- China

- /

- Electrical

- /

- SHSE:688191

Three Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts in Europe and fluctuating indices in the U.S., investor attention is drawn to sectors showing resilience and growth potential. In this environment, stocks with high insider ownership often signal strong internal confidence, suggesting that those closest to the company believe in its long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Koal Software (SHSE:603232)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Koal Software Co., Ltd. develops public key infrastructure platforms in China and has a market cap of CN¥3.01 billion.

Operations: Koal Software Co., Ltd.'s revenue is derived from its development of public key infrastructure platforms in China.

Insider Ownership: 30.2%

Earnings Growth Forecast: 46.2% p.a.

Koal Software demonstrates strong growth potential, with revenue forecasted to grow 24.3% annually, surpassing the CN market's 13.5%. Earnings are expected to increase significantly at 46.2% per year, despite recent financial results being impacted by large one-off items. The company became profitable this year and offers a price-to-earnings ratio of 80.3x, below the industry average of 83.7x, though its return on equity is projected to be low at 8.1%.

- Click to explore a detailed breakdown of our findings in Koal Software's earnings growth report.

- Our valuation report here indicates Koal Software may be overvalued.

Zhiyang Innovation Technology (SHSE:688191)

Simply Wall St Growth Rating: ★★★★★☆

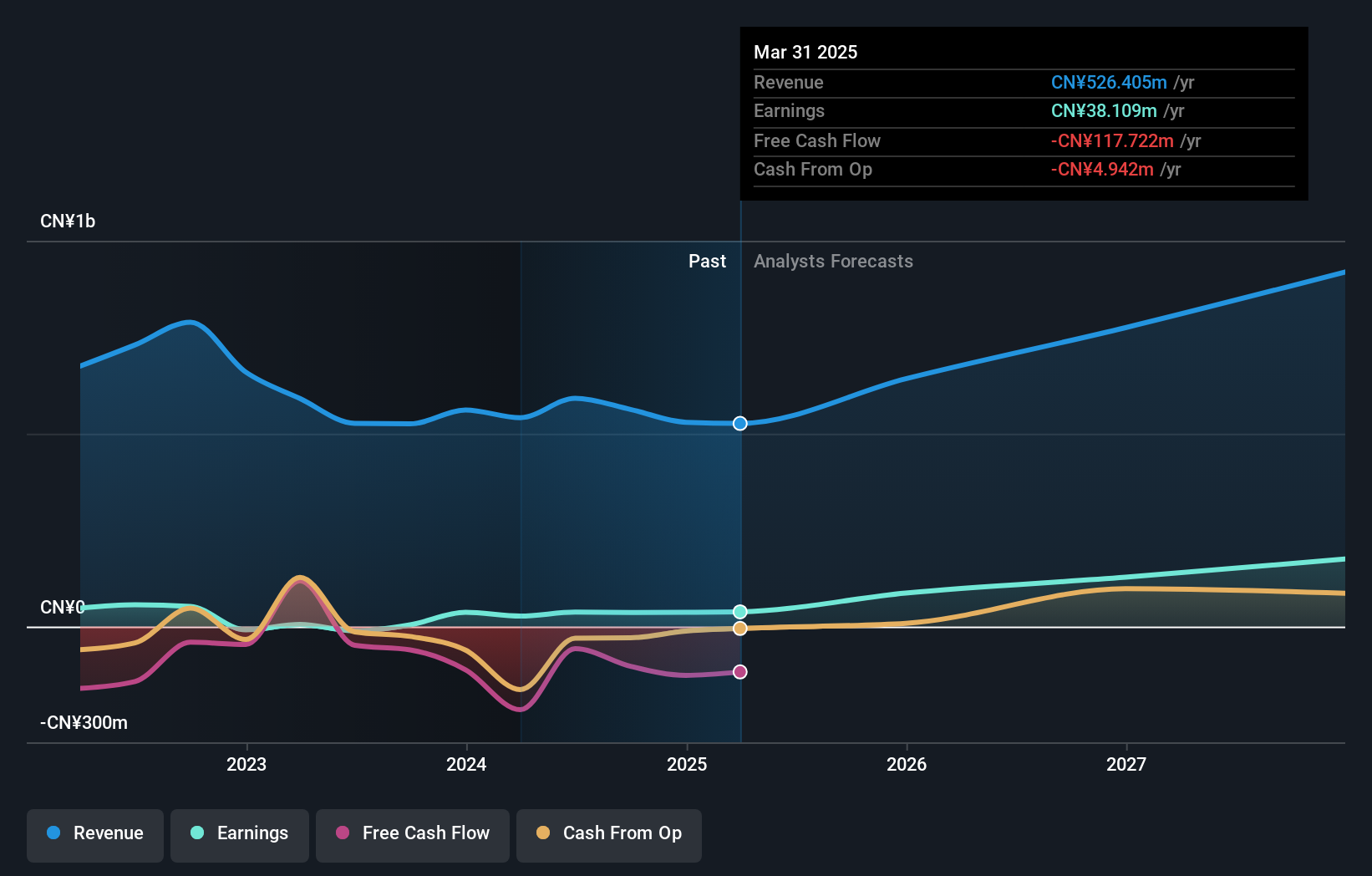

Overview: Zhiyang Innovation Technology Co., Ltd. manufactures and sells power equipment in China, with a market cap of CN¥2.75 billion.

Operations: The company's revenue is primarily derived from the manufacture and sale of power equipment in China.

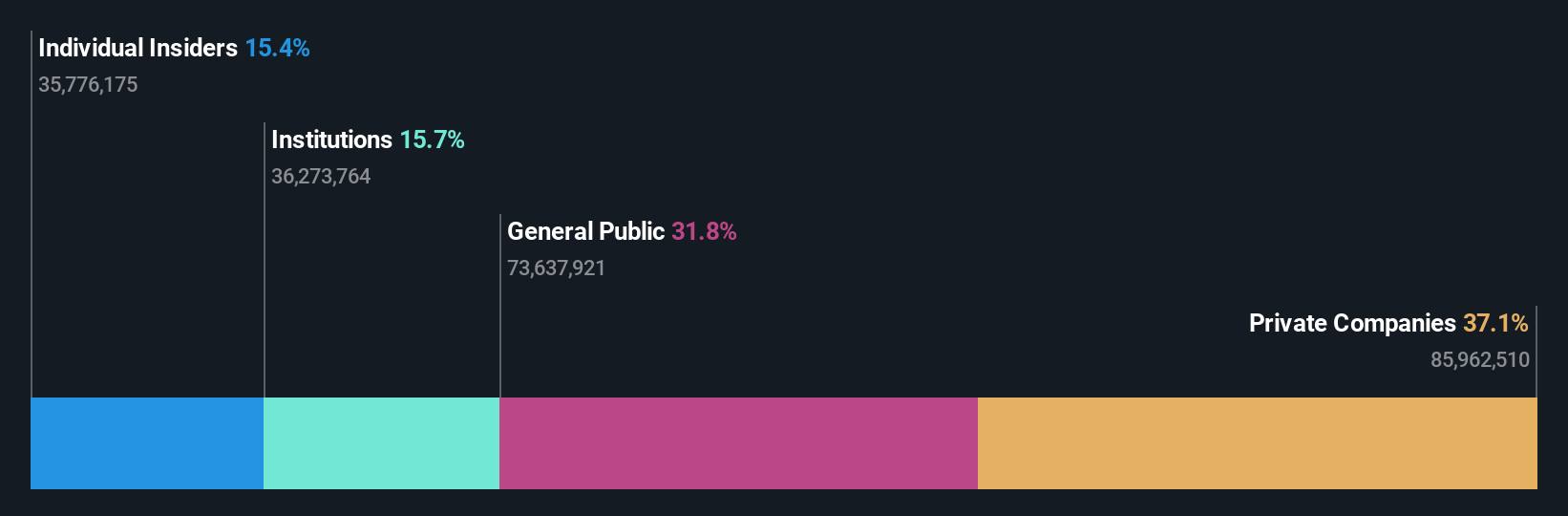

Insider Ownership: 15.7%

Earnings Growth Forecast: 40.7% p.a.

Zhiyang Innovation Technology shows promising growth, with revenue forecasted to increase 22.5% annually, outpacing the CN market's 13.5%. Earnings are expected to grow significantly at 40.7% per year, despite large one-off items affecting financial results. Recent earnings for H1 2024 showed a rise in net income to CNY 25.34 million from CNY 23.61 million last year, while basic EPS improved slightly to CNY 0.1651 from CNY 0.1538 previously reported.

- Delve into the full analysis future growth report here for a deeper understanding of Zhiyang Innovation Technology.

- Upon reviewing our latest valuation report, Zhiyang Innovation Technology's share price might be too optimistic.

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market in Poland and Ukraine with a market cap of PLN3.73 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, which amounts to PLN744.28 million.

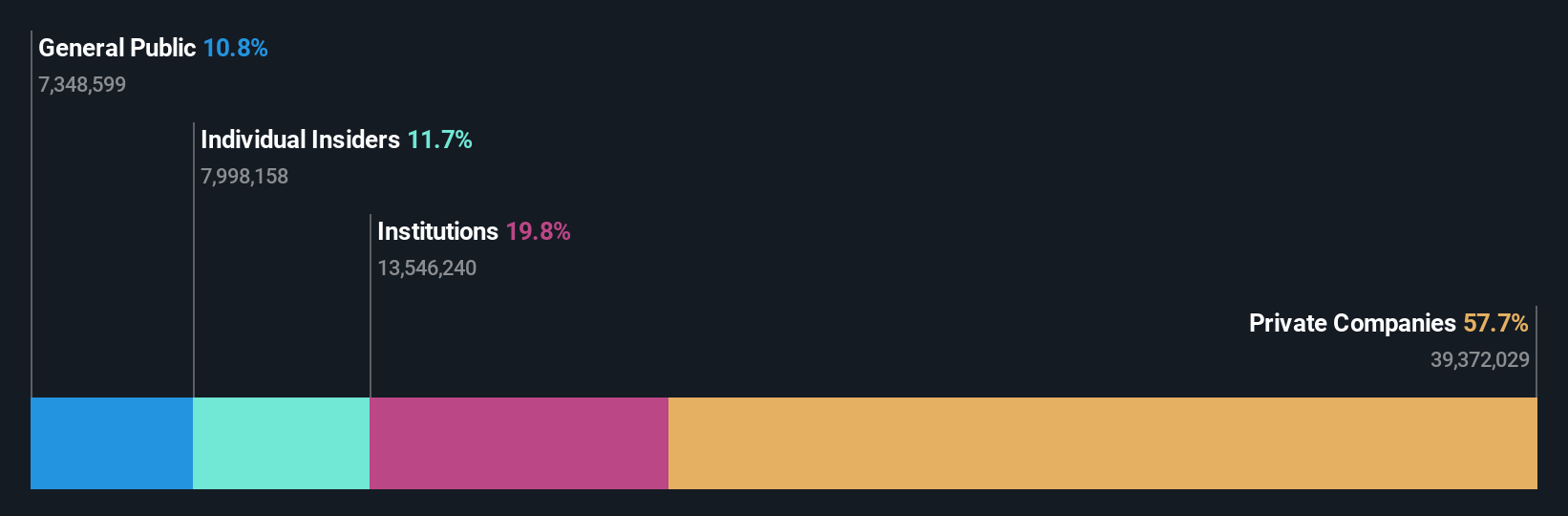

Insider Ownership: 12.1%

Earnings Growth Forecast: 16.2% p.a.

Grupa Pracuj's insider ownership aligns with its growth potential, as reflected by its addition to the S&P Global BMI Index and a 22.9% anticipated stock price increase. Despite recent earnings declines, with Q2 net income at PLN 41.54 million down from PLN 58.36 million, the company's earnings are forecasted to grow faster than the Polish market at 16.2% annually. Trading significantly below fair value suggests room for appreciation despite slower revenue growth projections of 8.6% per year.

- Navigate through the intricacies of Grupa Pracuj with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Grupa Pracuj implies its share price may be lower than expected.

Where To Now?

- Click this link to deep-dive into the 1489 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhiyang Innovation Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688191

Zhiyang Innovation Technology

Operates as artificial intelligence company in China.

Excellent balance sheet low.

Market Insights

Community Narratives