Additional Considerations Required While Assessing Dareway SoftwareLtd's (SHSE:688579) Strong Earnings

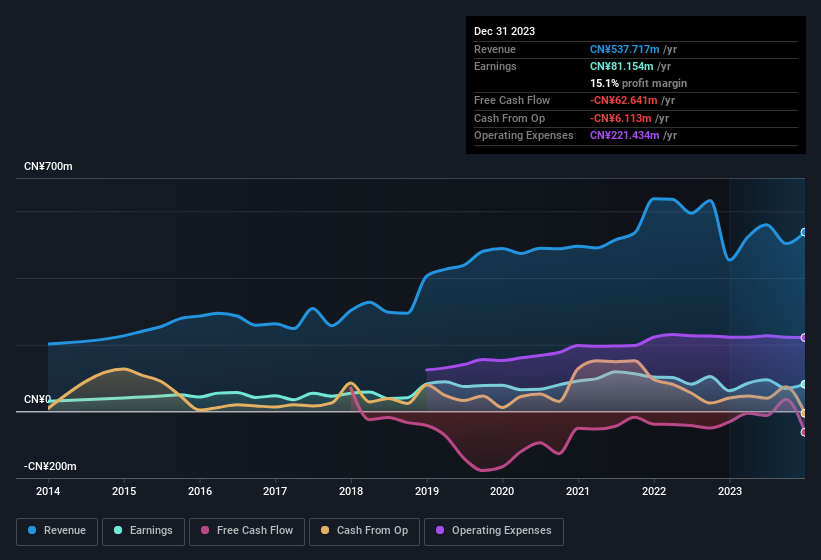

Investors were disappointed with Dareway Software Co.,Ltd.'s (SHSE:688579) earnings, despite the strong profit numbers. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for Dareway SoftwareLtd

The Impact Of Unusual Items On Profit

For anyone who wants to understand Dareway SoftwareLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥13m worth of unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Dareway SoftwareLtd.

Our Take On Dareway SoftwareLtd's Profit Performance

Arguably, Dareway SoftwareLtd's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Dareway SoftwareLtd's statutory profits are better than its underlying earnings power. The good news is that, its earnings per share increased by 31% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - Dareway SoftwareLtd has 2 warning signs we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Dareway SoftwareLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688579

Dareway SoftwareLtd

Operates as a AI and Blockchain technology service provider in China.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.