Even With A 34% Surge, Cautious Investors Are Not Rewarding Beijing Infosec Technologies Co.,Ltd.'s (SHSE:688201) Performance Completely

Those holding Beijing Infosec Technologies Co.,Ltd. (SHSE:688201) shares would be relieved that the share price has rebounded 34% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 68% share price drop in the last twelve months.

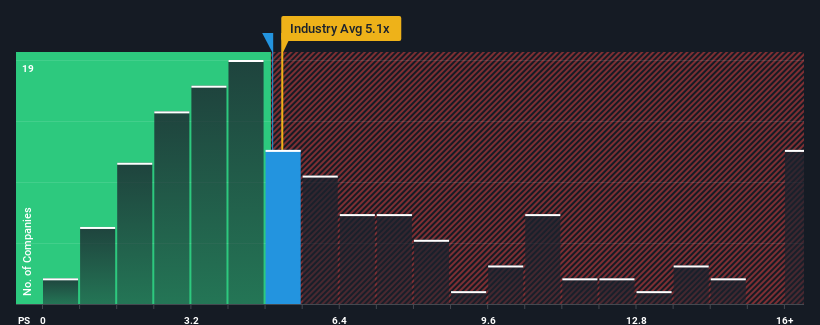

Even after such a large jump in price, there still wouldn't be many who think Beijing Infosec TechnologiesLtd's price-to-sales (or "P/S") ratio of 4.9x is worth a mention when the median P/S in China's Software industry is similar at about 5.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beijing Infosec TechnologiesLtd

How Has Beijing Infosec TechnologiesLtd Performed Recently?

Beijing Infosec TechnologiesLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Beijing Infosec TechnologiesLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Beijing Infosec TechnologiesLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 78% over the next year. That's shaping up to be materially higher than the 33% growth forecast for the broader industry.

In light of this, it's curious that Beijing Infosec TechnologiesLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Beijing Infosec TechnologiesLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Beijing Infosec TechnologiesLtd's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Beijing Infosec TechnologiesLtd that you should be aware of.

If you're unsure about the strength of Beijing Infosec TechnologiesLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives