- China

- /

- Hospitality

- /

- SHSE:605108

High Insider Confidence In Growth Stocks For October 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and sector-specific fluctuations, the U.S. indices have shown resilience with notable performances in small and mid-cap stocks, while European markets react to monetary policy shifts. Amidst these developments, growth companies with high insider ownership are drawing attention as potential indicators of confidence in their long-term prospects. In this context, understanding the alignment of insider interests with shareholder value becomes crucial for evaluating growth opportunities in today's evolving market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Tongqinglou Catering (SHSE:605108)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China with a market capitalization of CN¥5.19 billion.

Operations: The company generates revenue from its Catering and Accommodation Services segment, amounting to CN¥2.15 billion.

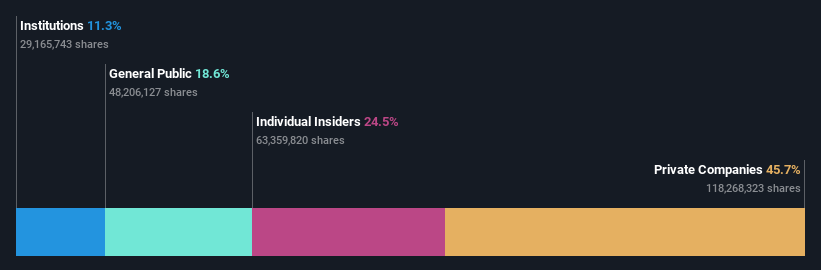

Insider Ownership: 24.5%

Earnings Growth Forecast: 30.2% p.a.

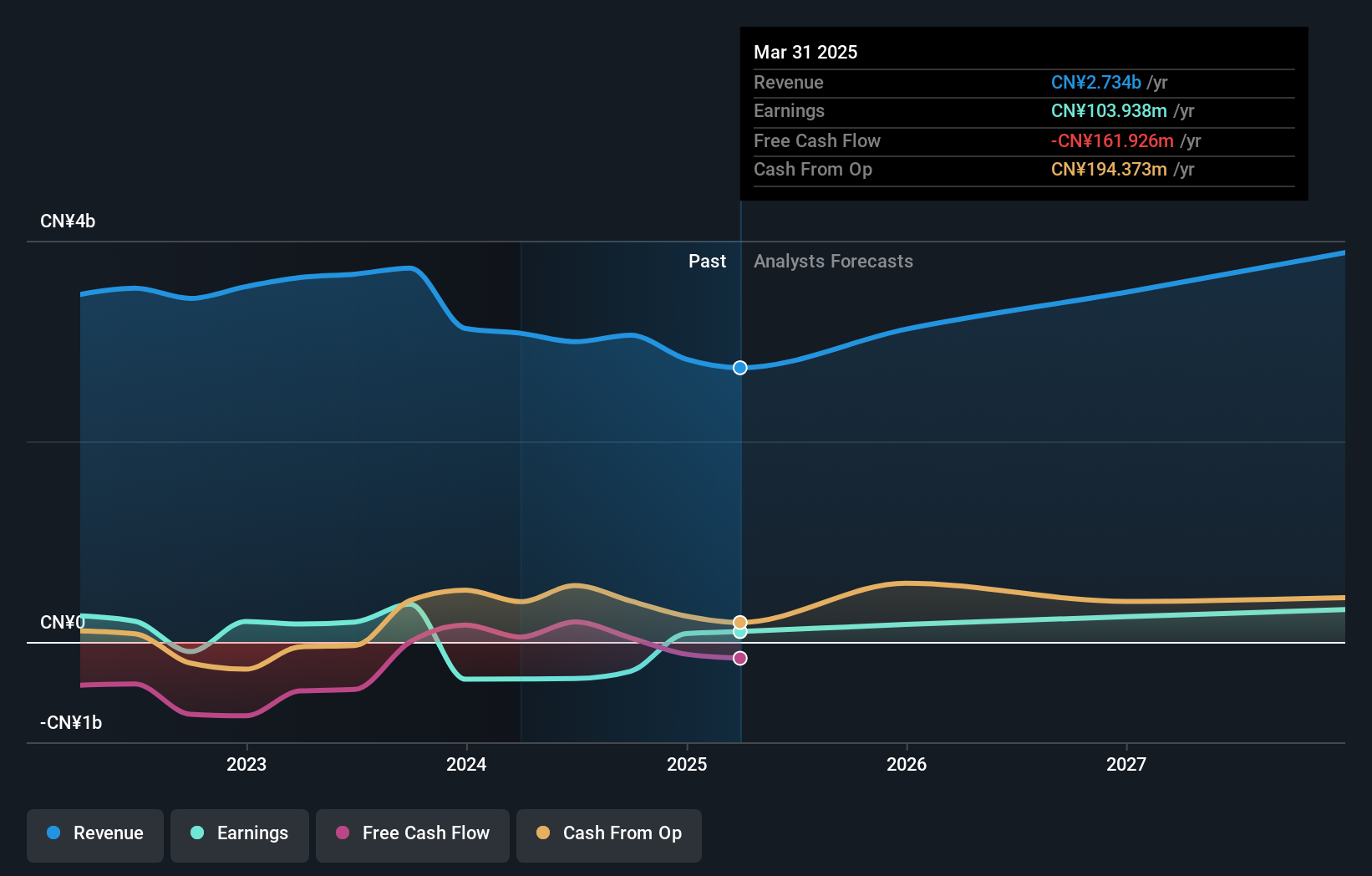

Tongqinglou Catering is positioned for growth, with revenue expected to increase by 22.3% annually, outpacing the Chinese market. Earnings are also forecast to grow significantly at 30.2% per year, despite a recent dip in net income from CNY 145.59 million to CNY 80.95 million for the half-year ended June 2024. The company's stock trades well below estimated fair value and offers good relative value compared to peers, although its dividend isn't well covered by free cash flows.

- Get an in-depth perspective on Tongqinglou Catering's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Tongqinglou Catering's share price might be too pessimistic.

Maxic Technology (SHSE:688458)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxic Technology, Inc. designs and sells analog and digital-analog hybrid integrated circuits (ICs) in China and internationally, with a market cap of approximately CN¥3.71 billion.

Operations: Maxic Technology generates revenue through the design and sale of analog and digital-analog hybrid integrated circuits in both domestic and international markets.

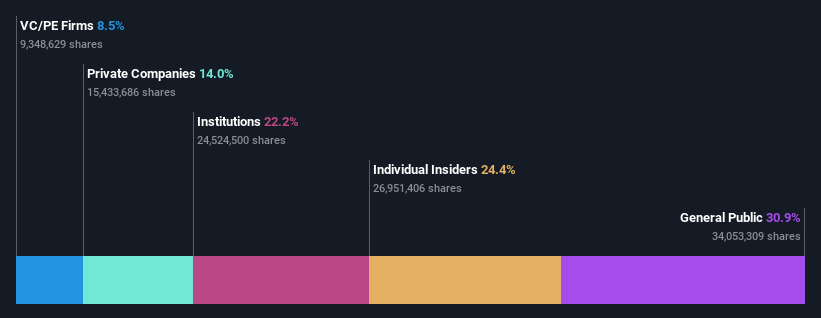

Insider Ownership: 24.4%

Earnings Growth Forecast: 71.8% p.a.

Maxic Technology anticipates robust growth, with revenue projected to rise 30.5% annually, surpassing the Chinese market's average. Despite a recent net loss of CNY 16.02 million for the half-year ended June 2024 and declining profit margins from last year, earnings are forecasted to grow significantly at 71.8% per annum over the next three years. The company completed a share buyback of CNY 59.83 million, enhancing shareholder value amidst high share price volatility recently observed.

- Delve into the full analysis future growth report here for a deeper understanding of Maxic Technology.

- Insights from our recent valuation report point to the potential overvaluation of Maxic Technology shares in the market.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topsec Technologies Group Inc. operates in China, offering cybersecurity, big data, and cloud services with a market capitalization of CN¥6.99 billion.

Operations: The company's revenue is primarily derived from its cybersecurity segment, which generated CN¥2.99 billion.

Insider Ownership: 10.8%

Earnings Growth Forecast: 75.6% p.a.

Topsec Technologies Group is trading at a significant discount to its estimated fair value and shows good relative value compared to peers. Despite reporting a net loss of CNY 205.77 million for the half-year ending June 2024, earnings are expected to grow by 75.63% annually, with profitability anticipated within three years. The company has completed share buybacks totaling CNY 60 million, indicating confidence in its future prospects amidst slower revenue growth projections of 15.1% annually.

- Unlock comprehensive insights into our analysis of Topsec Technologies Group stock in this growth report.

- The analysis detailed in our Topsec Technologies Group valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 1486 Fast Growing Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tongqinglou Catering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605108

Undervalued with high growth potential.