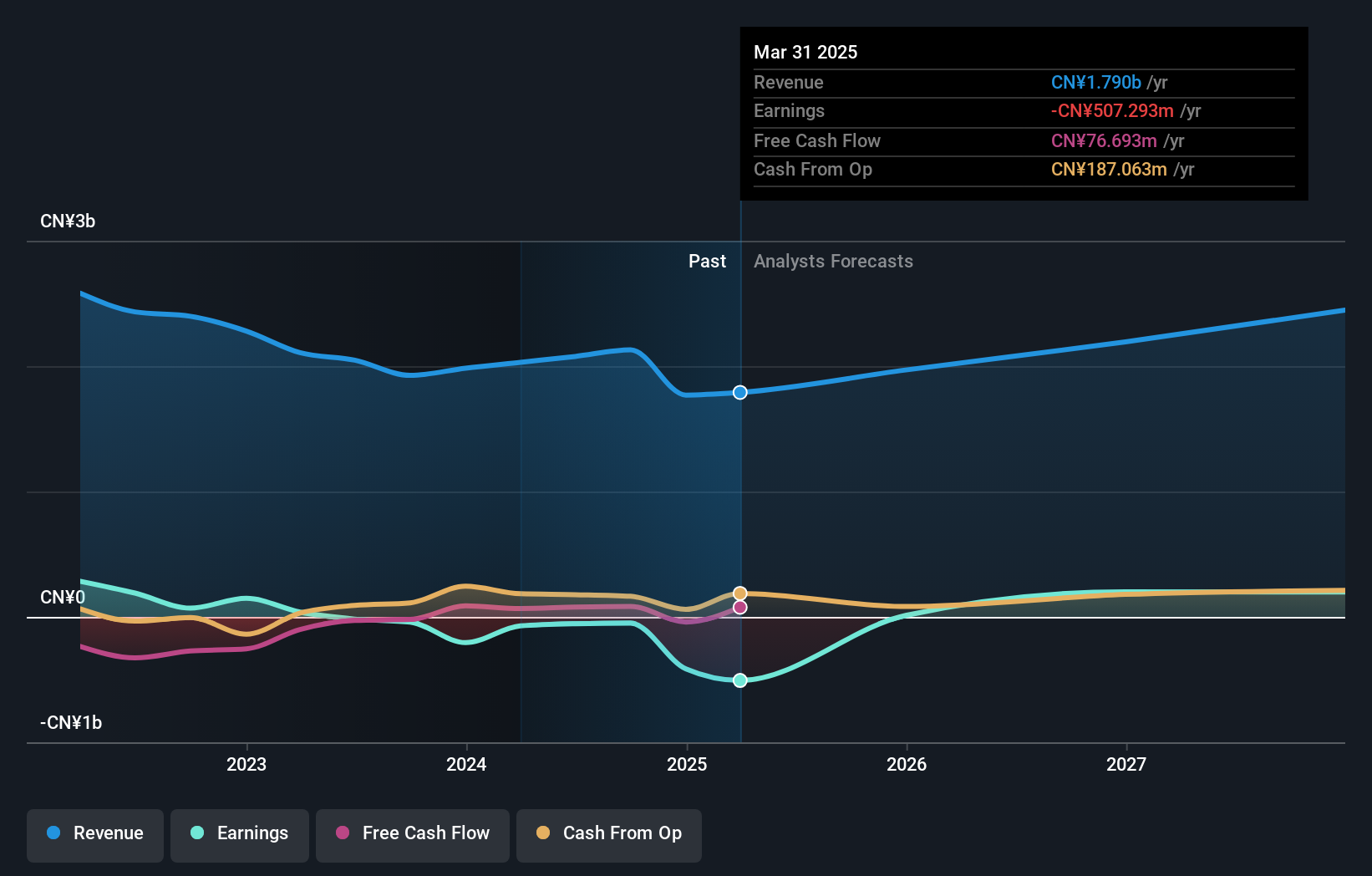

Servyou Software Group Co., Ltd. is navigating the competitive landscape of tech with a robust growth trajectory, evidenced by its annual revenue increase of 20.1% and an impressive earnings forecast to surge by 50.9% annually. Despite a challenging past year with earnings contraction of 38.5%, the firm's commitment to innovation is clear from its R&D spending trends, which align closely with industry demands for evolving software solutions. Recent financials underscore this dynamic, with a reported revenue jump to CNY 1.28 billion and net income rising to CNY 115.93 million in just nine months, up from the previous year's figures of CNY 1.19 billion and CNY 103.46 million respectively, demonstrating resilience and potential for sustained growth amidst market volatility.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥4.37 billion.

Operations: Jilin University Zhengyuan Information Technologies Co., Ltd. focuses on providing solutions within the information technology sector. The company generates revenue primarily through its IT services and solutions offerings, targeting various industries with its technological expertise.

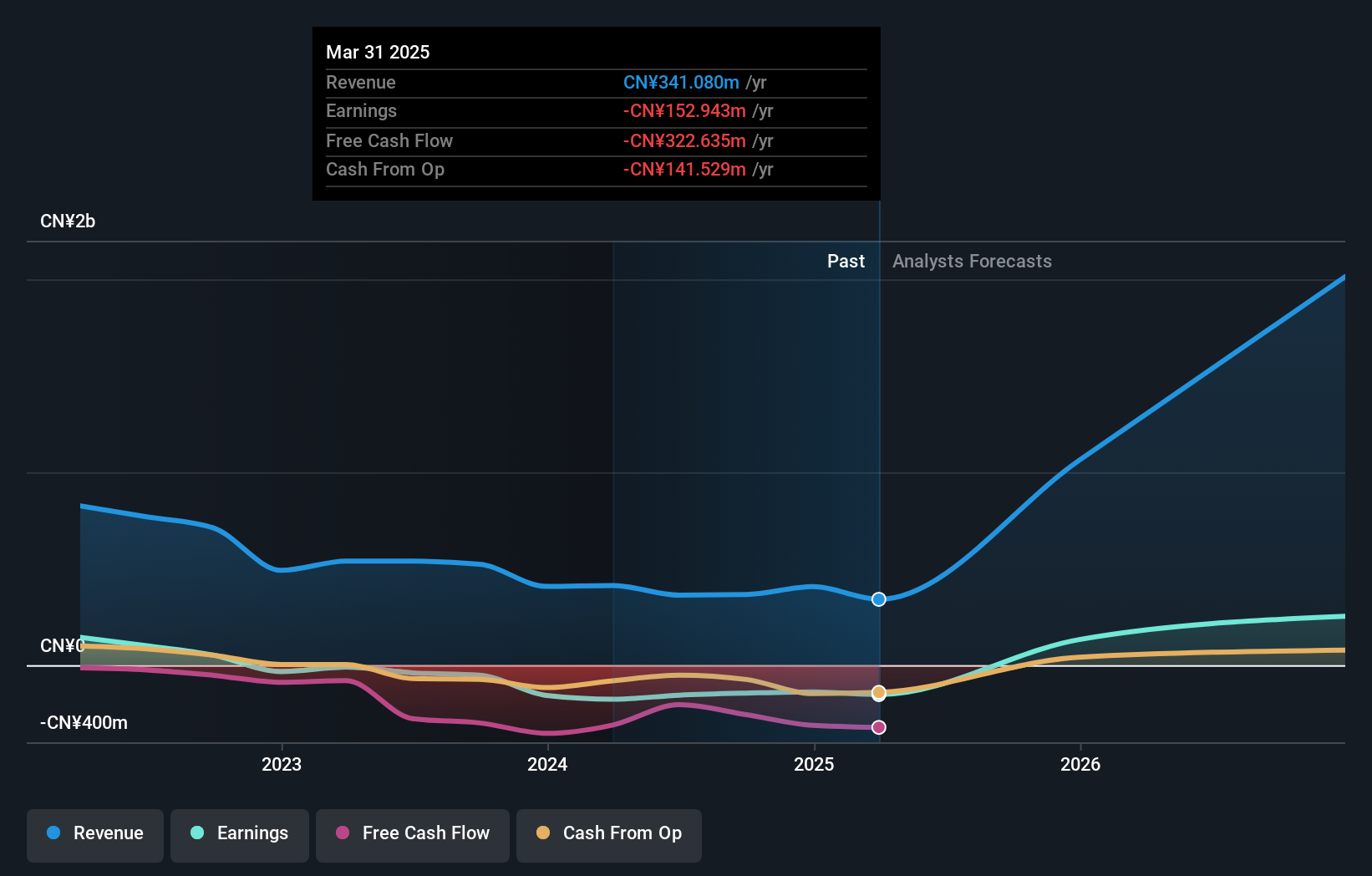

Jilin University Zhengyuan Information Technologies, while currently unprofitable, demonstrates significant potential with an expected revenue growth of 72.9% per year, outpacing the Chinese market average of 13.7%. This rapid growth is supported by substantial R&D investments tailored to evolving market demands in tech. Despite a recent downturn in earnings and a net loss reported for the nine months ending September 2024, the company's aggressive revenue trajectory and strategic share repurchases—totaling 5,219,800 shares for CNY 72.72 million—signal a robust commitment to future scalability and market presence.

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. operates in the technology sector and has a market capitalization of CN¥12.75 billion.

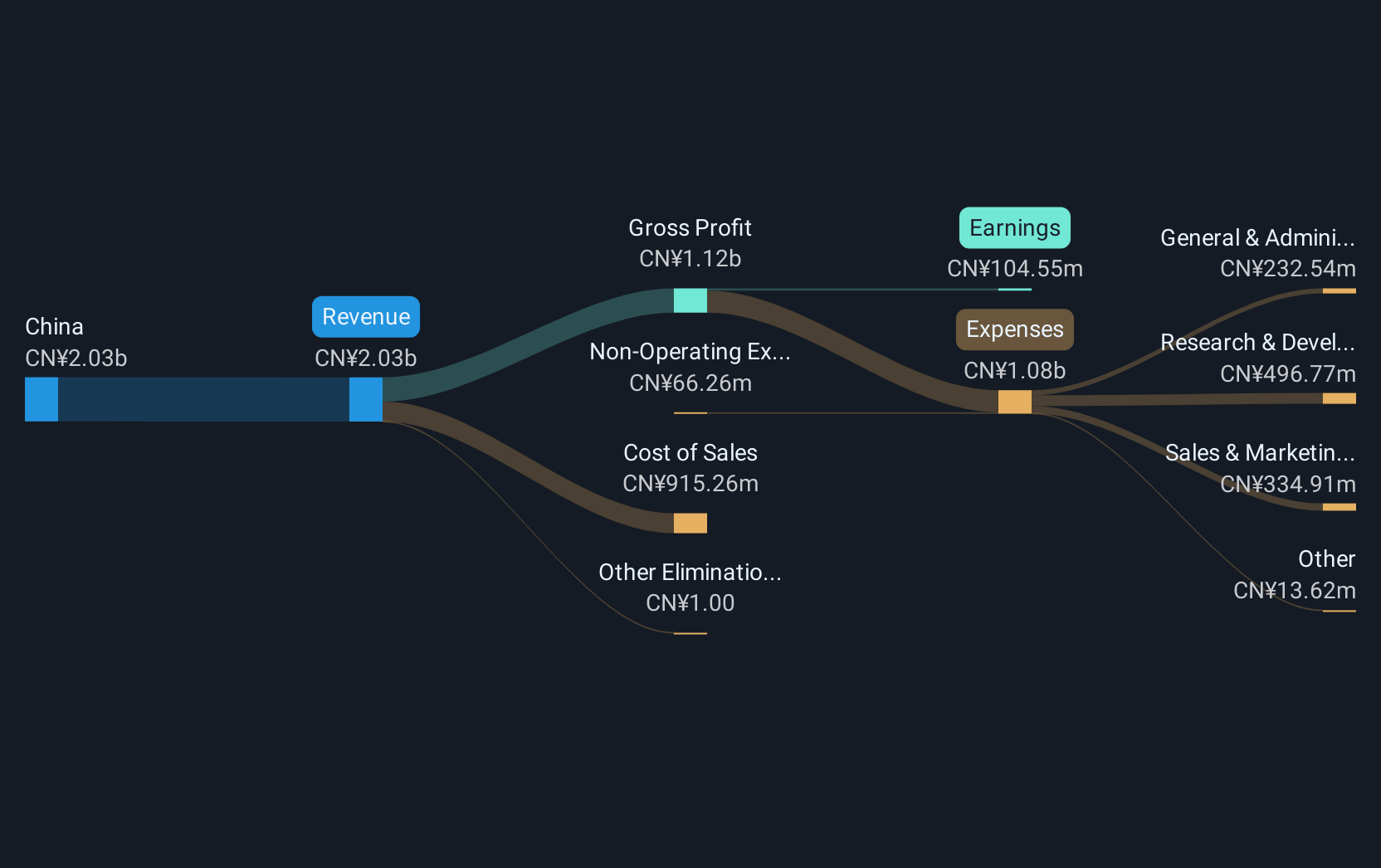

Operations: SDIC Intelligence Xiamen Information Co., Ltd. generates revenue through its technology operations, focusing on innovative solutions within the sector. The company exhibits a notable trend in its financial performance with a net profit margin of 15.3%, indicating efficient cost management relative to its income generation capabilities.

SDIC Intelligence Xiamen Information, despite its current unprofitability, is on a promising trajectory with a forecasted annual revenue growth of 22.6%, well above the Chinese market average of 13.7%. The company's recent financials show a reduction in net loss to CNY 241.83 million from CNY 397.09 million year-over-year, alongside an increase in sales to CNY 897.38 million from CNY 750.49 million, reflecting operational improvements and market resilience. With earnings expected to surge by approximately 65.72% annually over the next few years and strategic moves like changing audit firms and purchasing liability insurance for top executives discussed in their upcoming extraordinary meeting, SDIC Intelligence Xiamen Information is positioning itself for sustainable growth within the tech sector.

Next Steps

- Investigate our full lineup of 1270 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300188

SDIC Intelligence Information Technology

SDIC Intelligence Information Technology Co., Ltd.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives