- China

- /

- Electronic Equipment and Components

- /

- SHSE:688320

Exploring 3 High Growth Tech Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets navigate a complex landscape of fluctuating interest rates and geopolitical tensions, the technology sector faces its own set of challenges and opportunities, particularly with the emergence of new AI competitors like DeepSeek impacting market sentiment. In this environment, identifying high-growth tech stocks requires careful consideration of their innovation capabilities and adaptability to both competitive pressures and broader economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

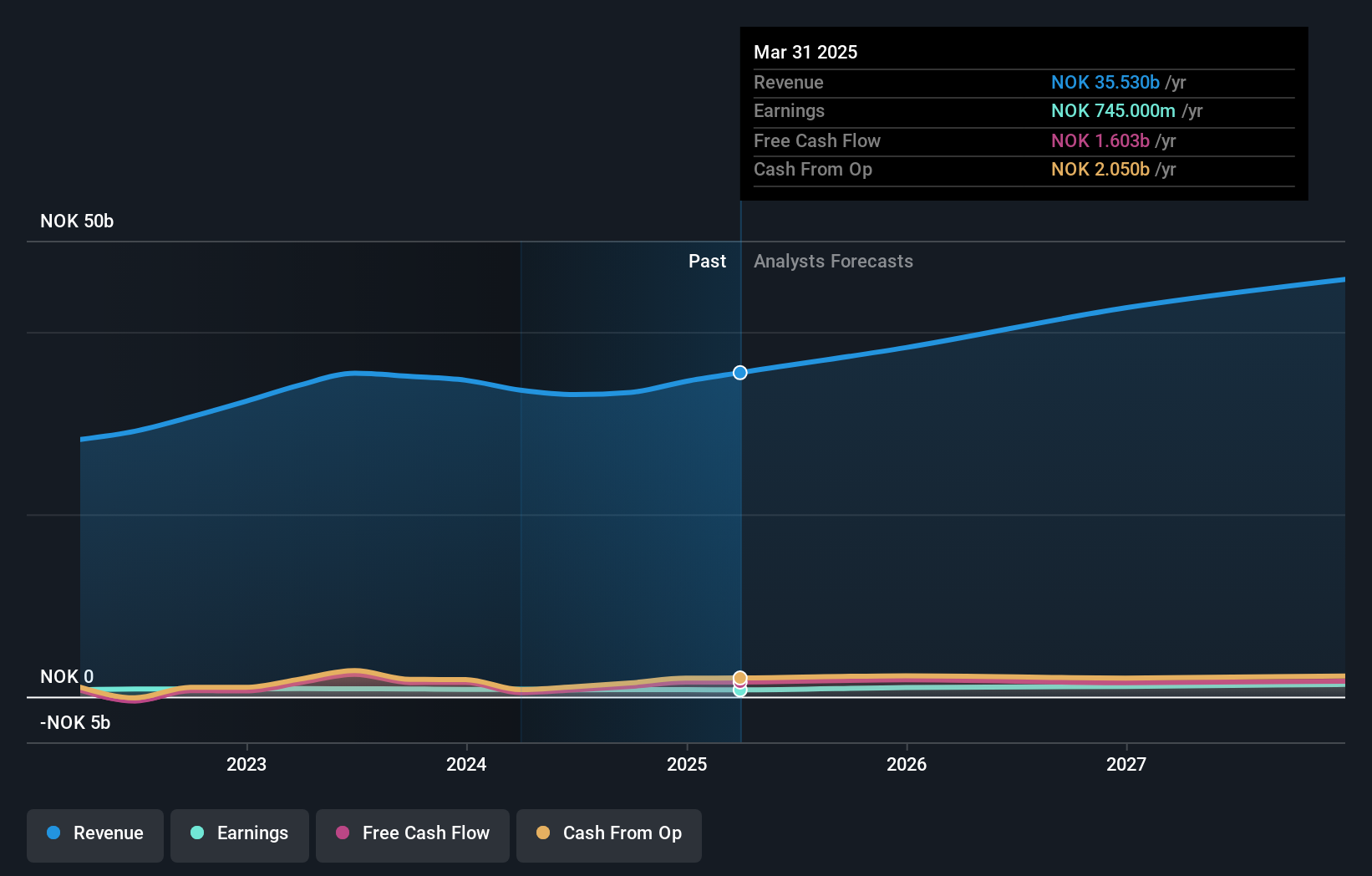

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA is a company that offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK16.10 billion.

Operations: Atea ASA generates revenue primarily from IT infrastructure solutions across the Nordic and Baltic regions, with significant contributions from Sweden (NOK12.44 billion) and Norway (NOK8.28 billion). The company incurs a group cost of NOK9.30 billion while offering shared services valued at NOK9.20 billion.

Atea stands out in the Norwegian tech landscape, with its revenue and earnings growth projections notably surpassing local market averages. With an annual revenue growth rate of 8%, Atea outpaces the general Norwegian market's 2% expansion. This is complemented by a robust annual earnings increase forecast at 19%, significantly higher than the market's 9%. Additionally, Atea's strategic focus on R&D has cemented its competitive edge; however, specific figures for R&D expenses were not disclosed. The company also benefits from high-quality past earnings and a promising Return on Equity forecast at 26.2% in three years, signaling strong future profitability potential despite a recent dip in year-over-year earnings growth by -9.3%. These dynamics suggest that while facing some challenges, Atea is well-positioned for sustained growth amidst evolving industry demands.

- Unlock comprehensive insights into our analysis of Atea stock in this health report.

Assess Atea's past performance with our detailed historical performance reports.

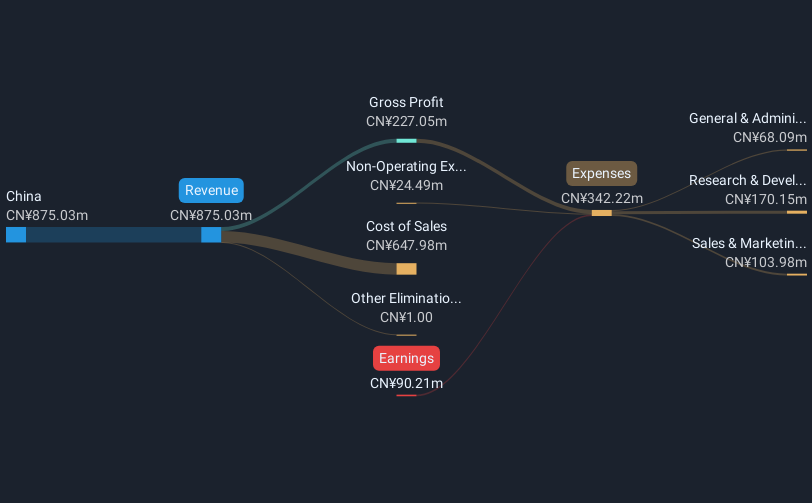

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research and development, manufacturing, sale, and application integration of industrial automation products, with a market capitalization of CN¥7.13 billion.

Operations: Hechuan Technology specializes in industrial automation products, generating revenue primarily through R&D, manufacturing, sales, and application integration. The company's financial performance is reflected in its market capitalization of CN¥7.13 billion.

Zhejiang Hechuan Technology, navigating a volatile market, has demonstrated potential with an impressive forecasted annual revenue growth of 19.8%, significantly outpacing the Chinese market's average of 13.3%. Despite current unprofitability and a recent exclusion from the S&P Global BMI Index, the company is poised for profitability with earnings expected to surge by 113.1% annually over the next three years. This growth trajectory is supported by strategic R&D investments, crucial for maintaining competitive advantage in the tech industry, although specific R&D expenditure figures are not disclosed. The firm's focus on innovation and market expansion suggests promising prospects despite short-term challenges.

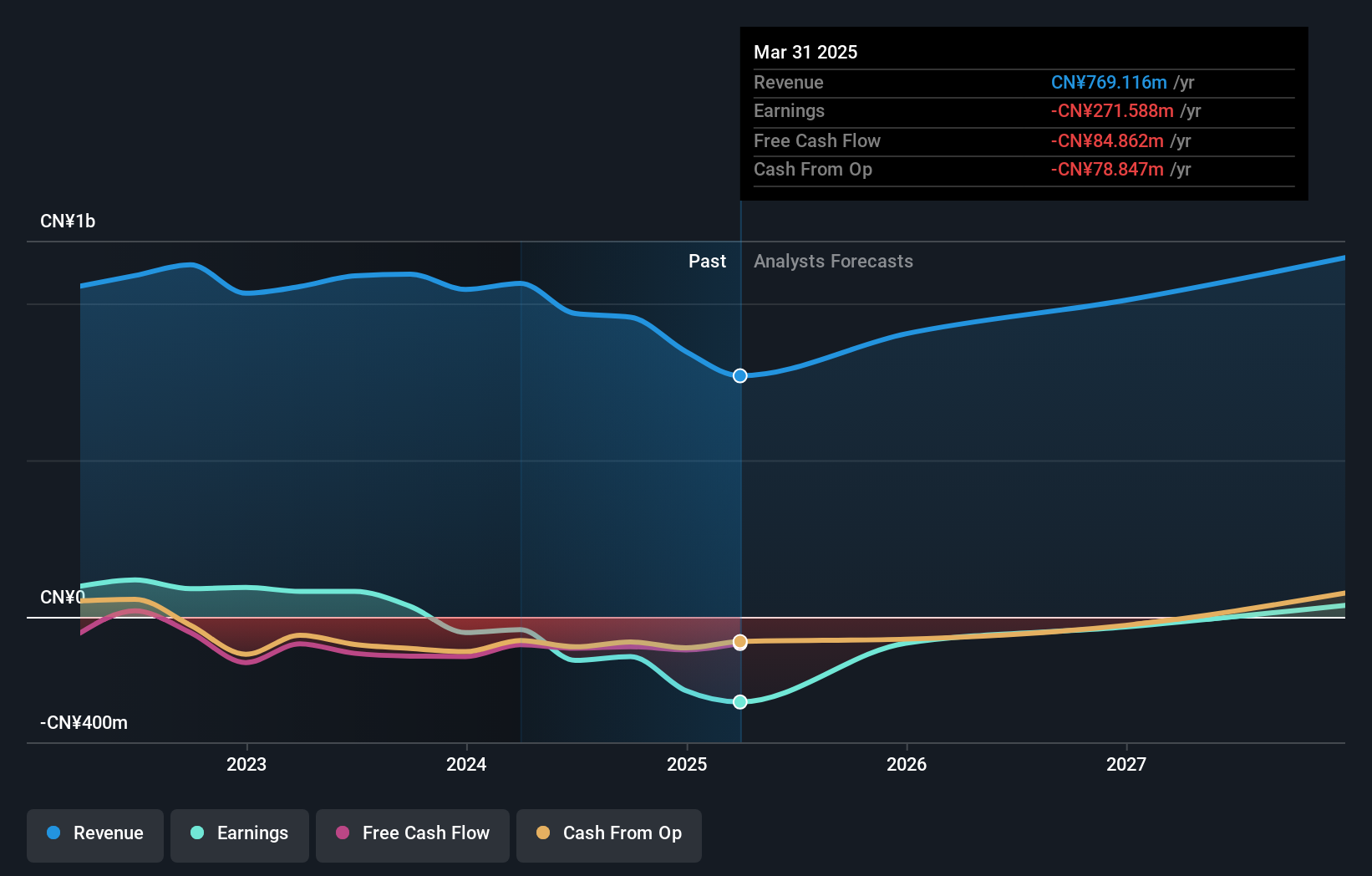

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. specializes in offering collaborative management software, solutions, platforms, and cloud services to organizational customers in China, with a market capitalization of CN¥2.96 billion.

Operations: Seeyon Internet Software generates revenue through the sale of collaborative management software, solutions, and cloud services tailored for organizational clients in China. The company's financial structure indicates a focus on software development and service delivery, contributing to its market presence within the tech industry.

BeiJing Seeyon Internet Software, amidst a highly volatile tech landscape, is carving out a niche with its robust annual revenue growth at 16.1%, surpassing the Chinese market average of 13.3%. This growth is underpinned by an aggressive R&D strategy, with expenditures that are essential for fostering innovation and maintaining competitiveness in the fast-evolving software sector. Despite current unprofitability, the company's earnings are projected to skyrocket by 173.6% annually over the next three years, positioning it well for future profitability and market share expansion in its segment.

Turning Ideas Into Actions

- Investigate our full lineup of 1234 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hechuan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688320

Zhejiang Hechuan Technology

Engages in the research and development, manufacturing, sale, and application integration of industrial automation products.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives