Market Cool On Piesat Information Technology Co., Ltd.'s (SHSE:688066) Revenues Pushing Shares 25% Lower

Piesat Information Technology Co., Ltd. (SHSE:688066) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

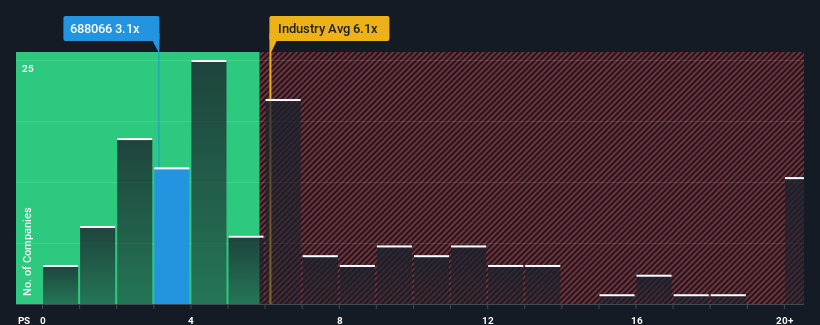

After such a large drop in price, Piesat Information Technology may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.1x, since almost half of all companies in the Software industry in China have P/S ratios greater than 6.1x and even P/S higher than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Piesat Information Technology

What Does Piesat Information Technology's Recent Performance Look Like?

Piesat Information Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Piesat Information Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Piesat Information Technology?

In order to justify its P/S ratio, Piesat Information Technology would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 78% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

With this information, we find it odd that Piesat Information Technology is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The southerly movements of Piesat Information Technology's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Piesat Information Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Piesat Information Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688066

Piesat Information Technology

Provides satellite internet services in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026