The Price Is Right For Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) Even After Diving 26%

The Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

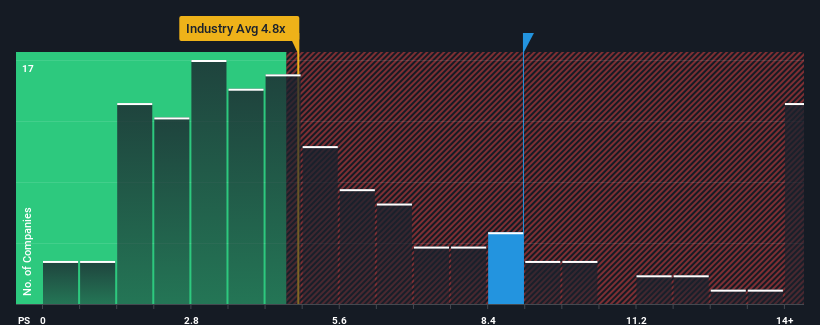

Even after such a large drop in price, given around half the companies in China's Software industry have price-to-sales ratios (or "P/S") below 4.8x, you may still consider Transwarp Technology (Shanghai)Ltd as a stock to avoid entirely with its 9.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Transwarp Technology (Shanghai)Ltd

How Transwarp Technology (Shanghai)Ltd Has Been Performing

Recent times have been advantageous for Transwarp Technology (Shanghai)Ltd as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Transwarp Technology (Shanghai)Ltd.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Transwarp Technology (Shanghai)Ltd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 44% gain to the company's top line. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 38% over the next year. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Transwarp Technology (Shanghai)Ltd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Transwarp Technology (Shanghai)Ltd's P/S

Transwarp Technology (Shanghai)Ltd's shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Transwarp Technology (Shanghai)Ltd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Transwarp Technology (Shanghai)Ltd that you should be aware of.

If these risks are making you reconsider your opinion on Transwarp Technology (Shanghai)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Transwarp Technology (Shanghai)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688031

Transwarp Technology (Shanghai)Ltd

Provides infrastructure software and services for integration, storage, governance, modeling, analysis, mining, and circulation in China and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives