In October 2024, global markets are navigating a complex landscape, with the U.S. indices showing mixed results as sectors like utilities and real estate lead gains while energy stocks face pressure due to easing geopolitical tensions. Amid these shifting dynamics, the European Central Bank's rate cuts have stirred expectations for further monetary easing, contributing to positive movements in major European stock indexes. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholders' interests—a critical factor when navigating uncertain economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Hillstone NetworksLtd (SHSE:688030)

Simply Wall St Growth Rating: ★★★★★☆

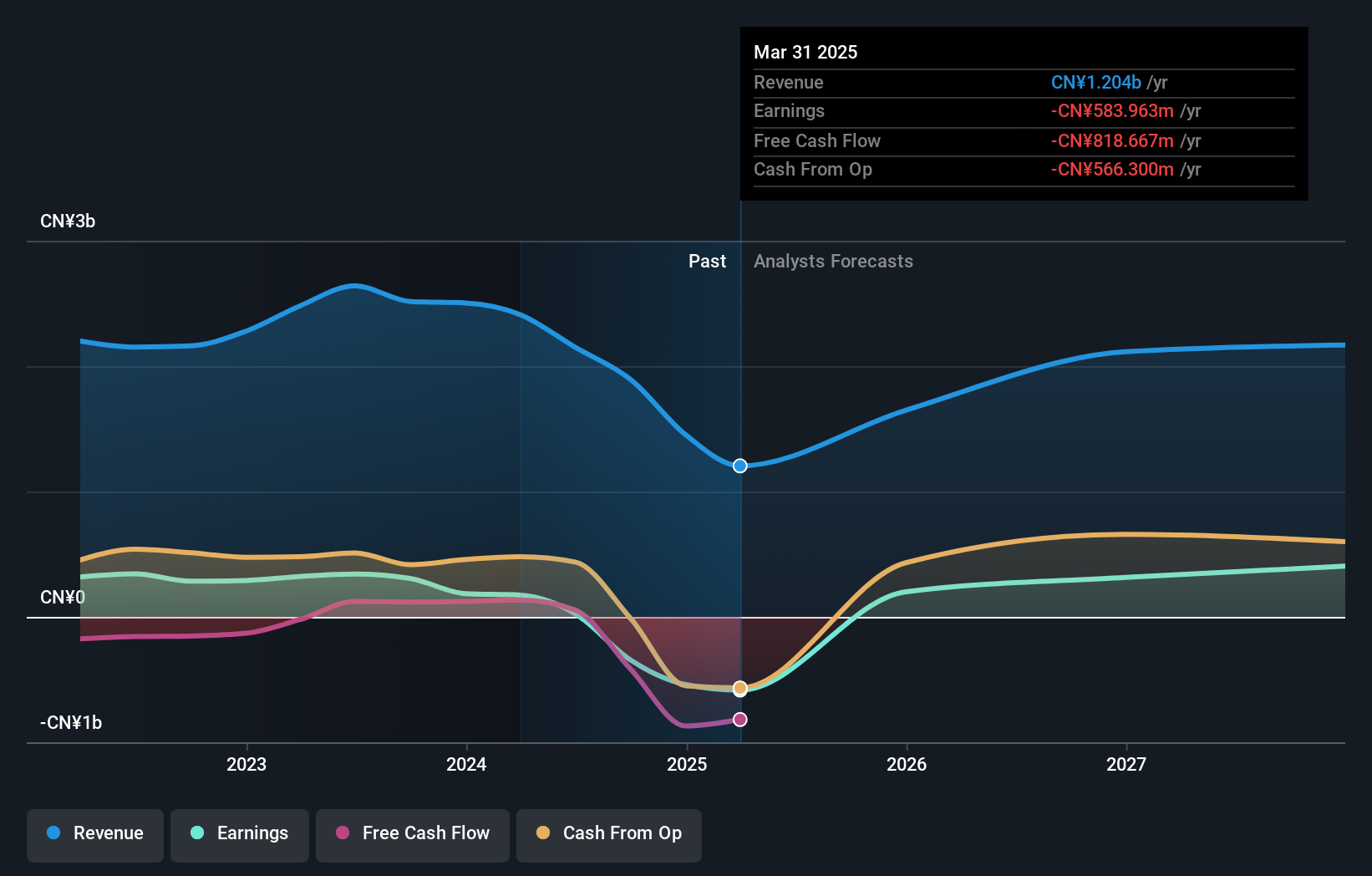

Overview: Hillstone Networks Co., Ltd. offers infrastructure protection solutions to enterprises and service providers, with a market cap of CN¥2.81 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, totaling CN¥908.57 million.

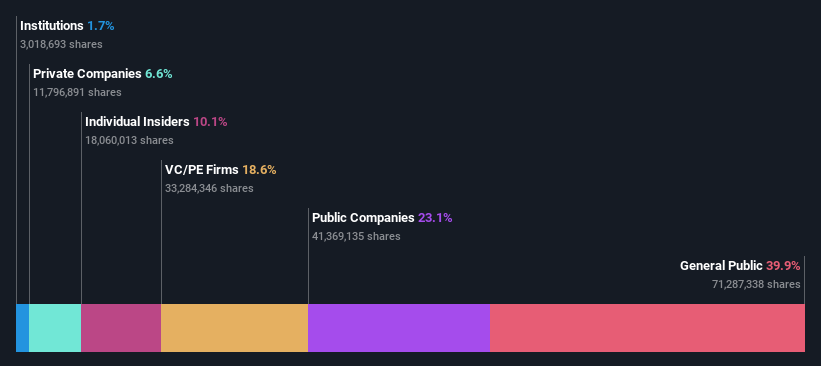

Insider Ownership: 10.1%

Revenue Growth Forecast: 22.9% p.a.

Hillstone Networks Ltd. demonstrates potential as a growth company with high insider ownership, evidenced by its forecasted revenue growth of 22.9% per year, outpacing the broader Chinese market's 13.5%. The company reported improved financials, reducing its net loss to CNY 80.01 million for the half-year ended June 30, 2024. Despite a low future return on equity and no recent insider buying or selling activity, it trades at good value relative to peers and industry standards.

- Take a closer look at Hillstone NetworksLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hillstone NetworksLtd's share price might be on the cheaper side.

ApicHope Pharmaceutical (SZSE:300723)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ApicHope Pharmaceutical Co., Ltd, along with its subsidiaries, focuses on the research, development, production, and sale of pharmaceutical drugs and has a market capitalization of approximately CN¥7.31 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 19.2%

Revenue Growth Forecast: 17.9% p.a.

ApicHope Pharmaceutical shows promise with earnings expected to grow significantly at 59.7% per year, outpacing the Chinese market's 23.8%. Despite a volatile share price and reduced profit margins, it is trading at good value relative to peers. Recent financials reveal decreased revenue and net income for H1 2024 compared to last year, impacting earnings quality due to large one-off items. No recent insider trading activity was reported.

- Unlock comprehensive insights into our analysis of ApicHope Pharmaceutical stock in this growth report.

- Our valuation report here indicates ApicHope Pharmaceutical may be undervalued.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

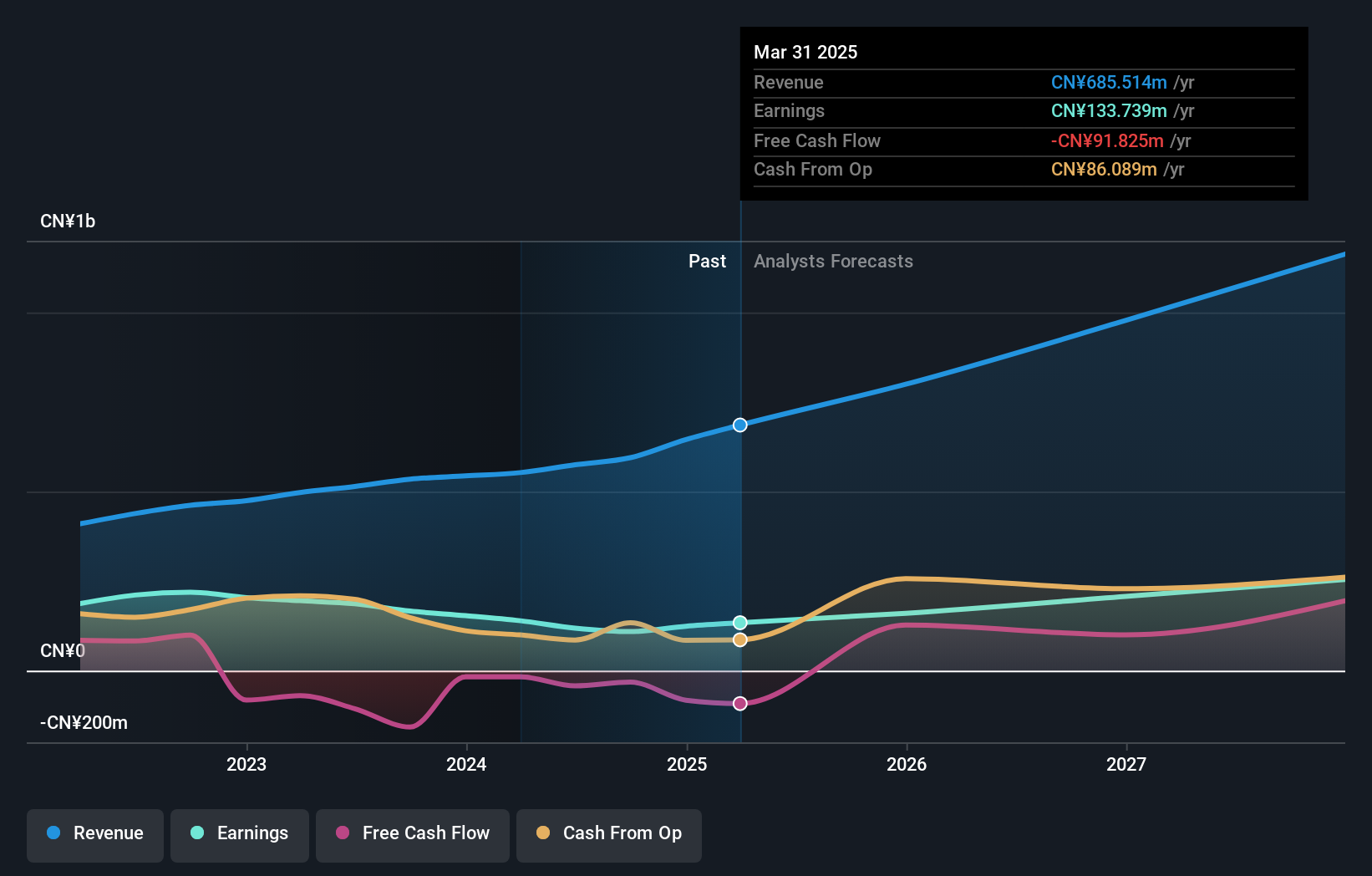

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and biological reagents for pharmaceutical and biotechnology companies, as well as scientific research institutions, with a market cap of CN¥4.72 billion.

Operations: The company's revenue primarily comes from the Research and Experimental Development segment, which generated CN¥563.80 million.

Insider Ownership: 37.3%

Revenue Growth Forecast: 18.9% p.a.

Acrobiosystems Ltd. anticipates revenue growth of 18.9% annually, surpassing the Chinese market's average while earnings are projected to grow at 26.5%. Despite a decline in profit margins and net income for H1 2024, it trades below its estimated fair value. The company has initiated a CNY 40 million share repurchase program, pending shareholder approval, which may enhance capital efficiency but lacks recent insider trading activity to gauge management sentiment.

- Click to explore a detailed breakdown of our findings in AcrobiosystemsLtd's earnings growth report.

- The analysis detailed in our AcrobiosystemsLtd valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Access the full spectrum of 1486 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hillstone NetworksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688030

Hillstone NetworksLtd

Provides an infrastructure protection solutions to enterprises and service providers.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives