The Price Is Right For Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) Even After Diving 35%

Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) shareholders won't be pleased to see that the share price has had a very rough month, dropping 35% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

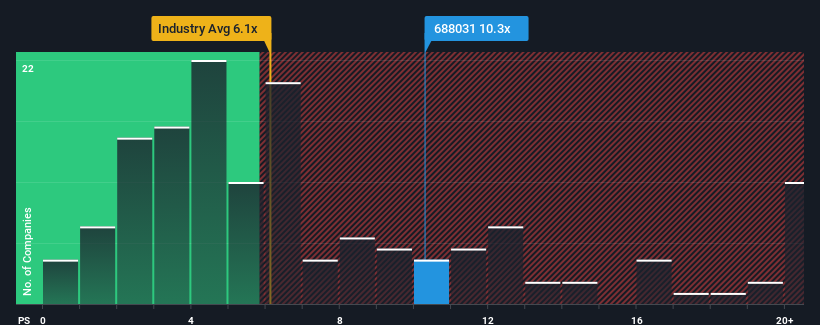

Even after such a large drop in price, Transwarp Technology (Shanghai)Ltd may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 10.3x, since almost half of all companies in the Software industry in China have P/S ratios under 6x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Transwarp Technology (Shanghai)Ltd

How Has Transwarp Technology (Shanghai)Ltd Performed Recently?

With revenue growth that's superior to most other companies of late, Transwarp Technology (Shanghai)Ltd has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Transwarp Technology (Shanghai)Ltd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Transwarp Technology (Shanghai)Ltd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 44% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 79% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

With this information, we can see why Transwarp Technology (Shanghai)Ltd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Transwarp Technology (Shanghai)Ltd's P/S Mean For Investors?

A significant share price dive has done very little to deflate Transwarp Technology (Shanghai)Ltd's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Transwarp Technology (Shanghai)Ltd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for Transwarp Technology (Shanghai)Ltd (1 is potentially serious!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Transwarp Technology (Shanghai)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688031

Transwarp Technology (Shanghai)Ltd

Provides infrastructure software and services for integration, storage, governance, modeling, analysis, mining, and circulation in China and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives