Beijing Infosec Technologies Co.,Ltd's (SHSE:688201) Share Price Is Still Matching Investor Opinion Despite 26% Slump

Beijing Infosec Technologies Co.,Ltd (SHSE:688201) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

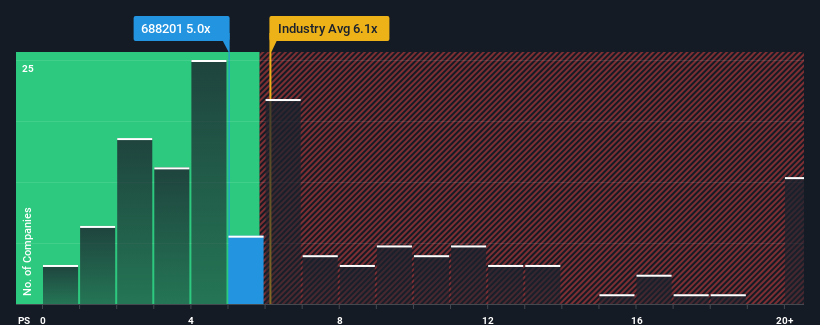

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Beijing Infosec TechnologiesLtd's P/S ratio of 5x, since the median price-to-sales (or "P/S") ratio for the Software industry in China is also close to 6.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Beijing Infosec TechnologiesLtd

How Has Beijing Infosec TechnologiesLtd Performed Recently?

While the industry has experienced revenue growth lately, Beijing Infosec TechnologiesLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Infosec TechnologiesLtd.Do Revenue Forecasts Match The P/S Ratio?

Beijing Infosec TechnologiesLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. Regardless, revenue has managed to lift by a handy 6.4% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 30%, which is not materially different.

With this information, we can see why Beijing Infosec TechnologiesLtd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Beijing Infosec TechnologiesLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Beijing Infosec TechnologiesLtd maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Beijing Infosec TechnologiesLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Infosec TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688201

Beijing Infosec TechnologiesLtd

Develops and provides application security products in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives