As global markets experience a surge propelled by favorable trade deals, the Asian tech sector is drawing attention for its potential to capitalize on these developments. In this dynamic environment, identifying promising high-growth tech stocks involves assessing their ability to leverage technological advancements and navigate evolving trade landscapes effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 27.32% | 30.59% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 27.79% | 111.80% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market cap of CN¥19.30 billion.

Operations: ArcSoft focuses on developing algorithms and software solutions for the computer vision sector globally. The company leverages its expertise in this field to generate revenue, supported by a market cap of CN¥19.30 billion.

ArcSoft, a prominent player in the Asian tech landscape, has demonstrated robust performance with a 27.4% annual revenue growth and an impressive 33.8% increase in earnings per year. Notably, the company's commitment to innovation is underscored by its significant investment in R&D, aligning with its strategic focus on deepening technological capabilities which are critical for maintaining competitive advantage in rapidly evolving markets like software and AI. Recent strategic moves include a share repurchase program announced on June 21, 2025, where ArcSoft plans to buy back up to CNY 400 million worth of shares at no more than CNY 118 each—a clear signal of confidence in its financial health and future prospects. This initiative not only reflects strong internal cash flow management but also promises to enhance shareholder value as it navigates forward amidst dynamic market conditions.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. offers artificial intelligence, big data, and data security products and services in China with a market capitalization of CN¥20.76 billion.

Operations: TRS Information Technology Co., Ltd. focuses on delivering advanced solutions in artificial intelligence, big data, and data security within the Chinese market. The company's revenue model capitalizes on these technology-driven sectors, catering to a diverse range of clients seeking innovative digital transformation tools.

TRS Information Technology, amidst a volatile market, has outlined ambitious plans to bolster its competitive edge through a recent shareholders meeting focused on implementing a new restricted stock incentive plan. This initiative aims to align employee interests with corporate growth targets, particularly as the company navigates through profitability challenges with an expected revenue growth of 16.4% per year and an impressive forecast of earnings growth at 79.7% annually. Despite current unprofitability, these strategic moves underscore TRS's commitment to harnessing internal talent and innovation for long-term success in Asia's tech sector, where dynamic shifts demand agile responses and robust R&D investment strategies.

- Click to explore a detailed breakdown of our findings in TRS Information Technology's health report.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

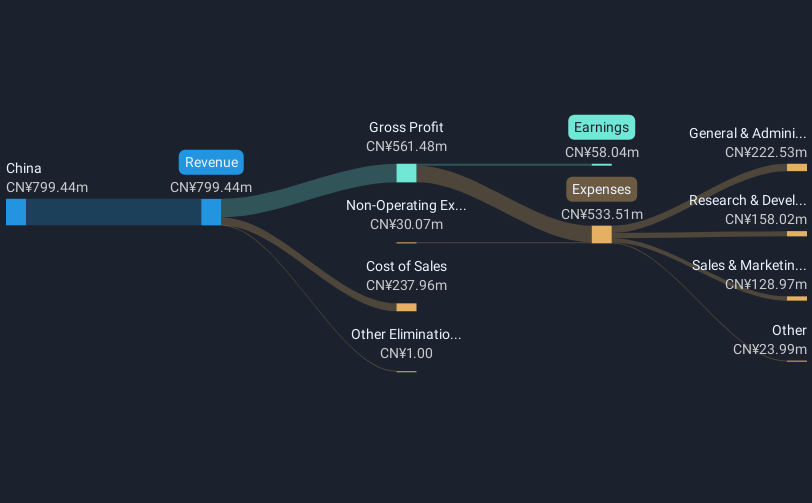

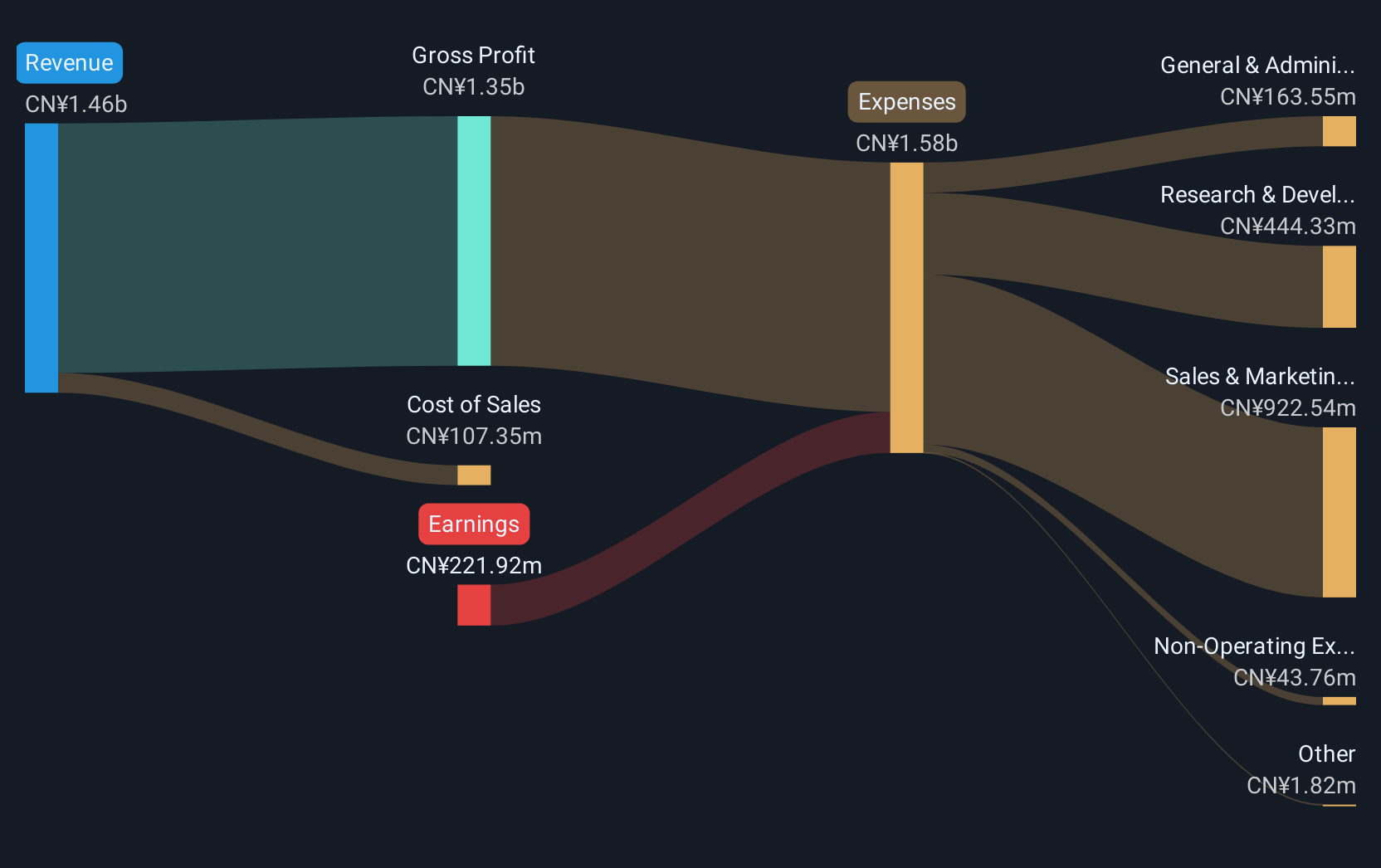

Overview: Wondershare Technology Group Co., Ltd. is a company that develops application software products both in China and internationally, with a market cap of CN¥14.37 billion.

Operations: Wondershare Technology Group focuses on developing application software products, generating revenue primarily from its software sales both domestically and internationally. The company has a market capitalization of CN¥14.37 billion.

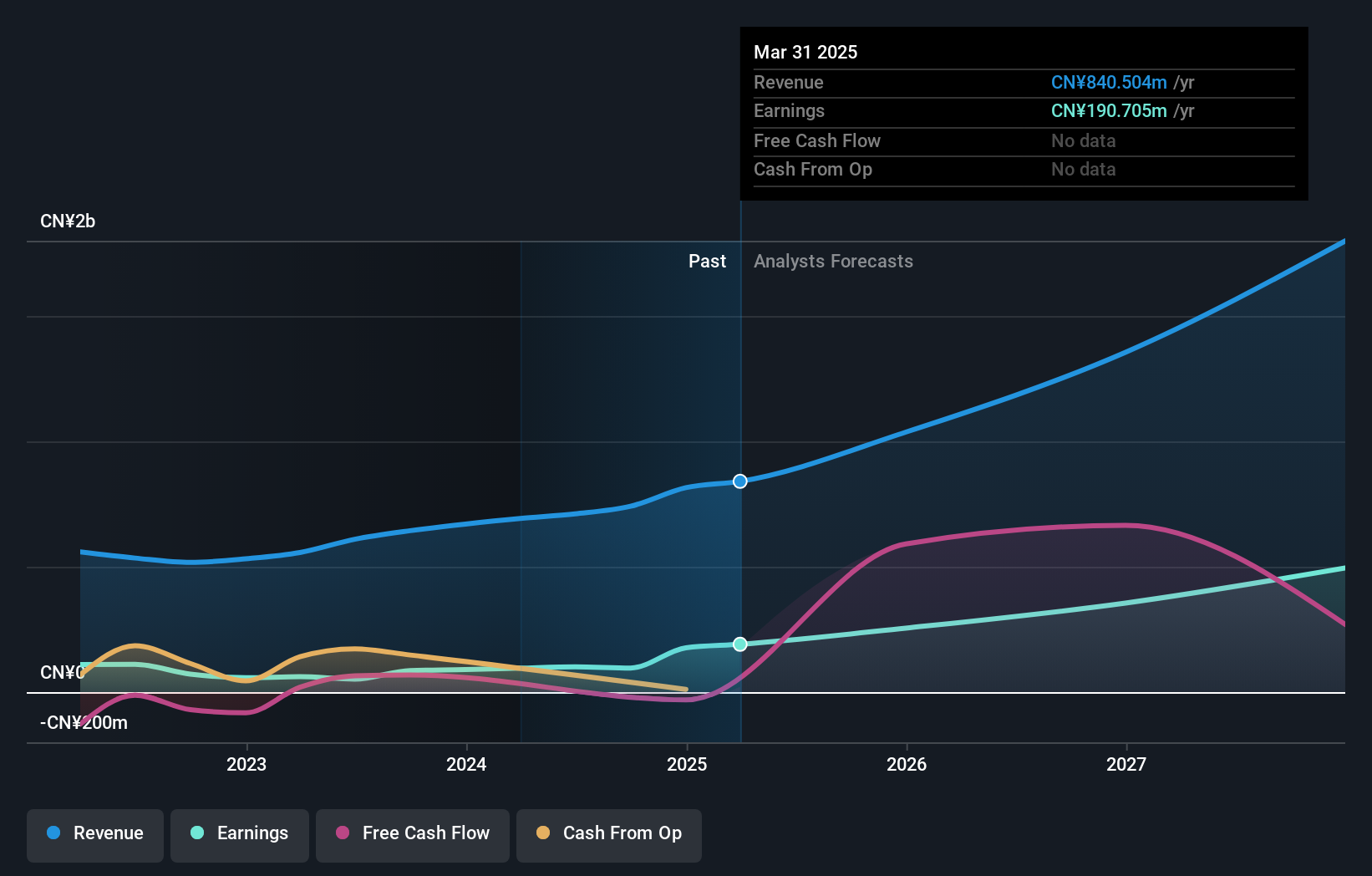

Wondershare Technology Group is steering its growth trajectory through strategic initiatives, notably integrating AI into its software solutions, as evidenced by the recent unveiling of EdrawMax V14.5 with advanced AI diagramming capabilities. This innovation not only enhances productivity but also solidifies Wondershare's position in the tech landscape by addressing the increasing demand for intelligent design tools across various sectors. The company's commitment to R&D is reflected in its substantial investment, aligning with an impressive annual revenue growth forecast of 14.6% and an anticipated profit surge of 99.6%. These figures underscore Wondershare’s potential in shaping future technology trends while adapting to dynamic market demands.

- Unlock comprehensive insights into our analysis of Wondershare Technology Group stock in this health report.

Gain insights into Wondershare Technology Group's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 478 Asian High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wondershare Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300624

Wondershare Technology Group

Develops application software products in China and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives