Hangzhou Hopechart IoT Technology Co.,Ltd's (SHSE:688288) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Those holding Hangzhou Hopechart IoT Technology Co.,Ltd (SHSE:688288) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

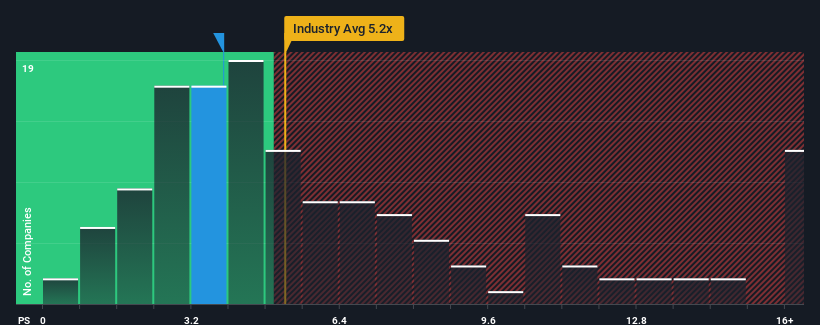

In spite of the firm bounce in price, Hangzhou Hopechart IoT TechnologyLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.9x, since almost half of all companies in the Software industry in China have P/S ratios greater than 5.2x and even P/S higher than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Hangzhou Hopechart IoT TechnologyLtd

What Does Hangzhou Hopechart IoT TechnologyLtd's Recent Performance Look Like?

Recent times have been quite advantageous for Hangzhou Hopechart IoT TechnologyLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hangzhou Hopechart IoT TechnologyLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Hangzhou Hopechart IoT TechnologyLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 70% last year. Still, revenue has fallen 11% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 33% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Hangzhou Hopechart IoT TechnologyLtd's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Hangzhou Hopechart IoT TechnologyLtd's P/S?

Despite Hangzhou Hopechart IoT TechnologyLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hangzhou Hopechart IoT TechnologyLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hangzhou Hopechart IoT TechnologyLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Hangzhou Hopechart IoT TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Hopechart IoT TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688288

Hangzhou Hopechart IoT TechnologyLtd

Engages in the development, production, and sale of driving systems and advanced driver assistance systems (ADAS) in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026