August 2025's Top Asian Growth Stocks With Insider Confidence

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by potential rate cuts and evolving economic conditions, Asian stocks have shown resilience with significant gains in key indices, particularly in China. In this environment, growth companies with high insider ownership can be attractive due to the confidence insiders demonstrate in their long-term prospects, aligning well with investor sentiment seeking stability and potential growth amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Samyang Foods (KOSE:A003230) | 14.9% | 28.0% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 87.4% |

| AprilBioLtd (KOSDAQ:A397030) | 31.1% | 87.1% |

Let's uncover some gems from our specialized screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of approximately HK$31.27 billion.

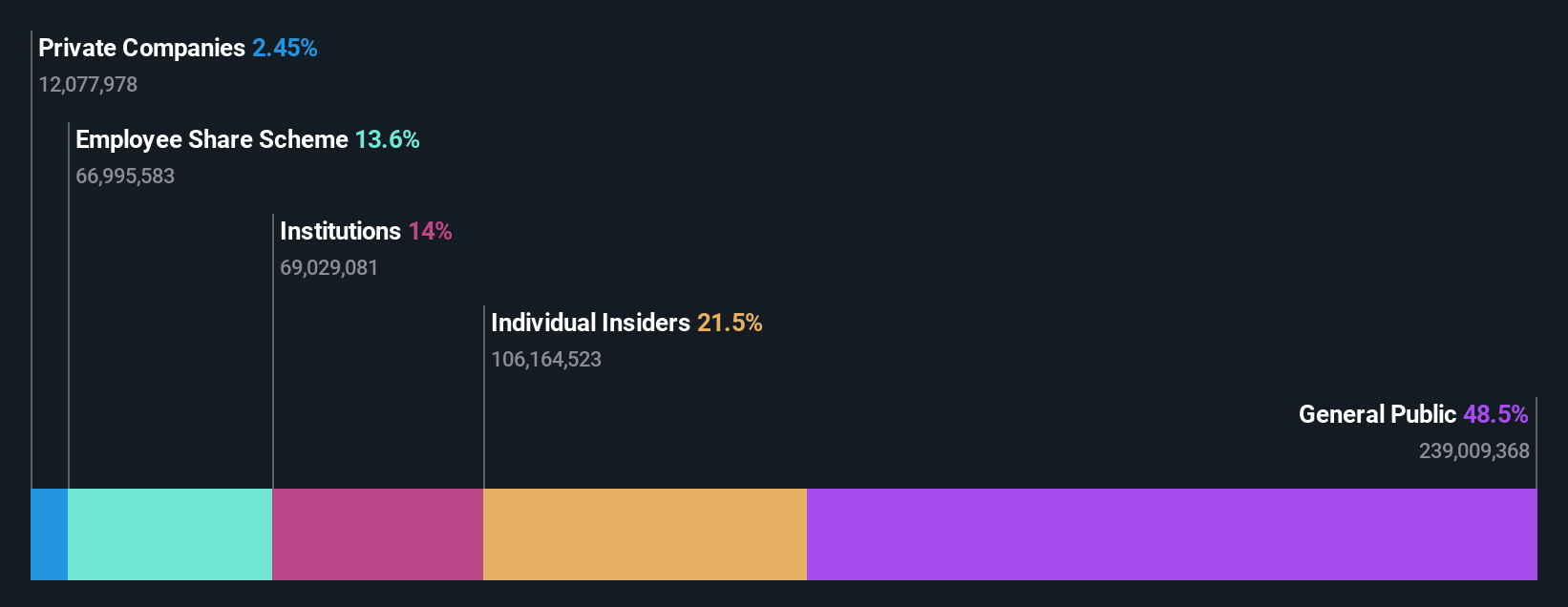

Operations: The company's revenue segments consist of CN¥505.70 million from Sagegpt Aigs Services, CN¥4.57 billion from the 4ParadigmSage AI Platform, and CN¥940.30 million from Shift Intelligent Solutions.

Insider Ownership: 20.5%

Earnings Growth Forecast: 110.8% p.a.

Beijing Fourth Paradigm Technology is forecasted to achieve significant revenue growth of 24.6% annually, outpacing the Hong Kong market. Despite a current net loss of CNY 66.97 million, the company is expected to become profitable within three years, driven by strong demand for its AI platform. Recent strategic joint ventures in energy and financial technology sectors highlight its innovative approach. The company completed a HKD 1.31 billion equity offering to support expansion efforts.

- Get an in-depth perspective on Beijing Fourth Paradigm Technology's performance by reading our analyst estimates report here.

- Our valuation report here indicates Beijing Fourth Paradigm Technology may be undervalued.

Piesat Information Technology (SHSE:688066)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Piesat Information Technology Co., Ltd. offers satellite internet services in China and has a market cap of CN¥8.32 billion.

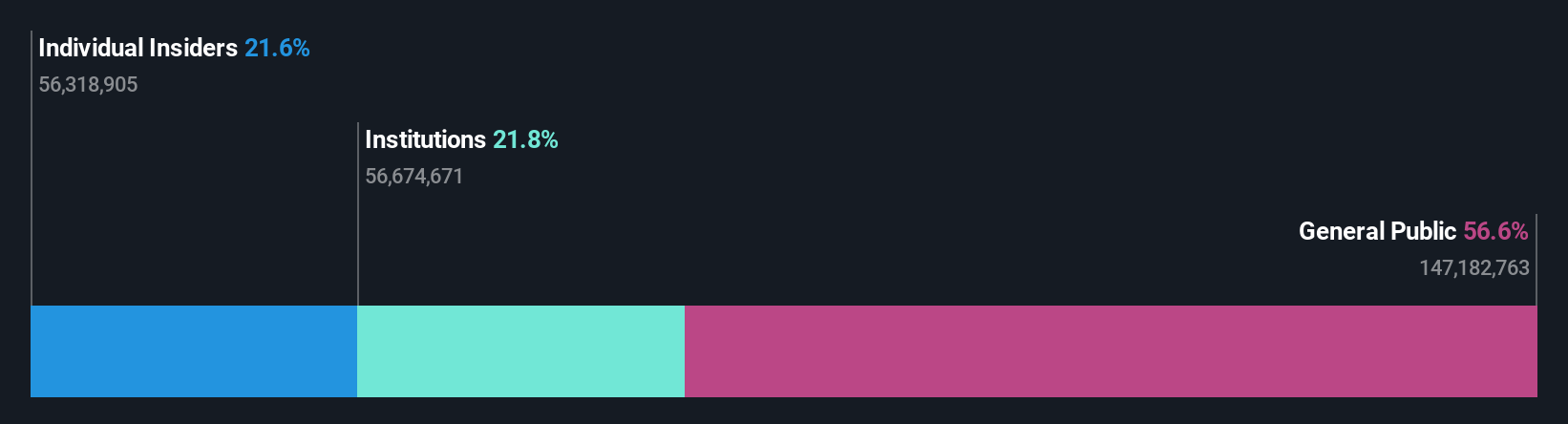

Operations: The company's revenue is primarily derived from its satellite application segment, which generated CN¥1.48 billion.

Insider Ownership: 21.6%

Earnings Growth Forecast: 103.3% p.a.

Piesat Information Technology is poised for significant growth, with revenue expected to increase by 30.2% annually, surpassing the Chinese market average. Despite a volatile share price recently, the company is projected to become profitable within three years, indicating above-average market growth potential. A recent acquisition by Bairui Jingou Private Securities Investment Fund reflects strategic interest in Piesat's future prospects, although its return on equity is forecasted to remain modest at 12.4%.

- Unlock comprehensive insights into our analysis of Piesat Information Technology stock in this growth report.

- Our valuation report here indicates Piesat Information Technology may be overvalued.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★★☆

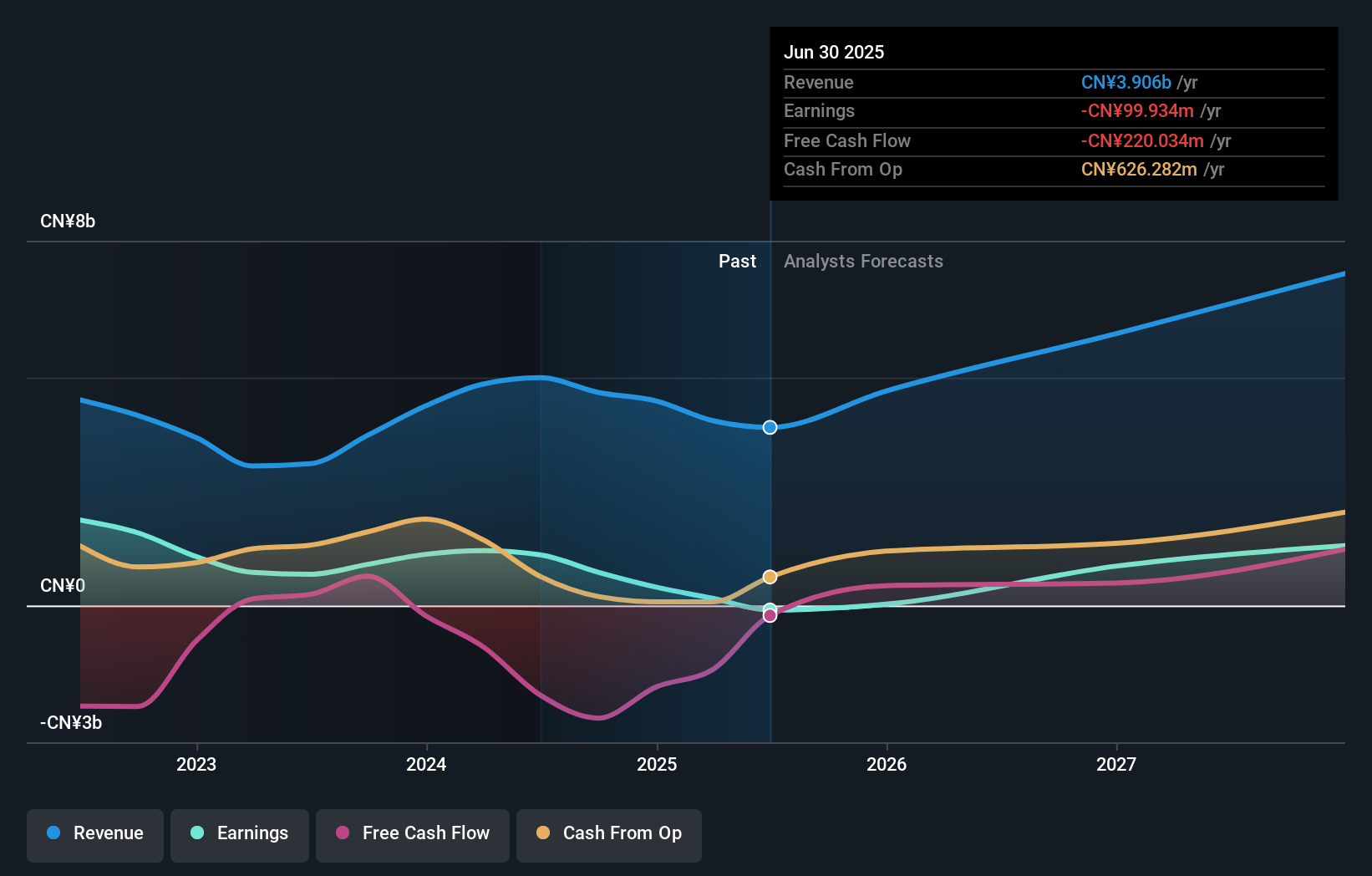

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China with a market capitalization of approximately CN¥45.18 billion.

Operations: Maxscend Microelectronics Company Limited generates revenue through its activities in the research, development, production, and sale of radio frequency integrated circuits within China.

Insider Ownership: 26.8%

Earnings Growth Forecast: 58.2% p.a.

Maxscend Microelectronics is on track for substantial growth, with revenue projected to rise by 20% annually, outpacing the broader Chinese market. Despite a recent downturn in earnings—reporting a net loss of CNY 147.39 million for the half year ending June 2025—the company is expected to turn profitable within three years. While its return on equity is forecasted to be modest at 11.9%, insider trading activity remains stable without significant buying or selling reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Maxscend Microelectronics.

- Insights from our recent valuation report point to the potential overvaluation of Maxscend Microelectronics shares in the market.

Next Steps

- Investigate our full lineup of 599 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688066

Piesat Information Technology

Provides satellite internet services in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026