Hillstone Networks Co.,Ltd.'s (SHSE:688030) Shares Leap 29% Yet They're Still Not Telling The Full Story

Hillstone Networks Co.,Ltd. (SHSE:688030) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

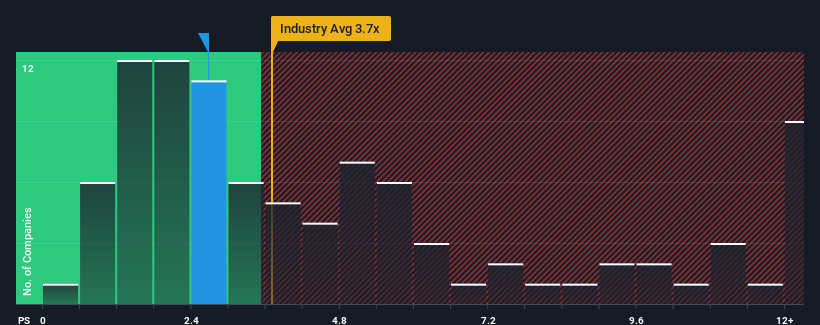

Even after such a large jump in price, Hillstone NetworksLtd's price-to-sales (or "P/S") ratio of 2.7x might still make it look like a buy right now compared to the IT industry in China, where around half of the companies have P/S ratios above 3.7x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Hillstone NetworksLtd

How Hillstone NetworksLtd Has Been Performing

Hillstone NetworksLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Hillstone NetworksLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hillstone NetworksLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen a 24% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 40% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Hillstone NetworksLtd's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Hillstone NetworksLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Hillstone NetworksLtd remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hillstone NetworksLtd (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If you're unsure about the strength of Hillstone NetworksLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hillstone NetworksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688030

Hillstone NetworksLtd

Provides an infrastructure protection solutions to enterprises and service providers.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026