Shaky Earnings May Not Tell The Whole Story For Guo Tai Epoint SoftwareLtd (SHSE:688232)

Guo Tai Epoint Software Co.,Ltd (SHSE:688232) recently posted soft earnings but shareholders didn't react strongly. Our analysis suggests that they may be missing some concerning details underlying the profit numbers.

View our latest analysis for Guo Tai Epoint SoftwareLtd

Zooming In On Guo Tai Epoint SoftwareLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

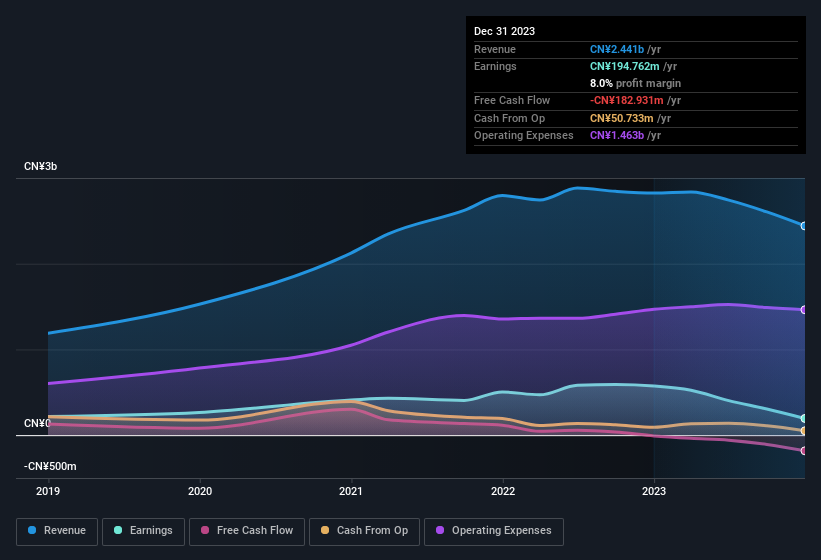

Over the twelve months to December 2023, Guo Tai Epoint SoftwareLtd recorded an accrual ratio of 0.22. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of CN¥183m, in contrast to the aforementioned profit of CN¥194.8m. We also note that Guo Tai Epoint SoftwareLtd's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥183m. Having said that it seems that a recent tax benefit and some unusual items have impacted its profit (and this its accrual ratio).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Guo Tai Epoint SoftwareLtd's profit was boosted by unusual items worth CN¥103m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Guo Tai Epoint SoftwareLtd had a rather significant contribution from unusual items relative to its profit to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Guo Tai Epoint SoftwareLtd received a tax benefit of CN¥14m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Guo Tai Epoint SoftwareLtd's Profit Performance

Summing up, Guo Tai Epoint SoftwareLtd's tax benefit and unusual items boosted its statutory profit leading to poor cash conversion, as reflected by its accrual ratio. On reflection, the above-mentioned factors give us the strong impression that Guo Tai Epoint SoftwareLtd'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 3 warning signs for Guo Tai Epoint SoftwareLtd (of which 1 is a bit concerning!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688232

Guo Tai Epoint SoftwareLtd

Offers software and information technology solutions in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives