CETC Digital Technology Co.,Ltd. (SHSE:600850) Stock Rockets 46% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, CETC Digital Technology Co.,Ltd. (SHSE:600850) shares have been powering on, with a gain of 46% in the last thirty days. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

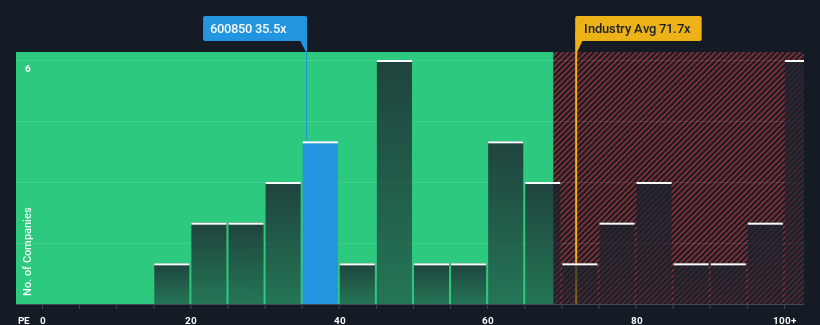

In spite of the firm bounce in price, it's still not a stretch to say that CETC Digital TechnologyLtd's price-to-earnings (or "P/E") ratio of 35.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 33x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

CETC Digital TechnologyLtd has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for CETC Digital TechnologyLtd

What Are Growth Metrics Telling Us About The P/E?

CETC Digital TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.9%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 12% per annum over the next three years. With the market predicted to deliver 18% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's curious that CETC Digital TechnologyLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From CETC Digital TechnologyLtd's P/E?

CETC Digital TechnologyLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of CETC Digital TechnologyLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for CETC Digital TechnologyLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on CETC Digital TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600850

CETC Digital TechnologyLtd

Provides software and information technology services in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives