Investors Appear Satisfied With Transwarp Technology (Shanghai) Co.,Ltd.'s (SHSE:688031) Prospects

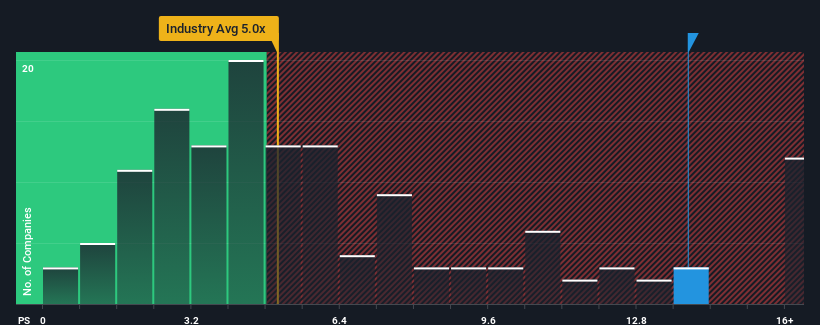

When you see that almost half of the companies in the Software industry in China have price-to-sales ratios (or "P/S") below 5x, Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) looks to be giving off strong sell signals with its 13.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Transwarp Technology (Shanghai)Ltd

How Has Transwarp Technology (Shanghai)Ltd Performed Recently?

Transwarp Technology (Shanghai)Ltd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Transwarp Technology (Shanghai)Ltd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Transwarp Technology (Shanghai)Ltd?

In order to justify its P/S ratio, Transwarp Technology (Shanghai)Ltd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 64% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 34% growth forecast for the broader industry.

In light of this, it's understandable that Transwarp Technology (Shanghai)Ltd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Transwarp Technology (Shanghai)Ltd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 2 warning signs for Transwarp Technology (Shanghai)Ltd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Transwarp Technology (Shanghai)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688031

Transwarp Technology (Shanghai)Ltd

Provides infrastructure software and services for integration, storage, governance, modeling, analysis, mining, and circulation in China and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026