As global markets experience a period of optimism with record highs in major indices and easing trade tensions, Asia's economic landscape is also showing signs of resilience. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We're going to check out a few of the best picks from our screener tool.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry, with a market cap of CN¥19.34 billion.

Operations: ArcSoft generates revenue primarily through its algorithm and software solutions in the computer vision sector.

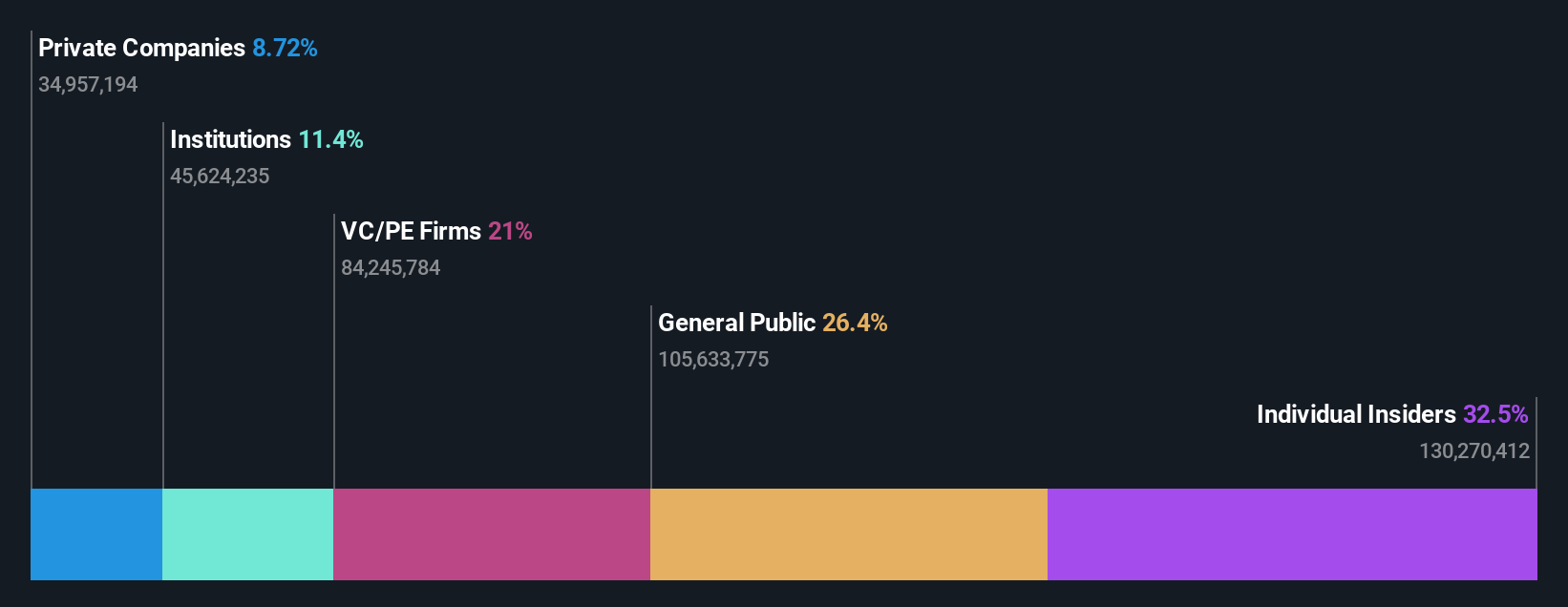

Insider Ownership: 32.5%

Revenue Growth Forecast: 27.4% p.a.

ArcSoft Corporation Limited is experiencing robust growth, with earnings forecasted to increase by 33.8% annually, outpacing the Chinese market's average. Recent earnings showed a notable rise in net income to CNY 49.66 million from CNY 34.17 million year-over-year. A share repurchase program worth up to CNY 400 million was announced, potentially signaling confidence in future performance and enhancing shareholder value despite a low return on equity forecast of 11.7%.

- Navigate through the intricacies of ArcSoft with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that ArcSoft's share price might be on the expensive side.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥17.73 billion.

Operations: Willfar Information Technology Co., Ltd. generates revenue through its provision of intelligent utility services and Internet of Things (IoT) solutions across domestic and international markets.

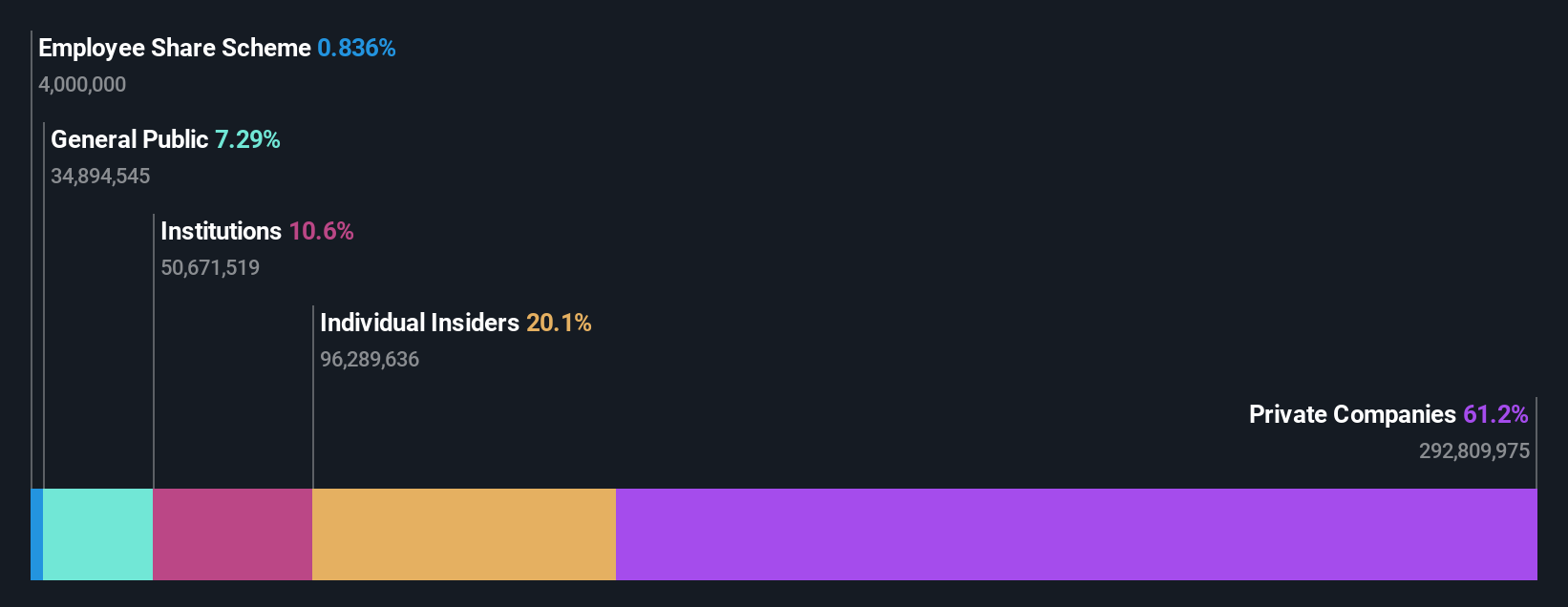

Insider Ownership: 20.1%

Revenue Growth Forecast: 21.4% p.a.

Willfar Information Technology demonstrates strong growth potential, with earnings projected to grow at 21.94% annually, supported by a recent increase in net income to CNY 139.37 million from CNY 111.2 million year-over-year. The company secured significant contracts worth RMB 232.54 million in State Grid's bidding and expanded operations with a new factory in Indonesia, enhancing its market footprint. Despite a lower-than-market average earnings growth forecast, its price-to-earnings ratio remains attractive at 26.9x compared to the CN market's 38.9x.

- Click to explore a detailed breakdown of our findings in Willfar Information Technology's earnings growth report.

- The valuation report we've compiled suggests that Willfar Information Technology's current price could be quite moderate.

Ningbo Zhenyu Technology (SZSE:300953)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Zhenyu Technology Co., Ltd. engages in the research, development, manufacturing, and sale of lamination dies and precision machining equipment both in China and internationally, with a market cap of CN¥17.21 billion.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, which generated CN¥7.48 billion.

Insider Ownership: 38.3%

Revenue Growth Forecast: 15.9% p.a.

Ningbo Zhenyu Technology demonstrates robust growth prospects, with earnings projected to grow significantly at 27% annually, outpacing the CN market. Recent financials show a rise in net income to CNY 72.86 million for Q1 2025 from CNY 52.46 million year-over-year, despite shareholder dilution and high volatility in share price. The company recently approved a cash dividend increase, reflecting confidence in its financial health amidst challenges like interest payments not well covered by earnings.

- Take a closer look at Ningbo Zhenyu Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report Ningbo Zhenyu Technology implies its share price may be too high.

Taking Advantage

- Click here to access our complete index of 606 Fast Growing Asian Companies With High Insider Ownership.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives